Tariffs Send Tremors Through Treasury Markets

Trump’s sweeping tariffs rattled Treasury markets, pushed yields higher, and reignited inflation fears, sparking fears of a slowdown amid global uncertainty.

The bond market has rarely seen a week like this. Following President Trump’s sweeping announcement of new tariffs, U.S. Treasury yields surged across the curve as investors digested a volatile mix of inflation fears, fiscal uncertainty, and geopolitical risk. The sharp reaction revealed just how sensitive financial markets remain to trade policy—and just how quickly confidence can shift.

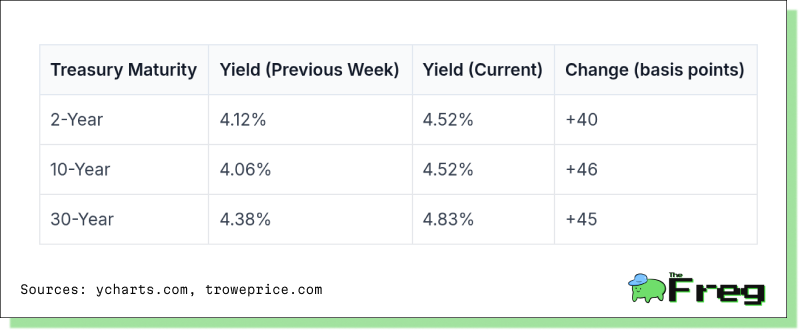

Treasury Turmoil: Yields Spike Across the Board

The most immediate fallout was in U.S. Treasuries, where yields jumped sharply across all maturities. The 10-year benchmark yield rose to 4.52% from 4.06% the previous week, while the 30-year briefly breached the 5% mark before settling at 4.83%. Even the 2-year yield, which is closely tied to Federal Reserve policy expectations, soared by 40 basis points.

These moves were not driven by foreign selloffs—China, for instance, wasn’t actively liquidating holdings—but more likely by hedge fund liquidations and diminishing demand from overseas buyers concerned about the U.S. fiscal path.

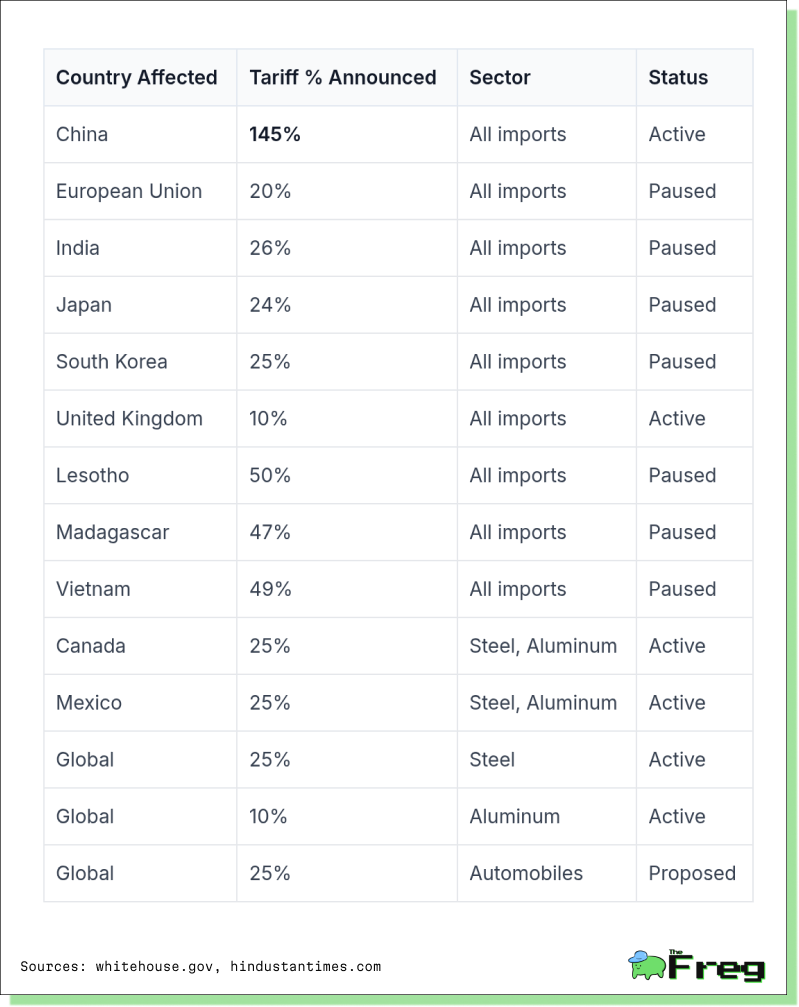

A Complex Global Tariff Web

The broader trade policy landscape now resembles a tangled web of tariffs and diplomatic uncertainty. While China faces the steepest active duties totalling at 145%, several developing nations are also exposed to elevated, albeit paused, tariffs.

While additional tariffs on the EU, India, and others are paused for now,

baseline 10% tariffs remain in effect. The uncertainty around their future status keeps global supply chains on edge. The auto sector, in particular, is bracing for a potential 25% tariff that could jolt manufacturers from Germany to Japan.

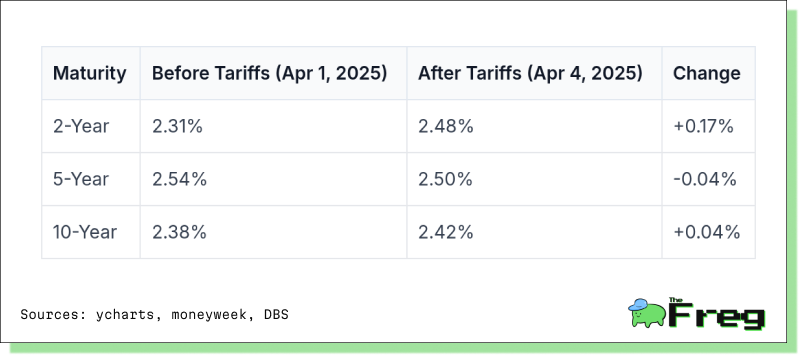

Inflation Expectations: The Markets React

One of the most closely watched gauges of future inflation—the breakeven inflation rate—offered mixed signals. The 2-year breakeven rate jumped by 17 basis points, signaling that markets see short-term inflation risks. Meanwhile, the 5-year rate dipped slightly, possibly reflecting concerns over growth.

The Federal Reserve faces a growing dilemma. Economists estimate that tariffs could add up to 2 percentage points to inflation in 2025—particularly through intermediate goods that ripple through supply chains. Fed Chair Jerome Powell acknowledged the challenge, warning of persistent inflation even as the economy shows signs of weakening.

Safe-Haven Shuffle: Investors Look Abroad

Ironically, U.S. Treasuries—the traditional safe-haven during global turmoil—saw capital flight. Instead, investors turned to gold, the Swiss franc, and German bunds. The euro appreciated, and the Swiss franc surged to a 10-year high against the dollar. This reversal highlights a growing unease with U.S. assets amid ballooning deficits and political instability.

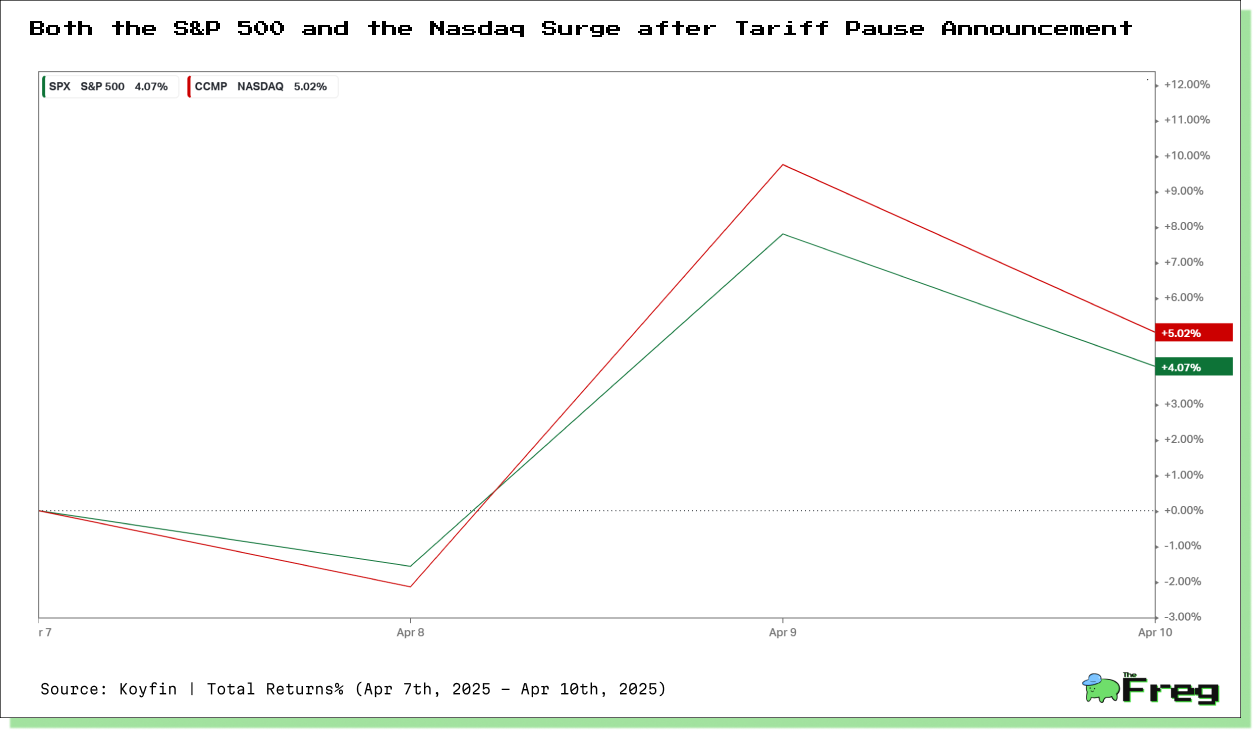

Market Rebounds, But Doubts Linger

Markets found temporary relief when Trump announced a 90-day pause on most reciprocal tariffs. The S&P 500 surged 8%, the Nasdaq jumped over 10%, and Treasury yields retreated slightly. But this reprieve was clouded by the announcement of a proposed 125% tariff on Chinese imports—signaling that the pause might be just that: temporary.

The Bond Market’s Message

Behind all the numbers, the message from the bond market is clear: investors are worried. The reappearance of so-called "bond vigilantes"—investors who demand higher yields in response to fiscal irresponsibility—suggests that markets are no longer giving Washington a free pass.

As the world watches how trade tensions evolve and how the Fed responds, the volatility of the past week serves as a stark reminder: the balance between growth, inflation, and global cooperation is more fragile than ever.