Tariffs, Tech, and Transformation: Hyundai's U.S. Bet

Hyundai’s bold $21 billion investment in U.S. manufacturing and strategic focus on electric vehicles and localization aims to navigate trade tensions, boost market relevance, and reshape the future of mobility in America.

As global automakers scramble to recalibrate amid intensifying trade tensions, Hyundai Motor Group is executing one of the most ambitious overhauls in its history—a calculated mix of strategic investment, political negotiation, and industrial reinvention. At the heart of this high-stakes pivot is a bold $21 billion bet on the United States, aimed at sidestepping newly imposed 25% import tariffs and solidifying Hyundai’s role as a serious contender in the next generation of mobility.

The $21 Billion Power Move

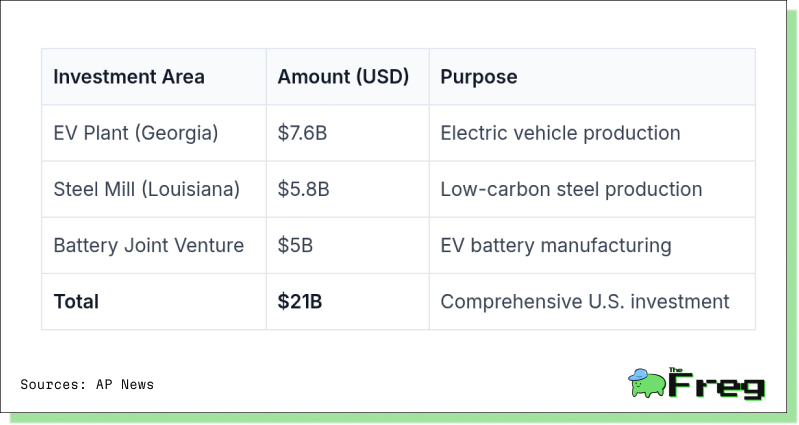

Hyundai’s commitment to invest $21 billion in the U.S. from 2025 through 2028 marks one of the largest foreign automotive investments in American history. This initiative builds on more than $20.5 billion already deployed since Hyundai entered the U.S. market in 1986, signaling a decisive shift toward localization.

Nearly half the new funding—$9 billion—is earmarked for scaling vehicle production to 1.2 million units annually across the Hyundai, Kia, and Genesis brands. A key focus is the expansion of Hyundai’s Georgia-based Metaplant America (see 'Building the Local Advantage').

Another $6 billion will go toward parts manufacturing, supply chain localization, and the construction of a Hyundai Steel facility in Louisiana. Expected to produce 2.7 million metric tons of low-carbon steel annually, the plant is a cornerstone in Hyundai’s efforts to green its supply chain while creating more than 1,400 U.S. jobs.

The remaining $6 billion will support future-facing initiatives, including partnerships in autonomous driving, robotics, artificial intelligence, and advanced air mobility. The group is also investing in EV charging infrastructure and securing energy supplies, including a $3 billion purchase of liquified natural gas from Alaska.

Tariffs, Trump, and Tactical Timing

Hyundai’s investment announcement came at a crucial political juncture. Just days after President Trump enacted sweeping 25% tariffs on imported vehicles and parts, the automaker revealed its aggressive U.S. strategy—earning a public nod from the President and a likely path to tariff exemption.

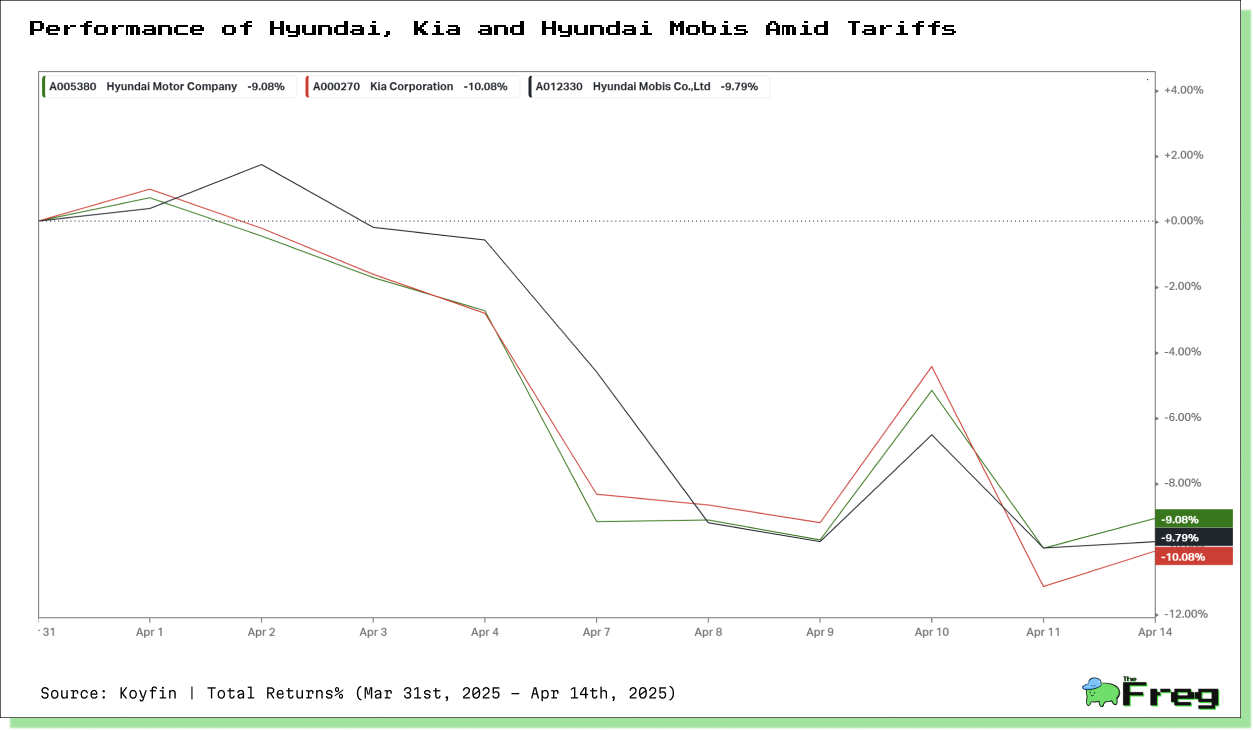

"Hyundai will be producing steel in America and making its cars in America," Trump declared, effectively granting the automaker a reprieve from the duties that have rattled the automotive sector. The market responded swiftly: Hyundai stock surged 3.85%, while Kia and Hyundai Mobis posted similar gains.

Behind the scenes, negotiations were equally strategic. Hyundai Chairman Euisun Chung met with Trump at the White House, underscoring the automaker’s alignment with the administration’s domestic manufacturing agenda. South Korean officials, meanwhile, initiated broader talks with U.S. counterparts on trade and energy cooperation, including the Alaskan LNG project.

A Pricing Lifeline for Consumers

In a move aimed at preserving customer trust and purchase momentum, Hyundai Motor America introduced a “Customer Assurance” program in early April. Under this initiative, the company guaranteed that the Manufacturer’s Suggested Retail Price (MSRP) for all Hyundai and Genesis vehicles would remain unchanged through June 2, 2025—despite the new tariffs.

Industry analysts had predicted sticker shock, estimating tariff-induced increases of $3,000 for domestically assembled vehicles and as much as $6,000 for those imported from neighboring countries. Hyundai’s price freeze not only mitigated consumer anxiety but also capitalized on strong Q1 sales to maintain showroom traffic amid economic uncertainty.

Building the Local Advantage

Hyundai’s strategy to mitigate tariff impact hinges on aggressive localization. “The best way to navigate tariffs is to increase localization,” said José Muñoz, President and CEO of Hyundai Motor Company. This philosophy is translating into tangible results across the U.S.

The group is now producing the 2025 IONIQ 5 EV in Georgia, with expanded capacity in Alabama and Louisiana. Hyundai’s supplier network is also growing—18 companies have already committed to supporting the Georgia EV facility, including Shinsung Petrochemical, which announced an $11.2 million investment.

The steel plant in Louisiana, a rare new entrant in the U.S. industrial landscape, represents a dual win: energy-efficient steel for EVs and a strategic hedge against global raw material volatility.

Investing in the Future of Mobility

Beyond traditional manufacturing, Hyundai is charging ahead into next-gen transport. At the 2025 Seoul Mobility Show, the company unveiled updated designs for the IONIQ 6 and performance-focused IONIQ 6 N Line. Its upcoming IONIQ 9 SUV, expected to feature premium safety tech and enhanced interiors, is another sign of Hyundai’s upscale ambitions.

Meanwhile, the automaker is exploring hybrid and plug-in hybrid production at its Georgia facility—originally envisioned solely for EVs—in response to shifting U.S. consumer preferences. Globally, it is investing in last-mile electric mobility through a partnership with TVS Motor in India, rolling out three-wheeler and micro four-wheeler prototypes tailored for emerging markets.

A Global Footprint with Strategic Flexibility

Hyundai’s 12 manufacturing facilities across 10 countries reinforce its capacity to navigate a volatile geopolitical landscape. From its flagship Ulsan plant in South Korea—capable of producing 1.4 million vehicles annually—to a carbon-neutral facility in the Czech Republic and a smart factory in Singapore where 200 robots assist human workers, Hyundai’s global operations provide both scale and adaptability.

The Alabama and Georgia plants alone contribute 700,000 engines and 700,000 vehicles annually, respectively. These facilities are pivotal to Hyundai’s U.S. operations, especially as the company races to meet rising demand without incurring tariff penalties.

Genesis: From Luxury to Le Mans

In a bid to elevate its luxury brand Genesis, Hyundai is entering the world of elite motorsport. The newly launched Genesis Magma Racing will debut in the FIA World Endurance Championship in 2026 with the GMR-001—an LMDh prototype built on an ORECA chassis and powered by a twin-turbo V8 derived from Hyundai’s rally experience.

The motorsport initiative, led by Team Principal Cyril Abiteboul, is more than a branding exercise. It’s a testbed for high-performance innovation that will eventually influence consumer vehicles. The team is spending 2025 competing in the European Le Mans Series, gathering vital experience before taking on endurance racing’s top tier.

Navigating Future Challenges

Hyundai’s global growth strategy hinges increasingly on U.S. manufacturing and EV leadership, with trade policy accelerating that shift. But its global sales performance tells a nuanced story of rising regional divergence.

The company’s surging U.S. sales contrast sharply with shrinking numbers elsewhere, underlining why Hyundai is betting so heavily on American soil — not just for EVs, but for relevance in a fragmented global market.

Steering a Resilient Road Ahead

Despite short-term market volatility—including a 12.77% stock dip after the initial tariff announcement—Hyundai’s long-term strategy is drawing cautious optimism from analysts. The company’s IPO in India was priced at a 26x FY2024 earnings multiple, below Mahindra & Mahindra’s peak but well above Tata Motors, signaling investor confidence in Hyundai’s future-readiness.

In India, Hyundai’s success in localization—achieving a 92% rate at its Chennai plant and saving over $672 million in foreign exchange since 2019—serves as a blueprint for other markets. The brand is also realigning export strategies, shifting focus from traditional strongholds in Latin America to emerging demand in Africa.

While geopolitical instability and macroeconomic uncertainty continue to pose challenges, Hyundai is proving it can pivot with precision. Through a blend of political savvy, industrial investment, and product innovation, the company is not just bracing for the future—it’s actively shaping it.