Liberation Day Plunges Stock Market

The 'Liberation Day' tariffs announcement caused turmoil across global markets, with the S&P 500 and Nasdaq tanking hard.

President Donald Trump's announcement of sweeping tariffs on virtually all U.S. imports sent shockwaves through global markets, with the S&P 500 and Nasdaq experiencing significant plunges as investors grappled with the potential economic fallout and uncertainty ahead.

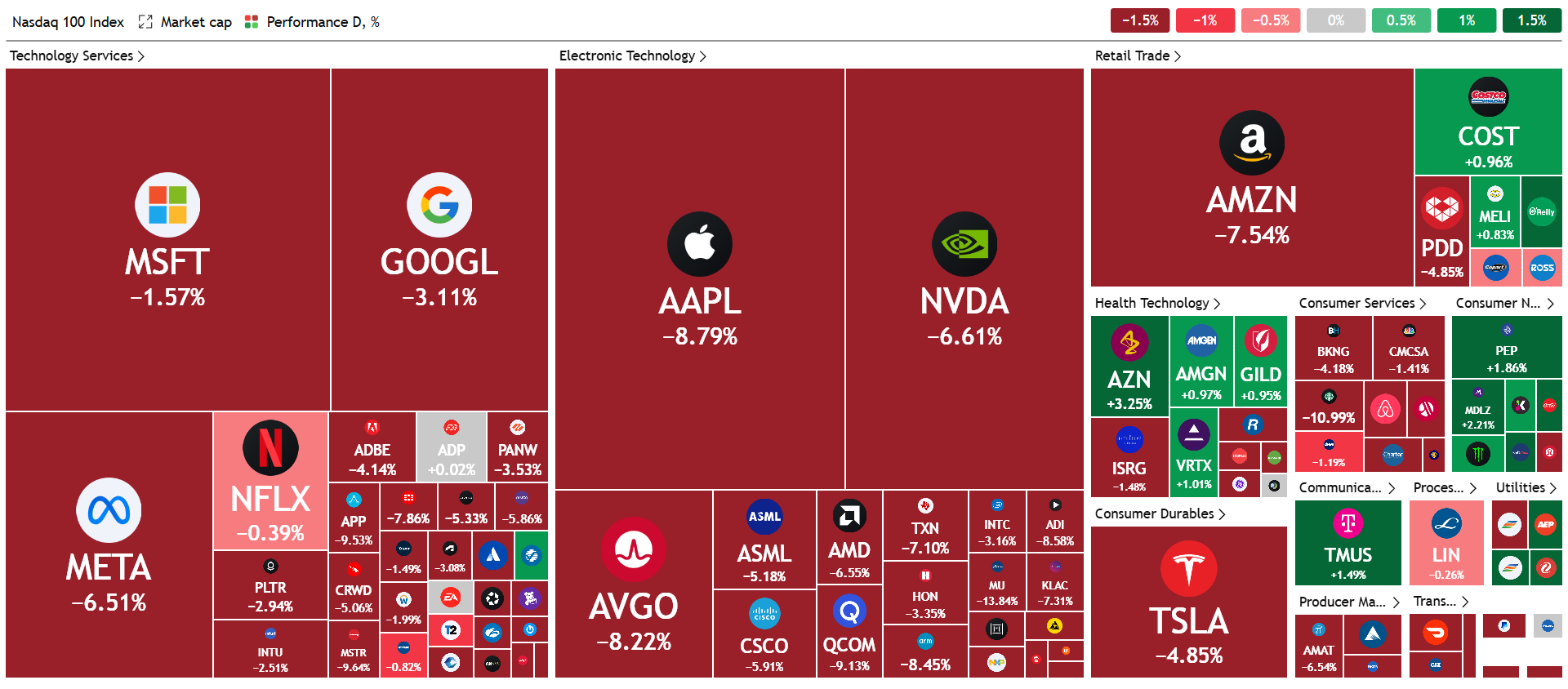

Nasdaq's Sharpest Decline Explained

The Nasdaq Composite experienced its most severe decline since the pandemic began in 2020, plummeting by 4.8%. This sharp drop was primarily driven by the tech sector's vulnerability to Trump's new tariff policy, particularly affecting companies with significant overseas manufacturing dependencies. Apple, a major component of the Nasdaq, saw its stock fall by over 8% due to concerns about disruptions in its China-based supply chain. Other tech giants and semiconductor stocks faced similar declines, contributing to the index's dramatic fall.

- The Nasdaq's decline outpaced other major indices, with the S&P 500 falling 3.7% and the Dow Jones dropping 3.1%.

- Tech-heavy stocks were hit hardest due to their reliance on global supply chains and international markets.

- The sell-off wiped out nearly $2 trillion from the U.S. stock market, with the so-called "Magnificent 7" stocks experiencing particularly sharp drops.

S&P 500's $2 Trillion Loss

The S&P 500 experienced a staggering loss of approximately $2 trillion in market capitalization within a remarkably short period following President Trump's tariff announcement. This dramatic decline occurred in less than 20 minutes, with the index shedding nearly $125 billion per minute between 4:25 PM and 4:42 PM Eastern Time. The sudden and severe market reaction highlighted the profound impact of the new trade policies on investor sentiment and economic outlook.

- The S&P 500 futures fell 3.6% in early trading on April 3.

- Over 80% of companies in the S&P 500 were trading lower, with nearly two-thirds of its 500 stocks down at least 2%.

- Companies heavily dependent on overseas manufacturing, such as Apple, Lululemon, and Nike, were among the hardest hit, with losses ranging from 9.5% to 12%.

- The index was on track for its biggest decline since 2022, reflecting widespread concerns about potential supply chain disruptions, increased inflation, and depressed consumer spending.

Memes Mock Tariff Math

The new tariffs have sparked widespread uncertainty in global markets, with analysts predicting a prolonged period of economic instability. While the baseline 10% levy applies across the board, specific countries face higher rates based on their existing duties on U.S. goods. A viral social media post humorously "decoded" Trump's tariff strategy, comparing it to a confused customer at a street market randomly demanding price hikes. Despite the levity online, serious concerns remain about potential retaliatory measures from trading partners and the impact on global supply chains, particularly in sectors like technology and manufacturing.

DID I CRACK IT?

— ☉rthonormalist🧭✡️ (@orthonormalist) April 2, 2025

I think I figured out at least a chunk of the math.

It's trade deficit divided by their exports.

EU: exports 531.6, imports 333.4, deficit 198.2. 198.2/531.6 is 37, close to 39.

Israel: exports 22.2, imports 14.8, deficit 7.4. 7.4/22.2 is 33. https://t.co/urAVoCiPLV

- China faces a steep 34% tariff on top of existing duties, while India sees a 26% rate.

- The EU collectively faces a 20% tariff, with individual member states potentially seeing different rates.

- Experts warn that tariff uncertainty may be more damaging to businesses than the actual duties themselves.

- Social media reactions range from economic critiques to Bollywood-inspired memes about trade policy.

President Trump's tariff bombshell has sent the economic world into a tizzy, with global markets doing their best impression of a roller coaster gone rogue. This new era of 'Vibe' trade policy has left investors and analysts scratching their heads, wondering if their economic textbooks are now better suited as doorstops. Major stock indices have taken a nosedive, while consumer confidence is sinking faster than a lead balloon.