Safe Havens Shine as Tariffs Reshape April's Investment Landscape

Safe havens surged and India outperformed global equities as sweeping U.S. tariffs rattled markets in early April.

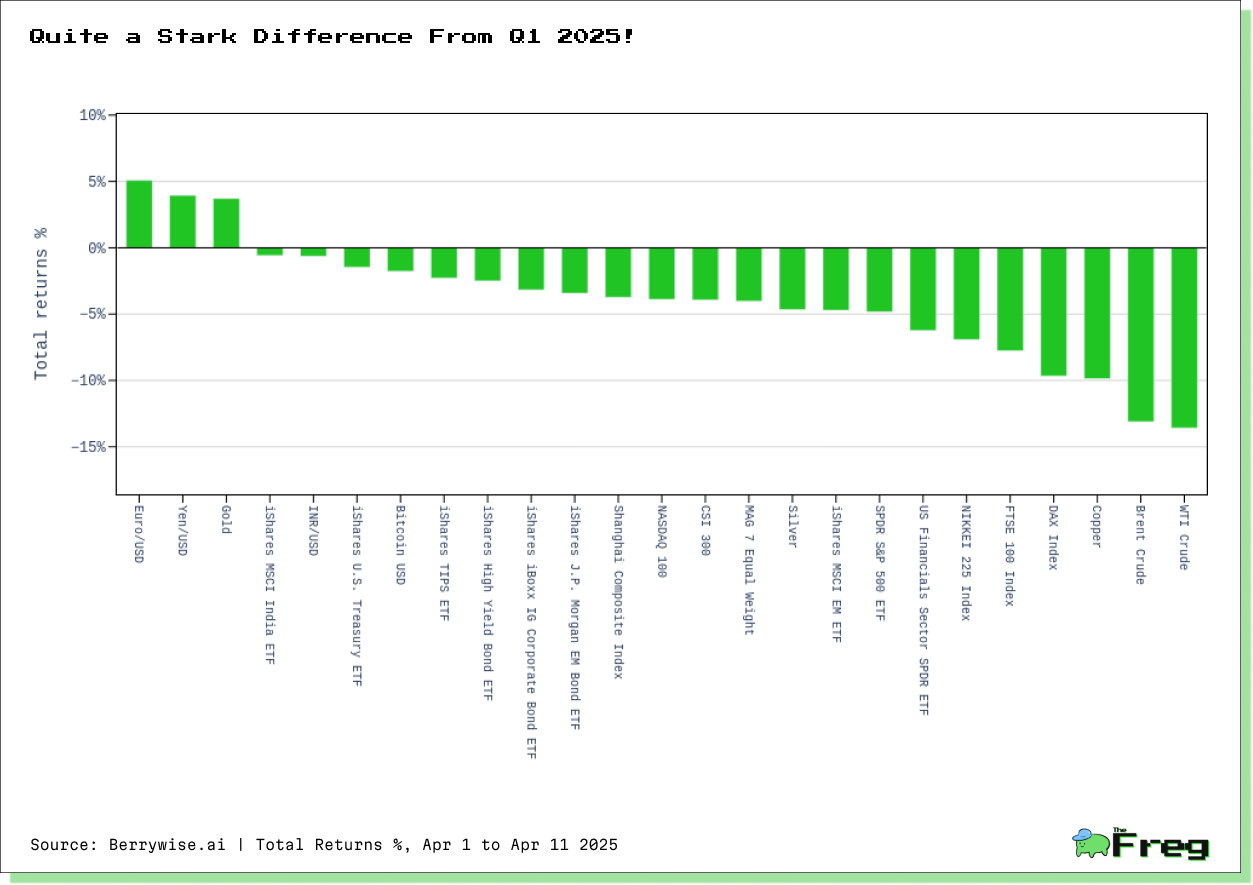

We would usually do this every quarter. But since the announcement of 'Liberation Day' tariffs on April 2nd, global markets have been upended. In a month dominated by trade tensions and recession fears, the first eleven days of

April 2025 have delivered a stark reminder of how quickly market dynamics can shift. President Trump's sweeping tariff announcements—have sent shockwaves through global markets, creating clear winners and losers across asset classes.

Currencies and Gold: The New Safe Havens Amid Tariff Chaos

As equity markets tumbled, traditional safe havens have emerged as the standout performers. The Euro and Japanese Yen have strengthened considerably against the dollar, posting gains of 5.08% and 3.95% respectively. This currency shift reflects growing international concerns about the impact of U.S. trade policies on domestic inflation and economic growth.

Gold has continued its impressive run, climbing 3.71% to surpass the $3,200 mark—a fresh all-time high. "In addition to concerns that tariffs will drive inflation higher, there are fears that a trade war will tip the global economy into recession," noted recent market commentary from Yahoo Finance. This dual threat has investors flocking to the precious metal, extending its remarkable gains from 2024.

India's Resilience in a Struggling Emerging Market Landscape

Among emerging markets, India has demonstrated remarkable resilience, with the iShares MSCI India ETF down just 0.58% compared to a 4.71% decline in the broader iShares MSCI EM ETF. Chinese markets have fared worse, with indices averaging a 3.83% decline as direct targets of the harshest U.S. tariffs.

"A key factor behind this optimism is India's limited trade dependence on the US and China," reported DD News, citing analysis from Jefferies. With exports to the U.S. representing just 2.3% of GDP and benefiting from declining crude oil prices, India appears well-positioned to weather the current storm.

Commodities and Oil: Direct Casualties of Economic Slowdown Fears

Energy markets have taken the hardest hit, with WTI Crude and Brent Crude plummeting 13.58% and 13.11% respectively, reaching four-year lows. Industrial metals haven't fared much better, with copper down 9.87%. Overall, commodities have averaged a staggering 12.19% decline.

"Oil has retreated by 15% so far in April, joining a broad selloff that's engulfed most commodities," reported Energy Connects. ANZ Bank analysts have warned that "oil consumption will decline by 1% if global economic growth falls below 3%," highlighting the direct link between trade tensions and commodity demand.

Bonds Provide Relative Shelter Compared to Equities

While fixed income hasn't escaped unscathed, U.S. bonds have demonstrated relative strength compared to equities. U.S. bond ETFs have averaged losses of 2.35%, significantly outperforming both U.S. stocks (-4.36%) and European equities (-8.71%), which have been particularly hard hit.

The bond market has experienced its own volatility, with the 10-year Treasury yield spiking as high as 4.5% before retreating, reflecting investor uncertainty about inflation expectations and potential foreign buyer reactions to tariffs.

As markets continue to digest the implications of these trade policies, investors are increasingly distinguishing between assets with direct exposure to tariff impacts and those offering relative insulation from the brewing economic storm.