Rethinking China: How Foreign Investors Are Shifting Their Playbook

Foreign investment in China is undergoing a strategic pivot. Amid regulatory shifts and global uncertainty, investors are opting for targeted, risk-aware, and regionally diversified approaches.

As China’s economic engine decelerates, the strategies of foreign investors are undergoing a quiet but profound evolution. The old model—characterized by aggressive expansion and bullish bets on the world's second-largest economy—is giving way to a more cautious, diversified, and selective approach. From regulatory recalibrations to geopolitical hedging and a rising appetite for private markets, investors are rethinking their China strategies with one eye on risk and the other on long-term opportunity.

Steering Through the Regulatory Labyrinth

Navigating China’s regulatory environment has always required finesse, but recent years have raised the stakes. The country’s unique blend of centralized oversight and localized implementation has created a fast-moving maze for foreign investors. Regulations are increasingly tied to state priorities—national security, technological self-sufficiency, and social stability—forcing companies to build deep local networks, invest in compliance, and stay agile to frequent policy shifts.

The 2020 Foreign Investment Law was heralded as a major reform, promising national treatment for foreign enterprises and stronger intellectual property protections. While implementation is ongoing, it signaled Beijing’s intent to remain open to foreign capital—albeit on its own terms.

The Rise of “China Plus One”

Rising labor costs and trade tensions have supercharged the “China Plus One” strategy. Multinationals are retaining a presence in China while shifting portions of their operations to other emerging markets—chief among them Vietnam and India. These nations are capturing record-breaking foreign direct investment (FDI) thanks to their cost advantages, improving infrastructure, and favorable demographics.

In 2023, Vietnam attracted $23.2 billion in FDI, its highest ever, with surges also seen in India, Indonesia, Malaysia, and even Mexico—now a nearshoring darling for U.S.-based firms. The transition isn’t overnight. China's deep integration into global supply chains makes sudden decoupling impractical. But the direction is clear: investors want options.

Labor Costs: Catalyst for Change

China's rapid wage growth—manufacturing wages tripled from 2006 to 2014—has been both a blessing and a challenge. On one hand, it reflects rising productivity and a maturing workforce. On the other, it has squeezed margins and nudged companies toward automation, inland relocation, or overseas diversification.

The upshot? A shift in China’s industrial focus. Lower-end manufacturing is leaving, while higher-value sectors—like electronics and precision engineering—are on the rise. For investors, that means fewer cheap-labor opportunities and more bets on innovation and efficiency.

A Quiet Pivot to Private Markets

While public equity flows waver, foreign capital is quietly flowing into China’s private sectors. Sovereign wealth funds from the Middle East are leading the charge, with investments in Chinese startups, infrastructure, and green energy projects surging. In the past year alone, these funds injected around $7 billion—five times the previous year’s total.

The Public Investment Fund of Saudi Arabia is a notable mover, inking deals that could unlock as much as $50 billion in future investments. Their focus? China’s digital economy and new energy sectors—areas aligned with global diversification goals and Beijing’s long-term development agenda.

The JV Revival

Joint ventures (JVs) are back in vogue. For foreign firms navigating China’s complex terrain, partnering with local players offers a strategic edge: access to restricted sectors, regulatory insulation, and quicker market adaptation.

Sectors like electric vehicles (EVs), biotech, and renewable energy are at the forefront. Volkswagen, for example, has increased its stake in a Chinese JV to accelerate EV production. Meanwhile, biotech firms are collaborating with Chinese partners to leverage local R&D capabilities and patient pools. Even in renewables, firms like NTPC Green and ONGC Green are forming cross-border alliances to co-develop solar and wind projects.

Still, JVs come with risks—cultural clashes, IP concerns, and power struggles. But for high-growth sectors, the benefits increasingly outweigh the costs.

Playing the Sectors, Not the Market

The passive, broad-brush approach to China is falling out of favor. Instead, foreign investors are zeroing in on high-potential sectors—semiconductors, consumer staples, and automation.

Semiconductors are a geopolitical and economic battleground, with China's push for self-reliance attracting both state support and investor interest.

Consumer staples offer steady returns amid regulatory uncertainty. And robotics? A booming field with a projected 25.16% CAGR through 2032, driven by labor challenges and industrial upgrades.

Investors are turning to active, targeted approaches rather than broad exposure. ETFs and custom baskets now emphasize firms with high ESG scores, profitability, and manageable regulatory risk.

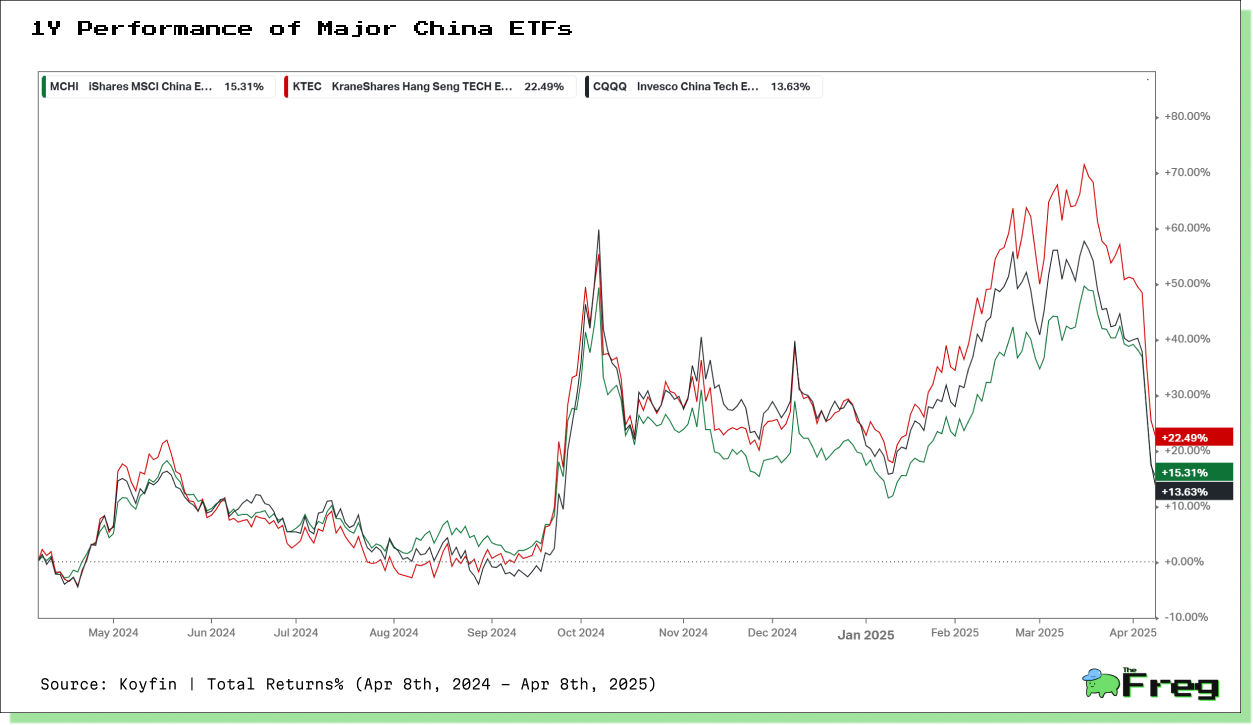

High Interest Sectors

Over the past year, Chinese tech-focused ETFs experienced strong but volatile returns. At their peak, these ETFs delivered returns of up to ~70% before correcting sharply. This pullback was largely driven by renewed fears surrounding proposed U.S. tariffs and tech restrictions under a potential Trump administration.

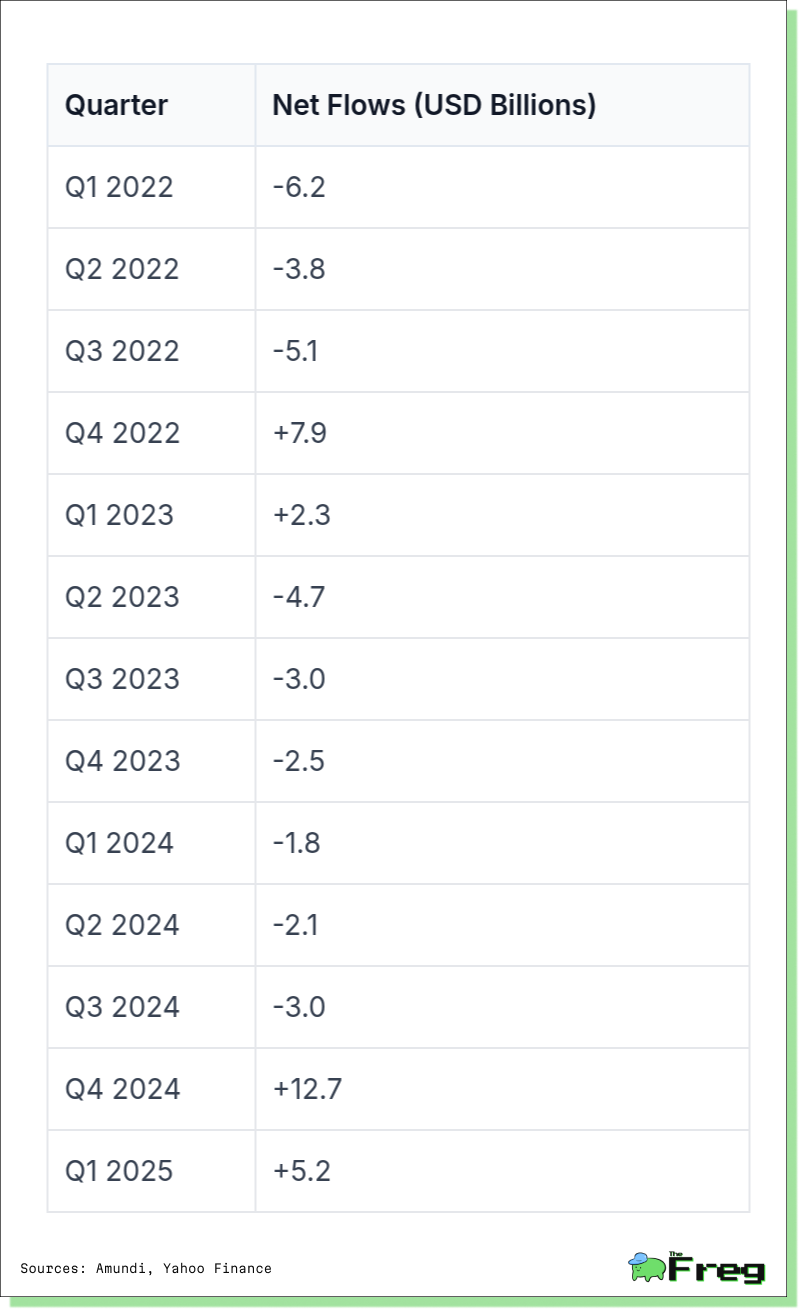

ETF Flows Tell a Volatile Tale

Quarterly flows into China-focused ETFs paint a picture of investor ambivalence. From Q1 2022 through most of 2024, the pattern was largely negative—with consistent outflows reflecting global uncertainty and domestic policy unpredictability. Then, in a surprising twist, Q4 2024 saw a massive $12.7 billion inflow within just a few weeks.

What changed? Market-friendly policy announcements, low valuations, and repositioning by global funds triggered a short-term rally. It’s a reminder that sentiment may swing, but the market's allure hasn’t vanished—it’s just become more conditional.

ASEAN Rising: The FDI Race

Foreign Direct Investment (FDI) inflows into ASEAN countries and China (USD Billion)

This data reveals several key trends:

- Singapore remains the top ASEAN FDI destination, reflecting its role as a financial and business hub.

- Indonesia, Vietnam, and Malaysia show consistent FDI growth, benefiting from supply chain shifts.

- Thailand rebounded post-2020, showing economic recovery and policy success.

- China saw peak FDI in 2022, followed by a dip due to global tensions and economic uncertainty.

Q1 2025 figures suggest ASEAN continues to gain investor favor as firms diversify operations under the "China Plus One" strategy.

The U.S. Trade Pivot

Trade data underscores the shifting tides. U.S. imports from Vietnam tripled from $46.5 billion in 2017 to $142.5 billion in 2023. India nearly doubled its export volume to the U.S. over the same period. Meanwhile, China’s exports to the U.S. have dipped from their 2018 peak.

Vietnam is the clear winner of the “China Plus One” pivot, while India gains ground through pharmaceuticals and tech. China still dominates—but its grip is loosening as supply chains reroute and trade strategies evolve.

Strategic Adaptation: The New Normal

What’s emerging is not an exodus from China, but a shift in mindset. Investors are embracing risk management, flexible operations, and regional diversification. Local partnerships, modular supply chains, and sector-specific bets are replacing broad-stroke expansion plans.

The days of unbridled optimism may be over, but the new playbook is one of strategic engagement. For those willing to adapt, China still holds promise—but success now demands sharper focus, deeper due diligence, and a broader geographical lens.

In the evolving landscape of global investment, China remains a central stage—but it's no longer the only show in town.