Tariff Shock Sends Factors Into Defensive Retreat

April's tariff storm reshaped factor flows, sparking sharp losses in cyclical exposures.

In a market landscape already navigating choppy waters, President Trump's April tariff announcements have sent ripples through factor performance, creating a stark divide between defensive and cyclical exposures. The blanket 10% tariff implemented on April 5, followed by a punishing 145% levy on Chinese imports just days later, triggered a widespread selloff that has reshaped the investment terrain.

"The flight to safety was immediate and decisive," notes Sarah Chen, Chief Investment Strategist at Meridian Capital. "With geopolitical tensions escalating and trade war fears reignited, investors rapidly repositioned their factor exposures."

YTD vs. April Performance: A Tale of Two Regimes

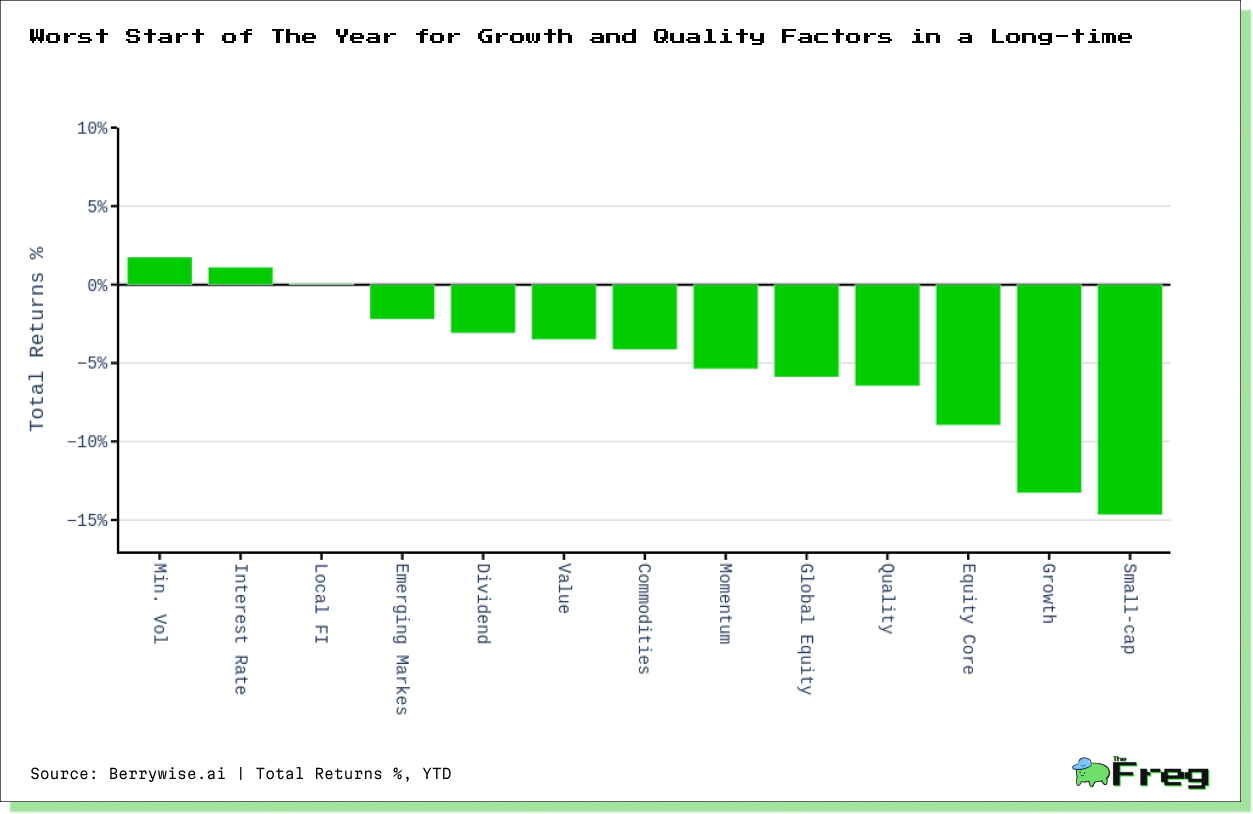

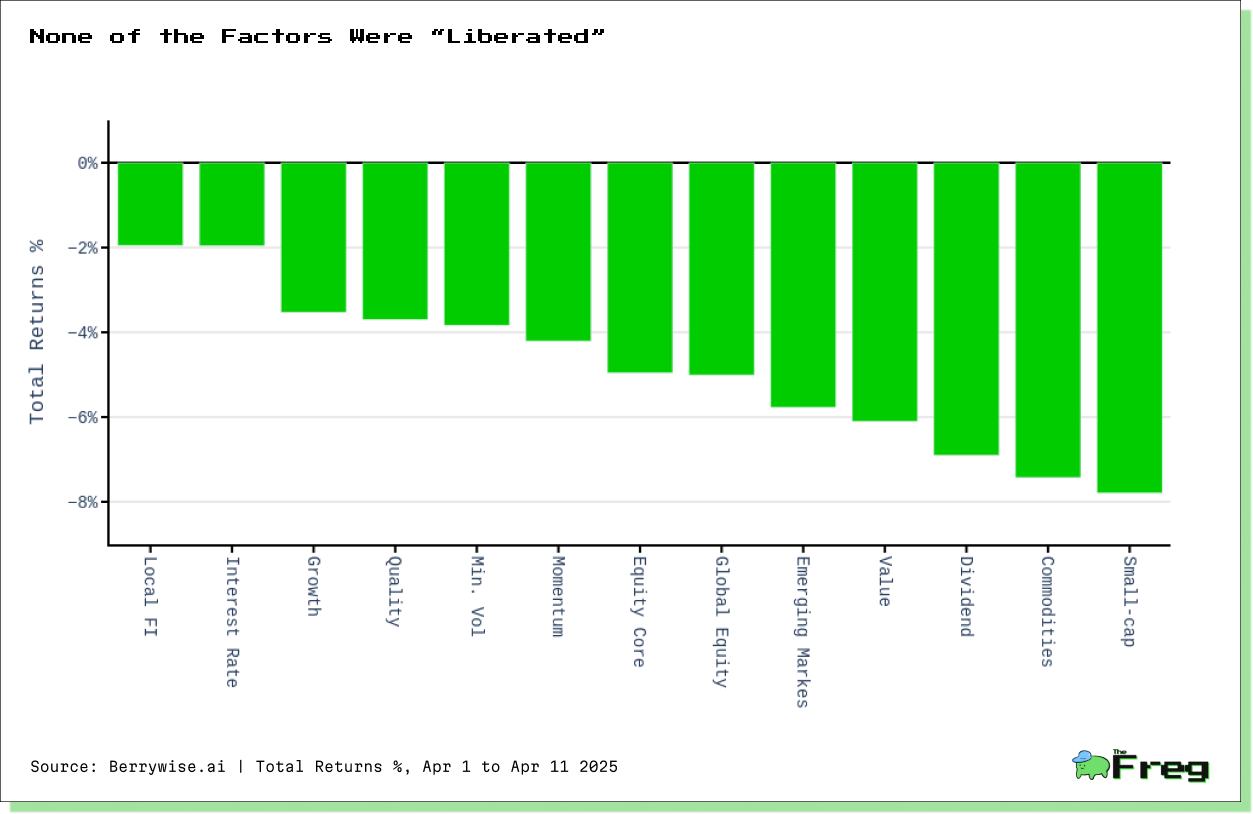

The contrast between year-to-date performance and April's tariff-shocked period tells a compelling story. While Minimum Volatility and Interest Rate factors had maintained positive YTD returns of 1.8% and 1.1% respectively through March, both succumbed to selling pressure in April, declining 3.8% and 2.0%.

Local Fixed Income, which had barely stayed positive YTD with a 0.05% return, reversed course in April with a 2.0% decline as investors reassessed interest rate trajectories amid the trade uncertainty.

Factor Performance Breakdown: Winners and Losers in the April Tariff Aftermath

Small-Cap Vulnerability

Small-cap stocks, already the worst YTD performer with a 14.7% decline, suffered additional pain during the tariff shock, dropping 7.8% in just eleven days. Their vulnerability stems from higher domestic exposure and less pricing power to absorb tariff-induced cost increases.

Commodities Under Pressure

Commodities, relatively insulated earlier in the year with a modest 4.1% YTD decline, plummeted 7.4% during the April period as trade war concerns amplified fears of global demand destruction. Except Gold.

Value's Continued Disappointment

Value stocks, which many analysts had predicted would outperform in 2025 after years of growth dominance, continued to disappoint with a 6.1% April decline, extending their YTD losses to 3.5%.

Growth's Surprising Resilience

The resilience of Growth stocks during the tariff shock period proved surprising. Despite being the second-worst YTD performer (-13.3%), Growth declined just 3.5% in April, suggesting investors may be selectively returning to quality growth names amid economic uncertainty.

Emerging Markets Weather the Storm

Emerging Markets, directly in the crosshairs of trade tensions, weathered the storm better than expected. While down 5.8% in April, this performance outpaced several domestic factors, possibly reflecting already-depressed valuations and China's stimulus measures announced in late March.

Beneath The Surface: Sector Dispersion Within Factors

A deeper sector analysis reveals significant dispersion within factors. Within Quality, healthcare names demonstrated remarkable resilience, down just 1.2% in April compared to the broader factor's 3.7% decline. Conversely, Quality technology stocks plunged 5.3% as supply chain disruptions threatened margins.

Similarly, within Emerging Markets, Latin American equities outperformed their Asian counterparts by over 300 basis points, highlighting the importance of regional diversification even within factor exposures.

Historical Context: Different This Time?

Historical precedent offers limited comfort. During the 2018-2019 trade tensions, factors exhibited similar initial reactions but with more pronounced mean reversion. "This time feels different," observes Elena Rodriguez, Chief Global Strategist at BlackRock. "The magnitude and breadth of these tariffs, combined with today's elevated valuations and tighter monetary conditions, create a more challenging recovery path for risk assets."

Institutional investors are responding with tactical adjustments rather than wholesale repositioning. A recent JPMorgan survey indicates 64% of asset managers are increasing allocations to defensive sectors within their factor exposures rather than abandoning factor strategies altogether.

As markets digest Trump's subsequent partial pause on tariff hikes, announced on April 9, the question remains whether the defensive positioning will reverse or if investors will maintain caution amid ongoing trade uncertainty.

"The next 90 days represent a critical window," explains Michael Torres, Global Head of Factor Investing at Atlantic Advisors. "If negotiations progress positively, we could see a dramatic rotation back into risk assets. If not, the defensive posture may intensify further."

Policy Shocks Elevate Factor Selection Importance

For investors navigating this complex landscape, the message is clear:

factor selection matters more than ever in a market increasingly driven by policy shocks rather than fundamentals.