Storm in the Straits: What’s Shaking Up the Singapore Stock Market?

Tariffs, turmoil, and trade shifts: Singapore braces for global shocks with resilience, smart policy, and strategic economic maneuvering.

Singapore’s Prime Minister Lawrence Wong has sounded a sharp warning about the state of the global economy, calling the world’s current path a “dangerous new era.” His remarks came in response to the U.S. President Donald Trump’s sweeping new tariffs, which disrupted global markets and shook the foundations of multilateral trade built over decades.

Trump’s Tariffs Spark Global Economic Turmoil

President Trump’s tariff overhaul, included a baseline 10% levy on all imports and higher rates for specific countries, pushing the average U.S. tariff rate to 16.5%—its highest since 1937. The fallout was swift and severe:

- $10 trillion wiped off global equity markets in just three days, nearly 10% of global GDP.

- The S&P 500 suffered its largest four-day drop since it was established.

- China responded with tariffs on U.S. goods up to 84%, while the EU imposed 25% tariffs on selected U.S. exports (now paused).

These actions stoked fears of a global recession, with J.P. Morgan raising the probability of one from 30% to 40%. U.S. businesses face rising production costs, and consumers may soon see higher prices. More alarmingly, economists warn that the weaponization of trade could deeply disrupt global growth and supply chains.

Multilateral Trade Norms Under Siege

Beyond economic pain, Trump’s tariffs threaten the foundation of the global trading system. As multilateralism falters, countries may pivot to bilateral or preferential trade agreements, increasing fragmentation and uncertainty.

Developing countries could be hit hardest. Non-reciprocal preferences in sectors such as textiles and agriculture are eroding, which could lead to reduced exports and economic instability in vulnerable regions.

Singapore's High Stakes in Global Trade

Singapore’s position as a trade-reliant economy makes it particularly susceptible to the turbulence. With trade volumes deeply intertwined with global supply chains, the country faces:

- Slower GDP growth, with the government reconsidering its 2025 projection of 1–3%.

- Job market pressure, including slower wage growth and potential layoffs.

- Supply chain disruptions in key sectors like manufacturing and wholesale trade.

Though Singapore holds a free trade agreement with the U.S., it was still subject to the blanket 10% tariff—an action PM Wong denounced as unbefitting of friendly relations. In response, Singapore has mobilized a national task force to support affected businesses and workers.

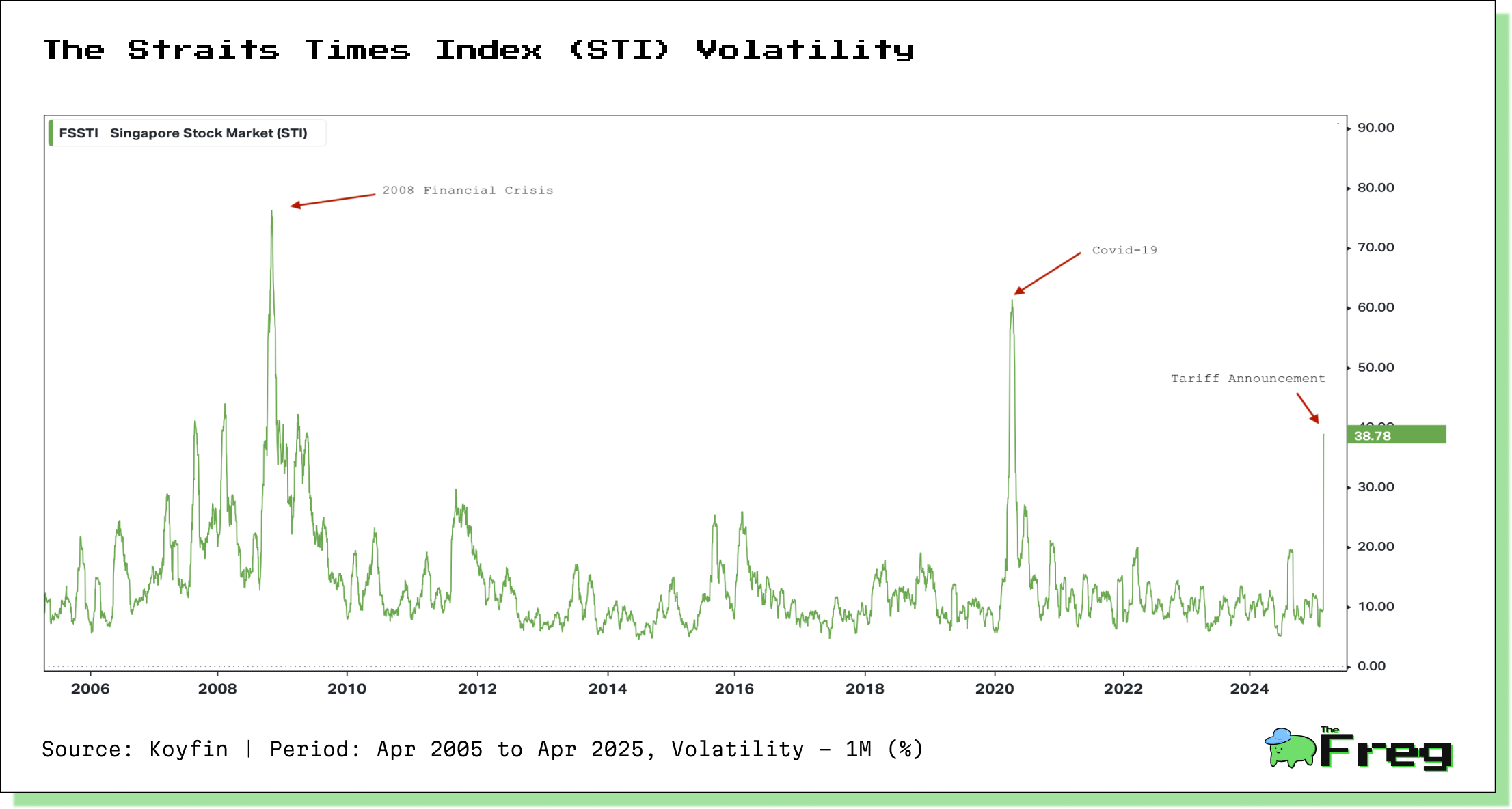

The Straits Times Index (STI), a key benchmark for the Singapore Exchange, experienced its 3rd highest spike in volatility over the last 20 years. This recent turbulence underscores the challenges facing Singapore's economy and highlights the need for robust policy responses from the government and Monetary Authority of Singapore to maintain stability in these uncertain times.

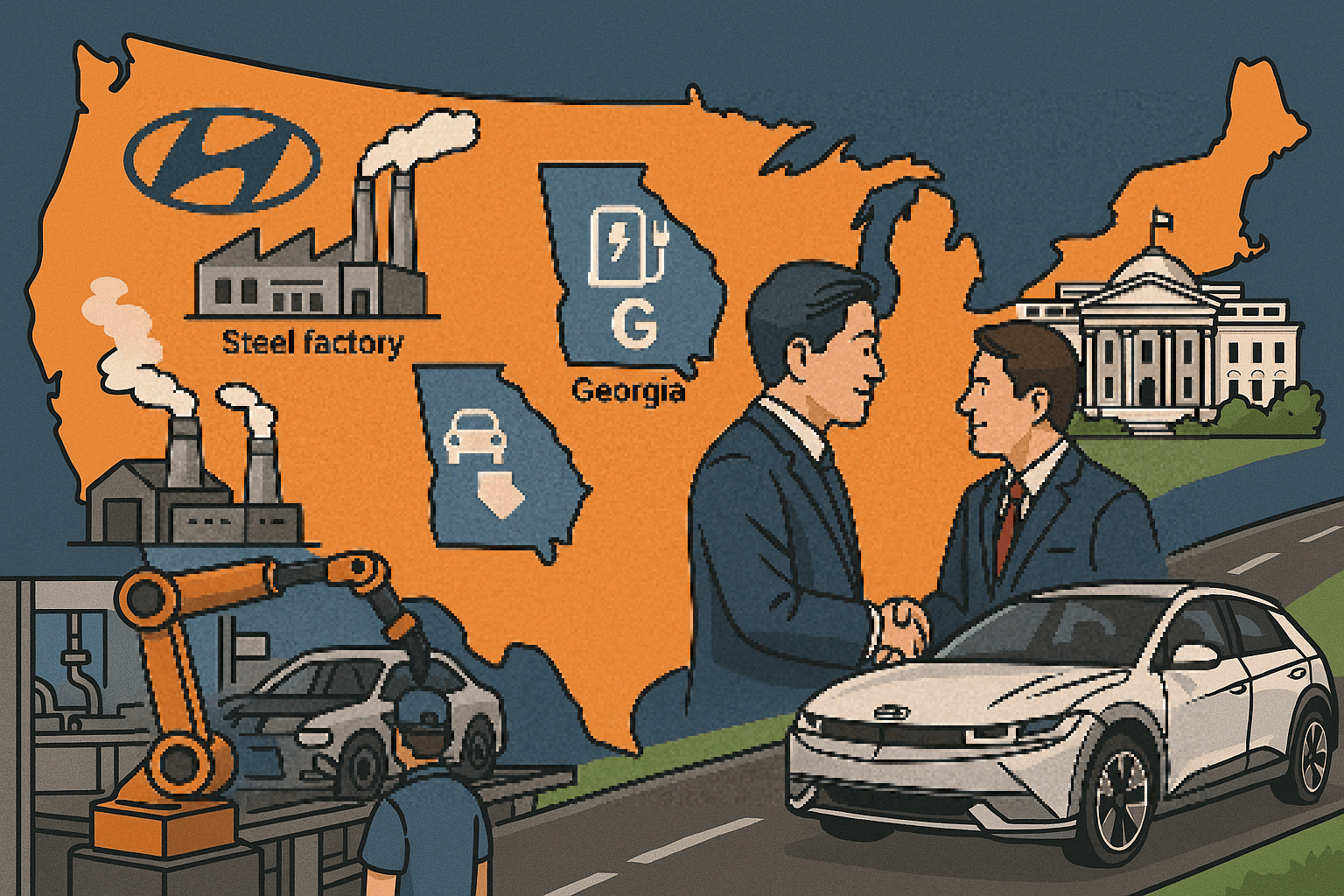

Sectoral Shockwaves: Winners and Losers in the event of tariffs

The tariffs’ impact on Singaporean industries is uneven, with several sectors taking significant hits:

- Electronics and Semiconductors: This pillar of the economy faces weakening demand, risking over 60,000 jobs.

- Manufacturing: Export-driven manufacturers are bracing for reduced global orders.

- Finance and Insurance: Market uncertainty could dampen investment and growth in these sectors.

- Pharmaceuticals: Potential U.S. tariffs up to 25% could severely affect companies like GSK and MSD, both of which have large operations in Singapore.

- REITs: Real estate investment trusts with U.S. and Chinese assets, such as Manulife US REIT and Sasseur REIT, suffered immediate sell-offs.

Yet, some bright spots remain. Singapore’s maritime and logistics sectors might benefit from firms relocating away from China. Smaller enterprises could seize new opportunities by reshaping supply chains and diversifying markets.

Government Takes Action

Singapore’s response is multi-faceted and proactive:

- Task Force Leadership: Led by Deputy PM Gan Kim Yong, this team is working with businesses to understand needs and tailor support.

- Monetary Policy: The Monetary Authority of Singapore (MAS) is ready to ease its exchange rate policy to stabilize the economy.

- Fiscal Support: Budget 2025 includes corporate tax rebates and productivity incentives, with more aid possible if conditions worsen.

- International Alliances: Singapore is doubling down on regional partnerships, especially within ASEAN, to fortify its trade resilience.

- Industry Engagement: Economic agencies are providing sector-specific assistance to mitigate disruption.

Outlook: Resilient but Cautious

Despite global headwinds, Singapore remains cautiously optimistic. Factors behind this resilience include:

- Strong governance and investor-friendly policies

- Strategic investments in innovation and digital trade

- Regional integration efforts like the Johor-Singapore Special Economic Zone

Singapore’s markets even saw a brief rally after Trump announced a 90-day pause on new tariffs. The Straits Times Index jumped over 150 points, reflecting cautious optimism. Except for China, which unfortunately does not get the benefit of the 90-day pause, instead saw an increase of up to 145% effective tariff rate.

Singapore’s unique monetary policy—focused on exchange rate management rather than interest rates—also equips it with a distinctive toolkit to manage external shocks.

As the world edges into a period marked by rising protectionism and eroding trade norms, Singapore finds itself both vulnerable and strategically prepared. Prime Minister Wong’s warning underscores the gravity of the moment, but the country’s robust policy framework, regional ties, and economic agility may yet see it through the storm.