Rivian: A Long-Term Bet or Just Short-Term Hype

Rivian is charging ahead in the EV race, surging in deliveries and investor interest. With Tesla stumbling, can Rivian seize the moment and dominate the EV market? This deep dive explores its wild stock swings, bold expansion plans, and the high-stakes battle for long-term success.

Rivian Automotive has been making waves in the electric vehicle (EV) market, with stock surges, production milestones, and ambitious expansion plans capturing the attention of investors. But with every success, the company faces an equally charged set of challenges. Is Rivian a promising long-term play or just another spark in the volatile EV industry?

The Market’s Electrifying Response

Rivian’s stock has been on a rollercoaster ride, recently jumping 7.59%

on April 1, 2025. This surge reflects the dynamic nature of the EV sector, where investor sentiment shifts as quickly as the latest technological advancements. The company’s push for profitability remains a hot topic, with a reported negative free cash flow of ~$5 billion in the past year. While Rivian managed to achieve a gross profit of $170 million in Q4 2024, the road to sustainable earnings is still under construction.

Power Struggle: Rivian’s Market Position

Rivian’s stock is no stranger to dramatic swings, boasting a

beta value of 2.21—more than double the market average. Several factors fuel this volatility:

- EV Market Dynamics: Government policies, shifting consumer demand, and tariffs on imported vehicles influence Rivian’s stock performance.

- Production Milestones: Hitting—or missing—production targets, particularly for the new R2 SUV, can drastically shift investor confidence.

- Competitive Landscape: Heavyweights like Tesla, Ford, and General Motors pose formidable competition, impacting Rivian’s market positioning.

- Institutional Activity: With 286 investors increasing stakes and 309 reducing them, market sentiment remains divided.

While this volatility presents opportunities for high returns, it also signals substantial risk, making Rivian a compelling but unpredictable player in the EV market.

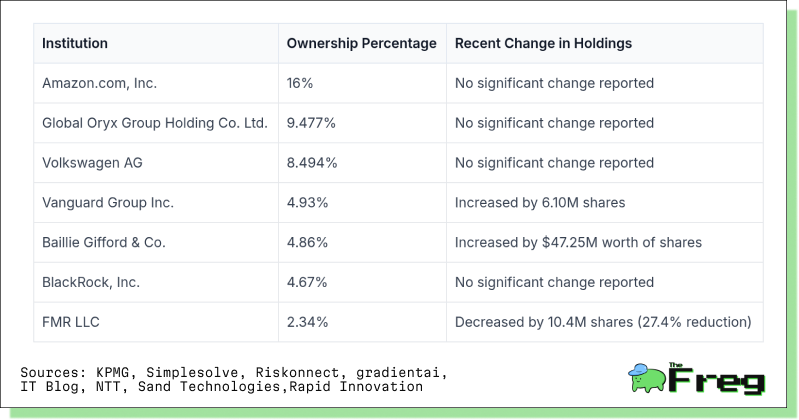

Betting Big: Institutional Confidence

Institutional investors hold 66.25% of Rivian’s stock, a strong indicator of confidence despite the company’s financial headwinds. 331 institutional buyers invested $1.46 billion in Rivian, while 185 sellers divested $1.15 billion. The tug-of-war between optimism and caution underscores the uncertainty surrounding Rivian’s future.

Institutional Ownership in Rivian

R2 SUV: Rivian’s Potential Game Changer

If there’s one vehicle that could steer Rivian toward profitability, it’s the R2 SUV. With a price tag of $45,000 and over 68,000 reservations within hours of its unveiling, the R2 targets a broader consumer base beyond Rivian’s traditionally high-end market. Cost-saving decisions, such as producing the R2 at its Illinois facility instead of constructing a new plant in Georgia, could save the company over $2.25 billion. However, potential bottlenecks in production capacity—initially capped at 25,000 units per year—may limit its ability to meet demand and capitalize on this momentum.

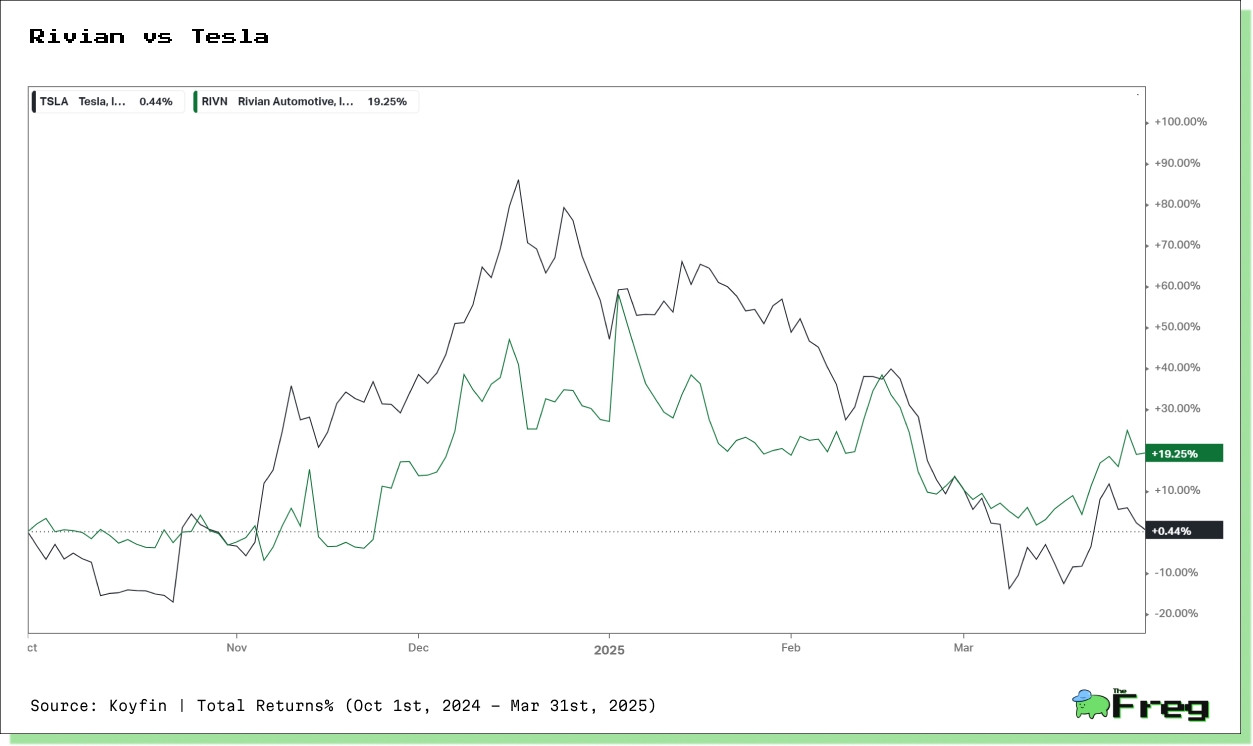

The EV Showdown: Tesla’s Stumble, Rivian’s Competitive Edge?

Tesla's Q1 2025 deliveries dropped 8.5% year-over-year to 386,800 units, amid ongoing concerns about build quality and customer service. In contrast, Rivian delivered 13,588 vehicles—a 71% increase year-over-year. Rivian’s focus on premium adventure vehicles and strong customer satisfaction ratings could help it carve out a niche where Tesla’s mass-market approach falls short. However, Rivian still faces challenges, including production limits and profitability hurdles. Its ability to capitalize on Tesla’s missteps will depend on scaling efficiently while maintaining quality.

Rivian has carved out a niche in the EV sector, focusing on premium adventure vehicles and commercial offerings. The R1T pickup and R1S SUV cater to off-road enthusiasts, distinguishing Rivian from mass-market players like Tesla and Ford. However, competition is heating up, with legacy automakers ramping up EV production and Chinese manufacturers like BYD expanding globally. Rivian’s partnership with Amazon for electric delivery vans offers a strategic advantage, but reliance on a single major buyer presents risks if demand shifts.

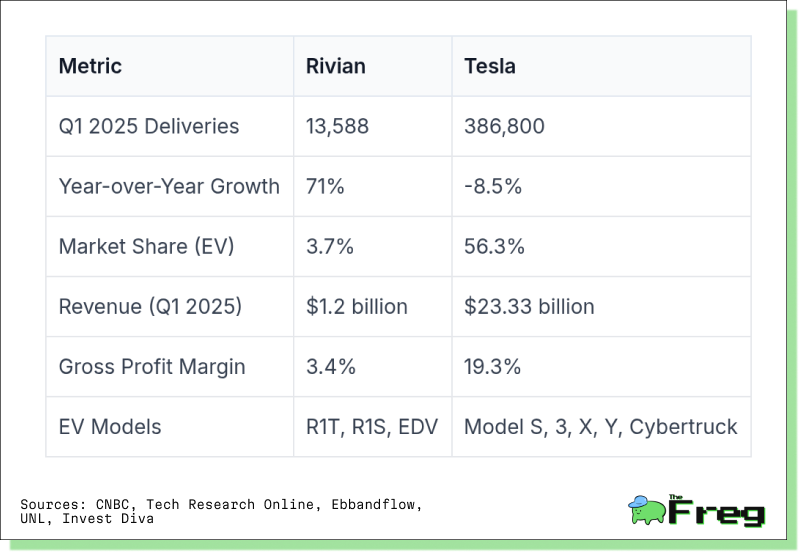

The EV Race: Rivian vs. Tesla

The electric vehicle market is rapidly evolving, with established players and newcomers vying for market share. Here is comparison between Rivian and Tesla, highlighting certain key metrics.

Financial Sparks and Short Circuits

Rivian’s revenue growth is promising, with a 12% increase in 2024, reaching

$4.97 billion. However, the company’s losses remain steep, reporting a

staggering $4.75 billion net loss for the year. While cost efficiencies are improving—automotive costs per vehicle dropped by $31,000 in Q4 2024—reaching sustained profitability remains a challenge. Rivian projects a “modest” gross profit in 2025, with adjusted losses expected to narrow to $1.7–$1.9 billion. However, the long-term outlook suggests that EBITDA positivity may not materialize until 2027.

Supply Chain Jams: Production Hurdles

Rivian’s road to success is riddled with supply chain obstacles. A recent shortage of a critical electric motor component forced the company to slash its 2024 production target from 57,000 to 47,000–49,000 vehicles. Such disruptions highlight broader vulnerabilities in the EV supply chain, including dependence on single-source suppliers, geopolitical uncertainties, and logistical bottlenecks. To mitigate these risks, Rivian must strengthen supplier diversification and enhance supply chain resilience.

The Fast Lane: Future Growth Plans

Rivian’s growth strategy hinges on its R2 platform, slated for early 2026, which aims to transform the company from a niche luxury EV maker to a mass-market contender. With an anticipated annual production of 155,000 units, the R2 could redefine Rivian’s trajectory. The company’s $6.6 billion Department of Energy loan for its Georgia plant expansion signals strong government backing but introduces potential regulatory risks.

As Rivian accelerates into the future, it remains at a crossroads—will it power through its financial and production challenges to emerge as a dominant force in the EV industry, or will it run out of charge before reaching its destination? Investors and enthusiasts alike will be watching closely, ready for the next twist in this electrifying journey.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.