Tariffs Spark Market Jitters

"Liberation Day" tariffs loom large, threatening to reshape global trade and rattle financial markets. Investors brace for potential economic turmoil as the White House prepares to unveil sweeping import taxes that could affect all countries.

As Trump's "Liberation Day" for reciprocal tariffs looms, markets are bracing for a rollercoaster ride. According to CNBC, traders are grappling with mixed messages from the White House, sending the VIX volatility index soaring and leaving investors scrambling to position themselves ahead of what could be the biggest market risk in years.

Trump's Tariff Turmoil Explained

Trump's tariff announcements have sent shockwaves through global markets, sparking fears of a trade war and economic slowdown. The S&P 500 has fallen ~5% year-to-date, marking its worst start since 2020. Key impacts include:

- A 25% tariff on steel and aluminum imports imposed on March 11

- Doubling of tariffs on Chinese goods to 20%

- New 25% tariffs on imports from Canada and Mexico

- Threat of secondary tariffs on Russian oil exports

- Retaliatory measures announced by trading partners like Canada and the EU

The uncertainty has led to market volatility, with the VIX index

climbing to 22.5. Economists warn the tariffs could stifle growth, increase unemployment, and fuel inflation, with Goldman Sachs now

estimating a 35% chance of recession in the next year.

Sector Winners and Losers Identified

As Trump's tariff battle unfolds, clear winners and losers are emerging across various sectors. U.S. steel and aluminum producers like US Steel and Cleveland-Cliffs stand to benefit from the 25% tariff on foreign imports, with hot rolled coil prices reaching $945 per short ton. Domestic brewers like Anheuser-Busch, which sources 99% of its ingredients locally, are also well-positioned to weather the storm.

On the flip side, U.S. automakers face potential production cost increases of

$400 per vehicle. The tech sector has been hit hard, with the Nasdaq dropping over 2,300 points in the last month. Software firms like Palantir may avoid the worst effects, but hardware manufacturers like Apple, with its China-heavy supply chain, are vulnerable to a 20% tariff. In India, the jewellery sector faces significant risks, with the U.S. accounting for 30% of its exports. The textile industry, representing 28% of India's exports to the U.S., is also bracing for impact.

As markets adjust to the new reality, gold prices have surged to a record

$3,120 per ounce, reflecting increased safe-haven demand amid global trade tensions.

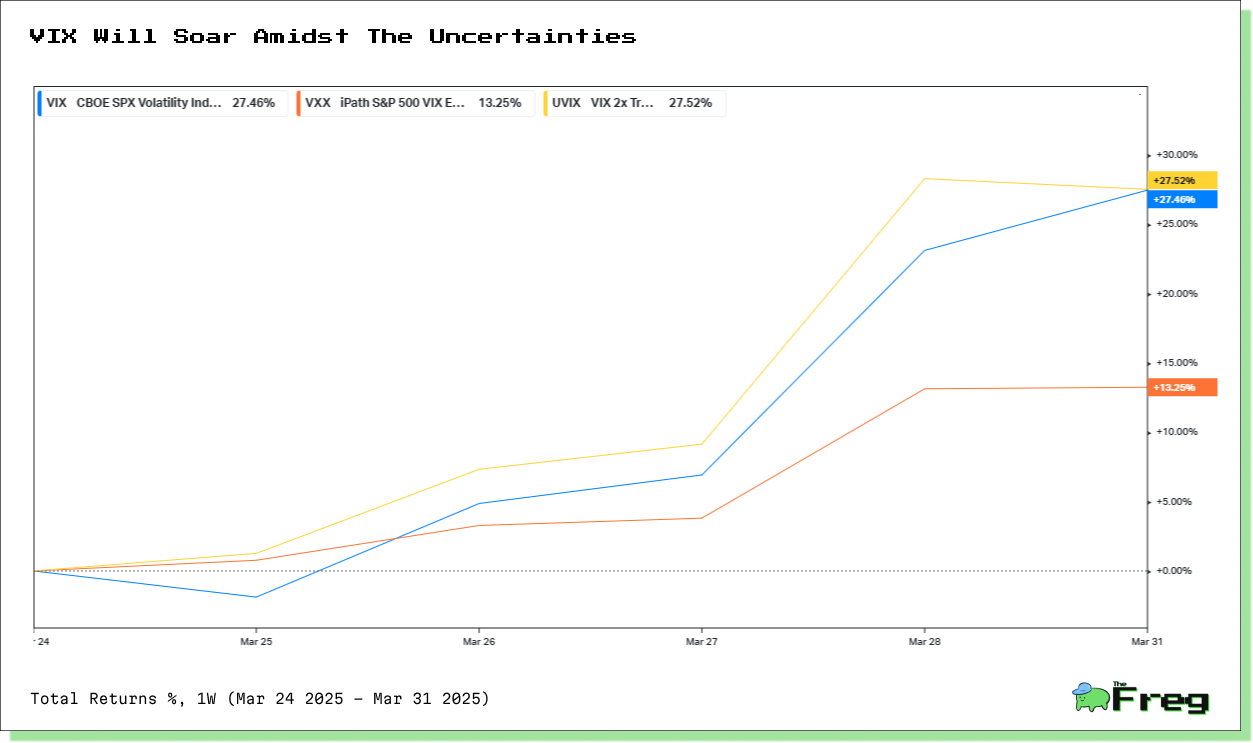

Hedging With Short-Term VIX

Going long on the VIX in the short term can be a risky but potentially rewarding strategy, especially in the current climate of market uncertainty. With Trump's tariff announcements causing market jitters, the VIX has spiked to 22.5, reflecting increased volatility. This surge presents an opportunity for traders looking to capitalize on short-term market fears.

However, caution is warranted. The VIX is known for its mean-reverting nature, typically averaging around 21 over the long run. Traders should be aware that any spike in volatility could be short-lived, making timing crucial. While going long VIX might offer a hedge against market downturns, it's not a strategy to be entered into lightly, especially given the complex dynamics of volatility trading.

Analysts Weigh Tariff Impact

Key analysts are expressing concern over the potential economic impact of Trump's "Liberation Day" tariffs. Goldman Sachs has increased the probability of a U.S. recession to 35%, up from 20%, citing the risk of tariffs stifling growth, elevating unemployment, and fueling inflation. The Kobeissi Letter, a prominent market commentator, warns that these tariffs could lead to "HOT" inflation in Q2 2025, as price hikes are likely to be passed on to consumers.

Mike Wilson, chief equity strategist at Morgan Stanley, suggests that the April 2 announcement is "likely a stepping stone for further tariff negotiations as opposed to a clearing event," indicating that policy uncertainty and growth risks may persist. Economic historian Douglas Irwin cautions that the impact could be "much bigger than Smoot-Hawley," given that imports now constitute a much larger share of GDP compared to the 1930s. Despite these concerns, some analysts note that a few countries like India, the UK, Japan, and South Korea might temporarily benefit from trade diversion if the escalation remains moderate.

Uncertainty Looms Ahead

The economic landscape is shrouded in uncertainty, prolonged ambiguity surrounding trade policies is taking a toll on business confidence and investment. Oxford Economics projects that if this uncertainty persists through Trump's entire term, it could drag down U.S. business investment by as much as 14%. This hesitation in capital spending could potentially push the economy towards a recession.

The global outlook remains precarious, with the International Monetary Fund (IMF) forecasting stable but underwhelming global growth of 3.2% in 2024 and 3.3% in 2025. However, the balance of risks is tilted to the downside, with geopolitical instability and political transitions emerging as key threats to both global and domestic growth. As markets brace for potential volatility, investors may need to reassess their strategies, considering long-term investing approaches and diversification to navigate the choppy waters ahead.