Strategic Currents: Saudi Investment Flows into India’s Expanding Economic Landscape

Saudi Arabia has invested nearly $10B in India, spanning energy, infrastructure, tech, and startups. Aligned with Vision 2030 and India’s growth goals, this evolving partnership is reshaping emerging market ties through capital, innovation, and collaboration.

Saudi Arabia has rapidly emerged as one of India’s most dynamic foreign investors, channeling nearly $10 billion across energy, infrastructure, technology, and real estate. This expanding partnership, rooted in complementary economic priorities, is increasingly aligned with the transformative ambitions of Saudi Vision 2030 and India’s trillion-dollar digital and green economy goals.

Investment Growth Trajectory: From Modest Origins to Strategic Stakes

In just over a decade, Saudi investments in India have leapt over 60-fold—from $51 million in 2014 to $3 billion by 2020, and nearly $10 billion by 2025. These capital flows reflect a wider surge in India’s FDI appeal, with cumulative inflows nearing $710 billion since 2014.

This financial momentum is supported by consistent high-level engagements, including the creation of the India-Saudi Strategic Partnership Council, and a shared vision to modernize both economies. As India and Saudi Arabia finalize a Bilateral Investment Treaty, investment flows are expected to deepen further. Despite a dip post-pandemic, Saudi Arabia has maintained a top-20 ranking in India’s FDI landscape. Notably, the Kingdom’s revised FDI reporting methodology since 2022 offers a fuller picture of its outbound capital activity.

Energy Investment Portfolio: Refining the Partnership

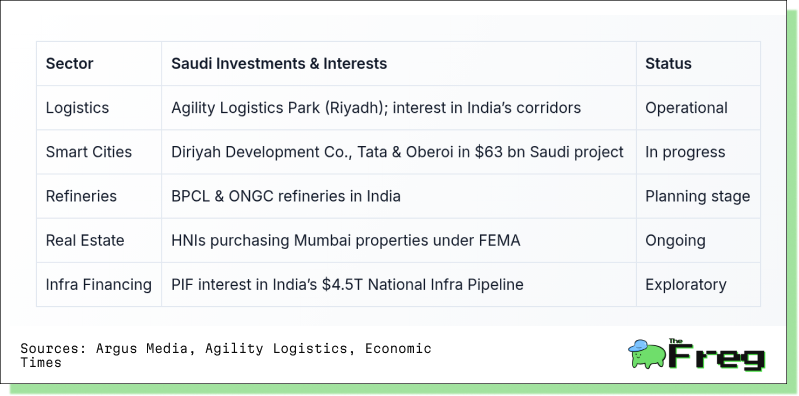

Saudi Aramco is actively pursuing equity stakes in India’s energy infrastructure. Talks are underway for 26% ownership in refineries led by BPCL in Andhra Pradesh and ONGC in Gujarat. If successful, these would secure Saudi Arabia’s crude outlet in a key growth market while potentially offering India oil supply guarantees, price discounts, and extended credit.

Renewable Energy and Green Hydrogen: A New Frontier

Both countries are transitioning toward cleaner energy matrices. The 2023 MoU on electrical interconnections and green hydrogen charts a path for electricity exchange during peak times and mutual hydrogen tech development.

The crown jewel of this cooperation is a potential undersea grid interconnectivity project linking India and Saudi Arabia. If realized, it would support India’s "One Sun, One World, One Grid" vision and mark India’s emergence as a renewable power exporter.

Infrastructure and Urban Development: Building the Future

Saudi investment extends beyond oil and renewables into India’s core infrastructure. The Public Investment Fund and Saudi private developers are exploring logistics parks, smart cities, and the National Infrastructure Pipeline

Digital Public Infrastructure: A High-Tech Axis

Digital cooperation took center stage during PM Modi’s 2025 Saudi visit. Agreements on AI, cybersecurity, semiconductors, and digital governance followed the 2024 pact on digital economy and e-health.

Saudi fintech is booming, with embedded finance revenue projected to triple by 2029. Indian firms like Infibeam and CCAvenue are leveraging this momentum—Infibeam became the first Indian firm to receive Saudi payment certification, while CCAvenue partnered with Riyad Bank.

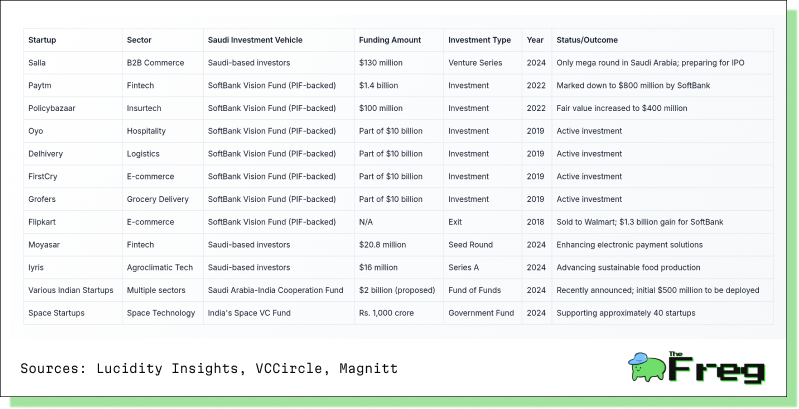

Startup Ecosystem and Technology Investments: Betting on the Next Big Thing

The Public Investment Fund and SoftBank Vision Fund (Saudi-backed) have committed nearly $10 billion into Indian startups, with major bets on Paytm, Oyo, Delhivery, and FirstCry.

With the recent announcement of a $2 billion Saudi-India Cooperation Fund and a new PIF office in India, the Kingdom is positioning itself for long-term engagement in India’s digital future.

Conclusion: A Symbiotic Future

India and Saudi Arabia are rapidly transitioning from a transactional oil trade relationship to a multi-dimensional strategic partnership. As Saudi Arabia diversifies its economy and India advances toward its $5 trillion GDP target, cross-border capital, technology, and infrastructure collaboration will be crucial drivers.

From green hydrogen to smart cities, and digital payments to startup unicorns, the Indo-Saudi investment corridor is not just growing—it’s transforming into a template for emerging market synergy in the 21st century.