Silver's Golden Opportunity: Why 2025 Could Be the Year of Silver

In 2025, silver stands at a critical crossroads, driven by historic undervaluation, industrial demand from green tech, and monetary tailwinds. This article explores why silver may outshine gold and emerge as one of the year’s top investment opportunities.

Silver is basking in a new spotlight in 2025, standing tall as both an industrial powerhouse and a trusted safe-haven asset. While gold traditionally dominates headlines during economic turbulence, a confluence of market forces suggests silver may finally step out of its gilded shadow. With mounting supply deficits, a green technology boom, and its dual monetary-industrial character, silver could be the breakout star investors have been waiting for.

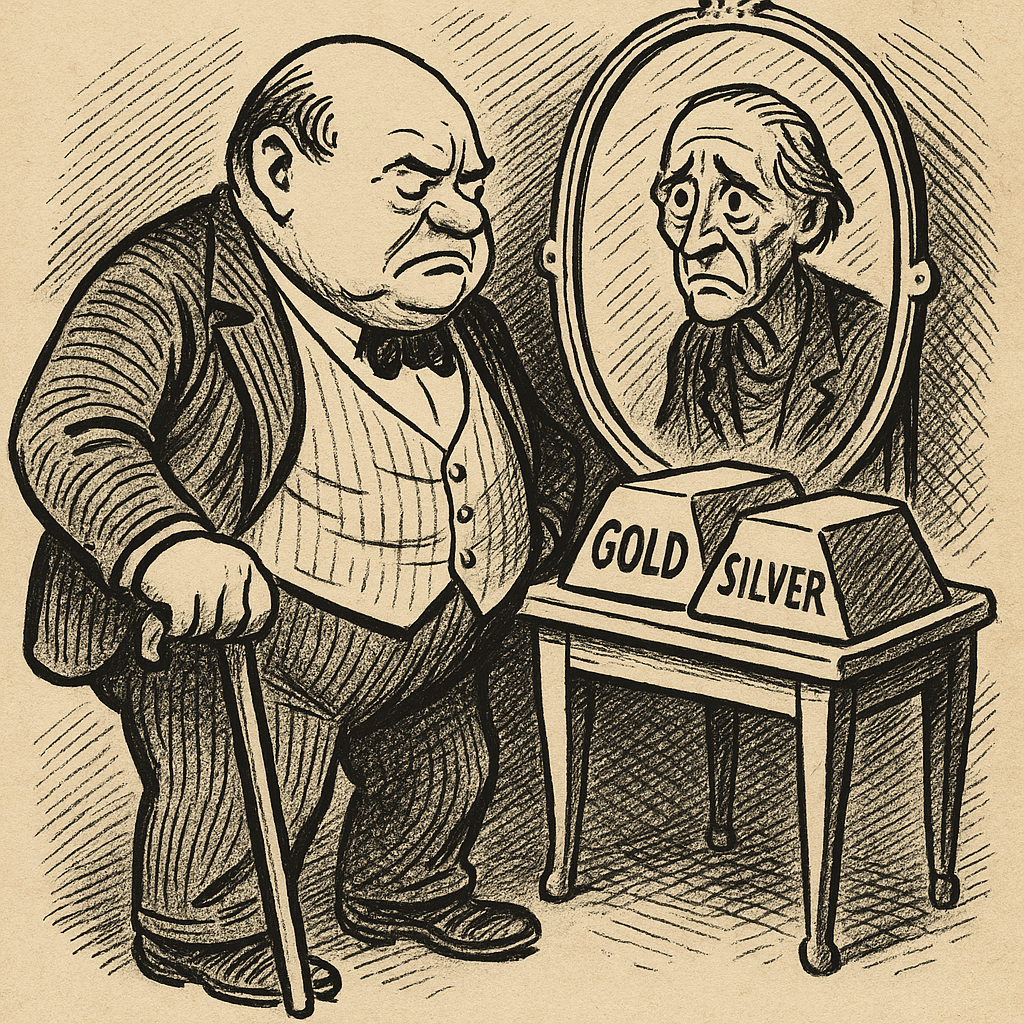

Ancient Foundations, Modern Potential

For millennia, gold and silver have been the bedrock of global wealth, used as currency and storehouses of value across civilizations. But today, a remarkable phenomenon is capturing attention: the gold-to-silver ratio has soared above

100—a level previously seen only during episodes of acute market stress like the COVID-19 crash.

Historically, an extreme ratio signals silver is undervalued relative to gold and sets the stage for powerful rallies. As industrial demand surges and market conditions tighten, silver seems primed to reclaim its luster.

Decoding the Gold-to-Silver Ratio

At its core, the gold-to-silver ratio measures how many ounces of silver it takes to purchase one ounce of gold. As of April 2025, the ratio sits at an extraordinary 100:1, far above the modern average of 50-70.

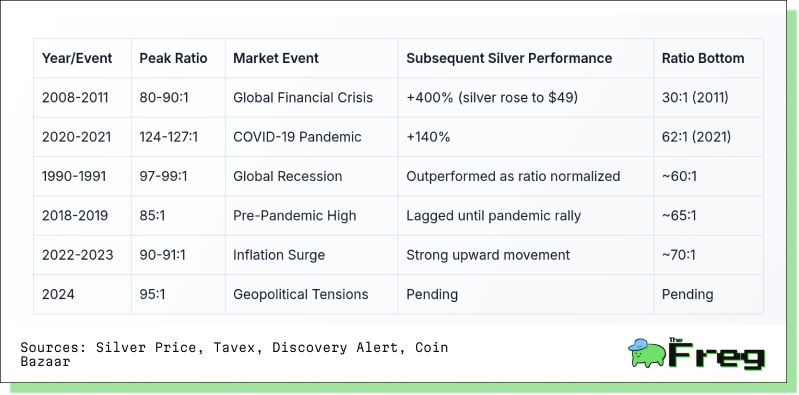

This metric has proven an effective timing tool. Whenever the ratio exceeds 80:1, silver historically tends to outperform. Notable instances include the post-2008 financial crisis and the post-pandemic rebound.

Silver's Dramatic Comebacks

Silver's reputation for volatility is both its risk and its reward. After the 2008 crisis, silver's price exploded 400% by 2011. Following the 2020 pandemic lows, it doubled from $12 to $29 in just over a year. These surges demonstrate silver's capacity to deliver outsized returns when market sentiment shifts.

Its smaller market size, combined with massive industrial demand—60% of annual consumption—creates sharp supply-demand imbalances that can turbocharge prices.

Industrial Tailwinds Strengthen

2025 isn't just about financial speculation. Silver’s industrial role is growing rapidly, particularly from green technologies. Solar panel manufacturing alone is projected to consume nearly 20% of global silver output this year. The explosion of electric vehicles, 5G infrastructure, and next-gen electronics is further stoking demand.

Meanwhile, monetary conditions are turning favorable. With inflation staying stubbornly high and the Federal Reserve moving toward rate cuts, the non-yielding nature of silver is becoming less of a disadvantage, reinforcing its appeal as a store of value.

Volatility and Risks to Watch

Investors must remain mindful of silver's notorious volatility. In 2025, silver's 20-day historical volatility clocked in at 38%, compared to gold's 22%.

Key risks include:

- Trade tensions dampening industrial demand

- Economic slowdowns squeezing manufacturing sectors

- Rising mining output narrowing supply deficits

- Technological "thrifting," reducing silver use per solar panel

Sharp moves in the gold-to-silver ratio itself also pose short-term challenges, with sudden corrections possible.

Dollar Dynamics and Silver's Fortunes

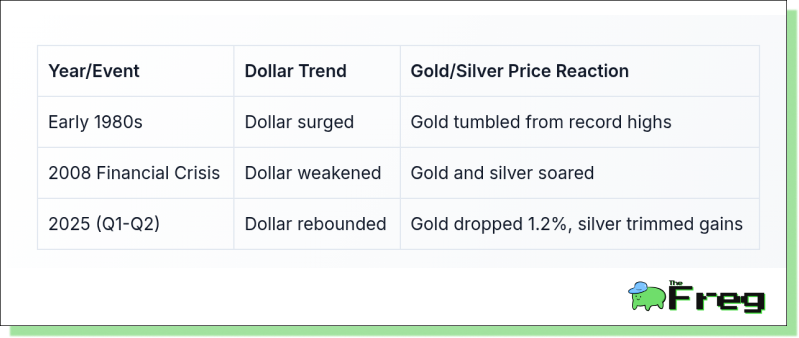

The U.S. dollar remains a critical force. Silver, like gold, generally moves inversely to the greenback. When the dollar strengthens, silver prices often fall, and vice versa. Here's how this relationship has played out:

Tracking the Dollar Index (DXY) can provide valuable clues for precious metals positioning.

Historical Performance Across Economic Cycles

Silver has demonstrated distinct performance patterns across different economic environments, making it a valuable asset to understand within broader market cycles. The table below summarizes silver's historical behavior during key economic conditions over the past century:

Silver's industrial demand component makes it more sensitive to economic slowdowns than gold, explaining its higher volatility during recessions. However, during stagflationary periods like the 1970s, silver has historically outperformed most other assets as investors seek tangible stores of value while industrial demand remains resilient.

Quantum Leap: Technology-Driven Demand

Silver’s technological applications are multiplying. Advanced photovoltaic cells—like TopCon and HJT—consume more silver per panel, pushing forecasts for solar-related silver use to nearly 273 million ounces by 2030.

Quantum computing is another frontier. Silver’s unparalleled conductivity makes it crucial in superconducting devices and quantum communication systems. Coupled with exploding demand from 5G, AI hardware, and IoT sensors, silver’s industrial future looks brighter than ever.

Strategic Investment Positioning

Given the historic undervaluation signaled by the gold-to-silver ratio, many experts advocate strategic exposure to silver in 2025. Some financial advisors recommend:

- Balanced portfolios: 5-8% gold, 3-5% silver

- Aggressive portfolios: Up to 7-10% silver allocation

Renowned voices like Robert Kiyosaki and Jim Rogers have highlighted silver’s upside potential, forecasting possible price doublings. However, silver's volatility demands careful sizing within diversified portfolios.

The Investment Case: Now or Never?

Silver's unique combination of monetary resilience and industrial dynamism could make it one of 2025’s most compelling investment stories. While risks abound, history suggests that when silver’s moment comes, it tends to shine brightly and fast. For those seeking both resilience and explosive growth potential, this may be the year to give silver a serious look.