Tax Cuts and Shopping Sprees: The FMCG Surge

With ₹1 lakh crore of disposable income unleashed, Indian households are expected to spark a wave of spending. The FMCG sector is already riding the rally as rural and urban wallets open wider.

India’s Union Budget 2025 is more than just a set of fiscal numbers—it’s a bold bet on the country’s burgeoning middle class and the economic engine of consumption. Finance Minister Nirmala Sitharaman’s sweeping tax reforms, headlined by zero tax on income up to ₹12 lakh, signal a decisive pivot from investment-led growth to one powered by household spending.

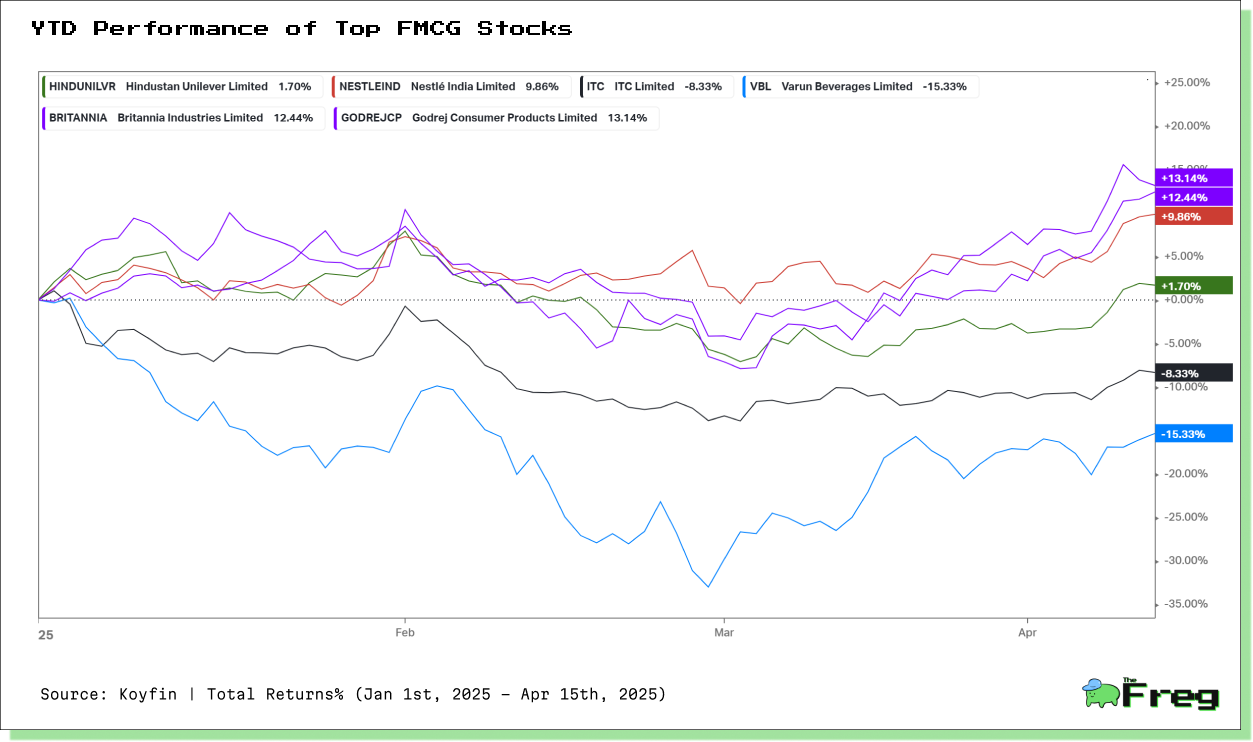

This move, potentially unlocking ₹1 lakh crore in disposable income, has already sent shockwaves through the stock markets. The Nifty FMCG Index leapt 4% on Budget Day—its strongest showing in seven months—with consumer-facing giants like ITC, Trent, and Godrej Consumer Products posting solid gains. For an economy where private consumption contributes nearly 60% of GDP, this policy shift could not have come at a more critical time.

A Quiet Revolution in Taxation

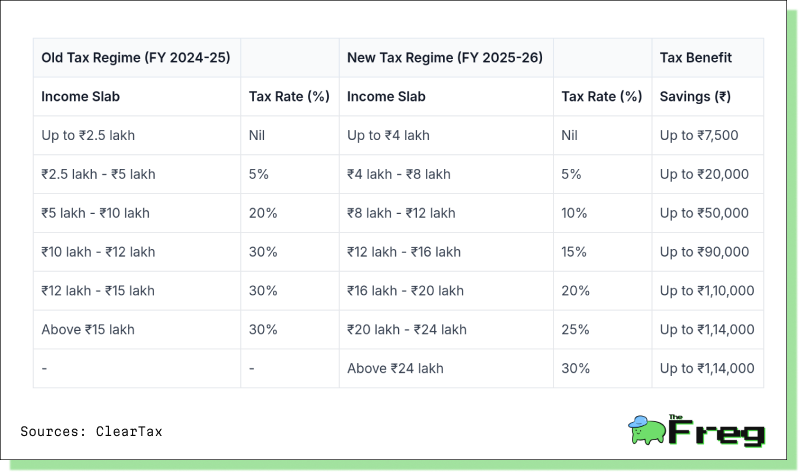

The revamped tax slabs under the new regime don’t just provide relief—they rewrite the rules for the middle class. Income up to ₹4 lakh is now entirely tax-free, with a gentle progression in rates thereafter. Thanks to a rebate mechanism and an enhanced standard deduction, incomes up to ₹12.75 lakh effectively escape taxation for salaried individuals. Crucially, those earning slightly more aren’t punished with abrupt tax jumps. A built-in marginal relief ensures a smooth glide path—a technical nuance that could make a massive difference in sustaining consumption momentum.

The Rural Resurgence

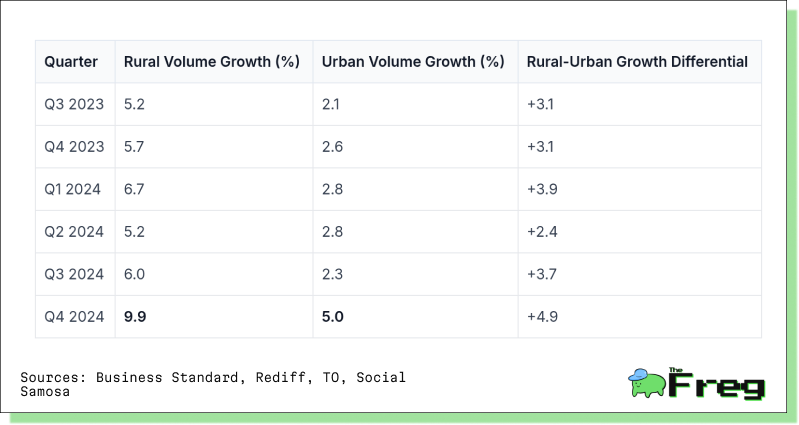

Interestingly, rural India—often treated as an afterthought in budget commentary—is stealing the spotlight. For the fourth quarter in a row, rural FMCG consumption outpaced urban markets, growing at 9.9% versus 5%. A combination of rising agricultural wages, softer inflation, and strategic pricing by FMCG firms has re-energized the rural consumer. Even monsoons are playing their part, with rainfall exceeding long-term averages.

Bigger basket sizes and a shift toward more value-added products suggest this isn’t just a blip—it’s a behavioral shift. Companies are responding with hyper-local strategies, customizing offerings by region and doubling down on rural distribution. With tax relief likely to percolate into these markets, the rural consumption engine may yet gain more horsepower.

Multiplying the Money

Economists suggest the tax relief could generate a consumption multiplier of five—meaning every rupee saved in taxes could create ₹5 in economic activity. The implications are profound. India’s middle class, growing steadily at over 6% annually, is projected to constitute nearly 60% of the population by 2047. As their purchasing power expands, the effects will cascade across industries: from real estate and healthcare to education, e-commerce, and entertainment.

Already, discretionary spending patterns are shifting. There’s greater appetite for premium goods, travel, and digital services. Post-pandemic, online consumption by middle-income households has soared by over 55%. Budget 2025 seems tailor-made to fuel this transition from necessity to aspiration.

FMCG: Fast Reactions to Fast Money

No sector responds faster to disposable income changes than FMCG. These are low-ticket, high-frequency items—soap, snacks, shampoo—that serve as real-time barometers of consumer sentiment. The pandemic, and even earlier GST tweaks, proved that any income shock—positive or negative—shows up almost instantly in FMCG sales.

Last quarter, the sector posted its strongest growth in a year, clocking in at 10.6%, largely on the back of rural demand. Now, with a policy-induced income surge, forecasts suggest FMCG could grow 5% this fiscal year, with a long-term CAGR nearing 15%. That’s not just recovery—that’s acceleration.

Beyond Groceries: The Domino Effect

While FMCG may be the first beneficiary, the knock-on effects of Budget 2025 span much wider. Discretionary sectors—automobiles, aviation, dining, and digital retail—are all poised to benefit. Companies like Maruti Suzuki and IndiGo are already seeing renewed investor interest. New-age platforms like Zomato and Nykaa could ride this wave as tier-2 and tier-3 cities open up to urban consumption trends.

Even sectors less directly linked to spending—logistics, packaging, financial services—stand to gain. More goods moved, more packages wrapped, and more loans taken to fund dreams and purchases alike. It’s an ecosystem-wide ripple.

Market Cheers, but Clouds Linger

Yet, for all the market euphoria, caution is warranted. The rally, while celebratory, has sentiment running ahead of fundamentals. Inflation remains a specter, cited by nearly a third of consumers as a threat to future spending. Global instability—from supply chain disruptions to geopolitical tensions—could also derail this consumption experiment.

Fiscal concerns loom large too. The projected federal deficit of $1.9 trillion, or 6.2% of GDP, doesn’t leave much room for error. And then there’s the unpredictable monsoon, the lifeline of rural India, where consumption growth is now anchored.

A Turning Point, or Just a Turn?

Whether Budget 2025 marks a structural shift in India’s economic model or simply a well-timed stimulus remains to be seen. The immediate effect is undoubtedly cyclical—money in hand tends to get spent. But if this policy manages to spur long-term changes in consumption, savings behavior, and investor confidence, it may well usher in a new era of growth.

India is targeting a $5 trillion economy and aspiring to developed-nation status by 2047. Budget 2025, with its focus on putting money directly into the hands of the middle class, could be a decisive step on that journey. The question now is: will the shopping carts keep rolling, or will the road ahead throw up unexpected speed bumps?