Tariffs Rattle Crypto Markets

President Donald Trump's recent announcement of sweeping tariffs triggering a sharp decline in cryptocurrency prices and related stocks as investors retreat from riskier assets amid heightened economic uncertainty.

As the U.S. ramps up its trade war rhetoric with sweeping new tariffs, the ripple effects are being felt well beyond traditional financial markets—into the volatile world of cryptocurrencies. A flurry of announcements from Trump has stoked fresh economic uncertainty, triggering sharp pullbacks in Bitcoin, altcoins, and crypto-related equities.

Crypto Caught in the Crossfire

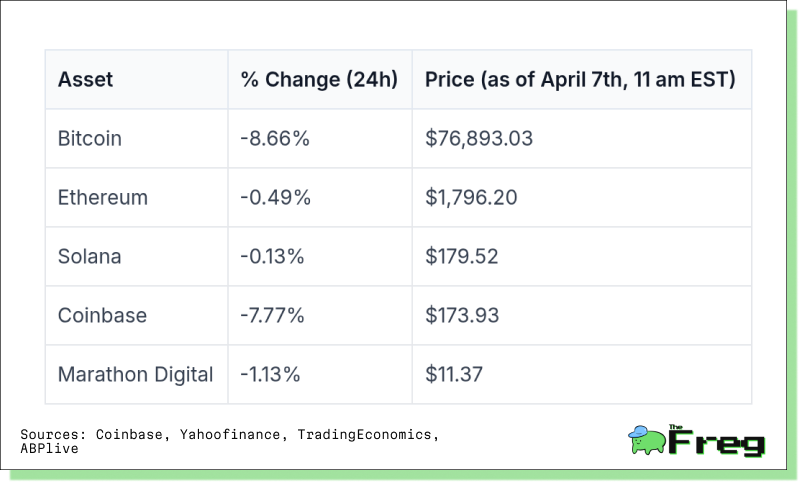

Bitcoin, often touted as a hedge against inflation and economic instability, is showing signs of stress amid mounting macroeconomic pressures. As of 11 AM EST on April 7, 2025, Bitcoin led a significant market downturn, dropping below the $77,000 mark. This sharp decline was triggered by President Trump's announcement of sweeping global tariffs, which rattled investor confidence across various asset classes.

Performance of key cryptocurrencies and crypto-related stocks as of April 7th, 2025, at 11 am EST

The cryptocurrency market experienced widespread losses, and the sell-off resulted in over $745 million in bullish crypto positions being liquidated within 24 hours, the highest in nearly six weeks. The market reaction underscores Bitcoin's increasing correlation with traditional financial markets and its sensitivity to macroeconomic factors, challenging its perception as a safe-haven asset during times of economic uncertainty.

Major altcoins weren’t spared either. Ethereum slid nearly 7%, while other popular tokens like Solana, XRP, and Dogecoin saw losses between 3% and 7%. This synchronized slump underscores how far crypto has come from its “decentralized and decoupled” roots—now closely mirroring broader market sentiment.

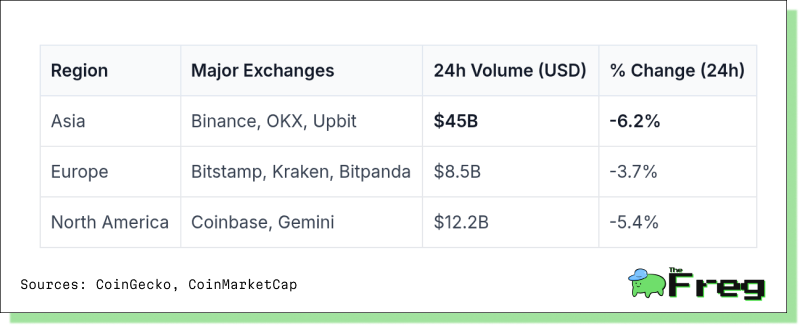

Global Crypto Market Reaction

The global cryptocurrency market experienced varied reactions to Trump's tariff announcement, with notable differences between Asian and European traders. In Asia, the impact was more pronounced, particularly in China, where crypto trading volumes saw a significant surge. Chinese investors, wary of potential economic repercussions from the tariffs, turned to cryptocurrencies as a hedge against currency devaluation. This shift led to a 29.6% increase in trading volume on Asia Pacific cryptocurrency exchange platforms.

European traders, while also affected, showed a more measured response. The European crypto market, already the second-largest globally, saw a modest increase in transaction volume, accounting for 17.6% of global crypto activity. This relative stability can be attributed to Europe's growing admiration for cryptocurrencies and the ongoing institutionalization of the market. However, the region did experience a slight decline in venture funding for crypto projects, with a 70% drop from its 2022 peak. Despite this, the launch of new financial instruments, such as euro-denominated Bitcoin and Ether futures contracts, is expected to further solidify Europe's position in the global crypto landscape.

Sentiment Sours, But Fundamentals Hold

Amidst the turbulence, investor sentiment has taken a hit. The Fear and

Greed Index has plunged to 14, signaling extreme fear. Traditional markets lost over $8 trillion in value, in a sell-off some analysts say eclipses the worst week of the 2008 financial crisis.

But even as fear grips the markets, the case for long-term crypto investment remains intact for some. High open interest in Bitcoin futures and spikes in trading volume around key support levels indicate there’s still life in the market—and perhaps a setup for a reversal.

From Digital Gold to Risk Asset?

Bitcoin’s role as a safe haven is under scrutiny. Despite its foundational promise as an asset immune to government meddling, recent price action suggests it's behaving more like a speculative tech stock than digital gold. Its 34% surge in volatility amid U.S.-China trade tensions adds fuel to this evolving identity.

In the wake of the tariff announcements, the S&P 500 remained relatively stable, highlighting Bitcoin’s growing sensitivity to geopolitical moves. Meanwhile, support levels are being closely watched, with nearly $800 million in long positions at risk of liquidation should Bitcoin break below that threshold.

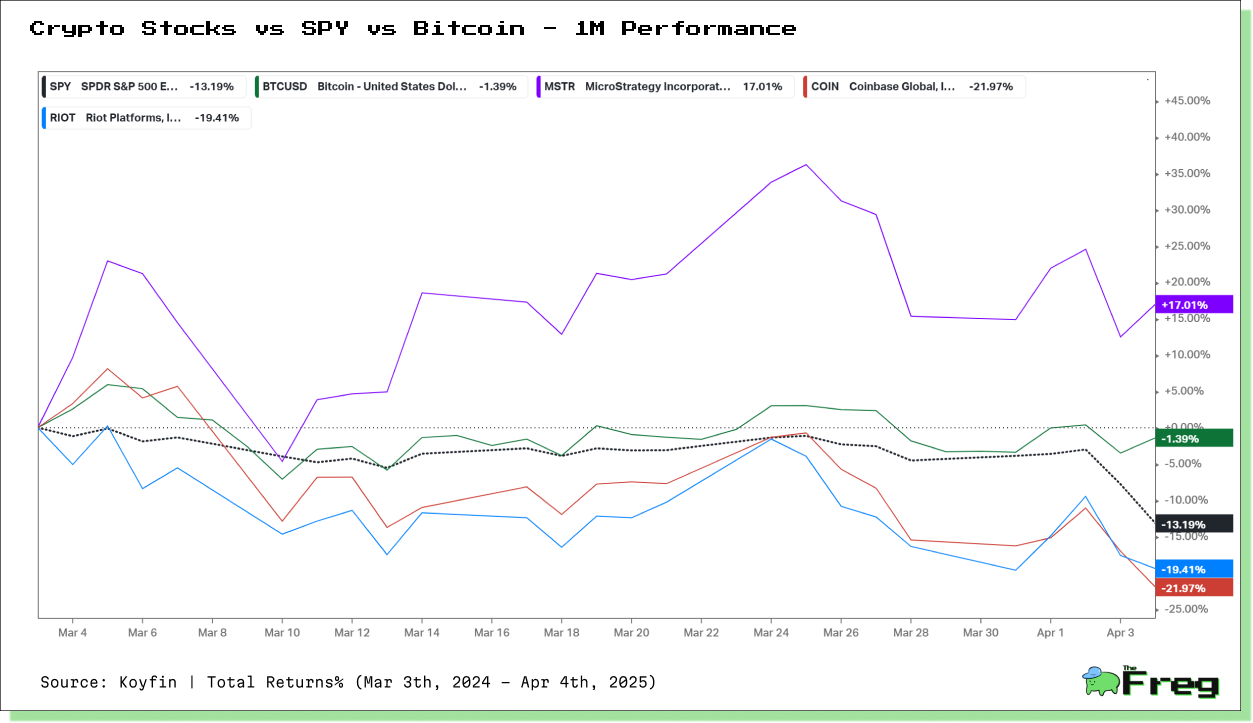

Crypto Stocks Follow Suit

The fallout hasn’t been limited to tokens themselves. Publicly traded crypto companies also took a hit. Coinbase dropped over 6%, while MicroStrategy—whose balance sheet boasts more than 214,000 BTC—fell nearly 10%. Miners like Riot Platforms and Marathon Digital logged losses of 5% and 5.1%, respectively.

Still, the drawdown was not as catastrophic as in some other sectors. Analysts attribute this resilience to crypto's inherently global nature and its decentralized foundation, which, despite its entanglement with Wall Street, continues to attract both retail and institutional attention.

Crypto-Equity Convergence

Part of crypto’s resilience in the face of macro headwinds stems from its growing entrenchment in institutional portfolios. Bitcoin ETFs have seen rapid adoption, with institutions holding over a quarter of assets under management—roughly $26.8 billion as of late 2024. These vehicles offer traditional investors exposure to digital assets without diving into wallets or private keys, further cementing Bitcoin’s place in mainstream finance.

As such, equities linked to Bitcoin have increasingly become proxies for crypto exposure. This "crypto-equity convergence" is redefining how investors access and interpret the digital asset market.

Eyes on the Fed, Inflation, and Ethereum

The coming week could prove pivotal. Investors are watching closely as new U.S. inflation data drops on Tuesday. A softer reading could reignite hopes of interest rate cuts—potentially bullish for crypto. Meanwhile, Fed Chair Jerome Powell’s congressional testimony may offer additional clues on the central bank’s next moves.

Elsewhere, Ethereum’s highly anticipated Pectra upgrade—set for Q2 2025—could spark renewed interest in the second-largest cryptocurrency, particularly if technical milestones are met on schedule.

The Big Picture

The current turbulence illustrates how crypto has evolved—from a rebellious outsider to a full participant in the global financial system. With that maturity comes a cost: exposure to the same policy shifts, rate expectations, and geopolitical dramas that sway traditional markets.

Bitcoin may still be young in its journey, but it's no longer isolated. As the digital asset ecosystem continues to integrate with legacy finance, investors should brace for volatility—but also recognize the long-term opportunities that could emerge from these periods of macroeconomic realignment.