The AI-Driven Insurance Revolution

AI is revolutionizing insurance, enhancing risk assessment, dynamic pricing, and fraud detection. While insurers leverage AI for efficiency, they face challenges like regulatory scrutiny, data privacy, and algorithmic bias.

Artificial intelligence (AI) is transforming the insurance industry, reshaping risk assessment, pricing, and policy development. With AI-related insurance premiums projected to reach nearly $5 billion by 2032, insurers are racing to develop innovative solutions despite the lack of historical data and rapidly evolving risks.

AI-powered systems are enhancing insurers’ ability to analyze vast amounts of data, enabling real-time risk management, hyper-personalized policies, and advanced fraud detection. Integrating Internet of Things (IoT) sensors and connected devices into insurance models is further refining risk assessments, particularly in sectors like cyber insurance. However, as AI becomes more prevalent, insurers must also navigate challenges such as data privacy concerns, algorithmic bias, and evolving regulatory frameworks.

The Emerging AI Risk Landscape

AI-related risks introduce new complexities that fall outside traditional insurance categories. These include algorithmic bias, cybersecurity breaches, deepfake fraud, and autonomous system failures. Traditional policies such as general liability and professional liability insurance often fail to comprehensively cover AI-specific risks, prompting insurers to develop specialized AI policies.

Emerging AI insurance products now provide coverage for:

- AI system malfunctions that cause property damage or personal injury

- Cybersecurity vulnerabilities leading to data breaches or hacking incidents

- Deepfake fraud and reputational harm

- Intellectual property disputes involving AI-generated content

As AI technology advances, insurers must continuously refine their methodologies to assess these risks effectively and ensure comprehensive coverage.

AI-Powered Risk Assessment & Pricing Challenges

Insurers are leveraging AI-driven methodologies to assess and quantify risk more accurately. Machine learning models analyze massive datasets, improving risk predictions over time. Techniques like Monte Carlo simulations and scenario modeling allow insurers to test various risk factors in complex AI-driven environments.

Key methodologies include:

- Dynamic risk management: Using real-time data from IoT and social media

- Predictive analytics: Forecasting potential claims based on AI behavior

- Advanced fraud detection: Identifying anomalies in claims data

- Scenario modeling: Evaluating potential AI-related failures

Despite these advancements, pricing AI insurance remains a challenge. The lack of historical claims data, combined with regulatory uncertainty and industry-specific variations in AI risks, makes it difficult to establish sustainable premium models. Insurers are addressing these challenges by implementing dynamic pricing, collaborating with AI experts, and developing industry-specific risk models to ensure fair and accurate pricing structures.

Regulatory Challenges & Compliance in AI Insurance

Governments and regulatory bodies are introducing new frameworks to oversee AI-driven insurance practices. The National Association of Insurance Commissioners (NAIC) in the U.S. has issued guidelines to mitigate bias and enhance transparency, while the European Union’s AI Act classifies some insurance applications as high-risk, requiring additional scrutiny.

Key regulatory considerations include:

- Governance controls and senior management oversight

- Third-party vendor compliance and risk assessment

- Regulatory exams focusing on data sources, bias mitigation, and model transparency

- Fair underwriting and claims handling to prevent discrimination

As global regulations continue to evolve, insurers must stay proactive to ensure compliance while maintaining consumer trust.

The Future of AI in Insurance

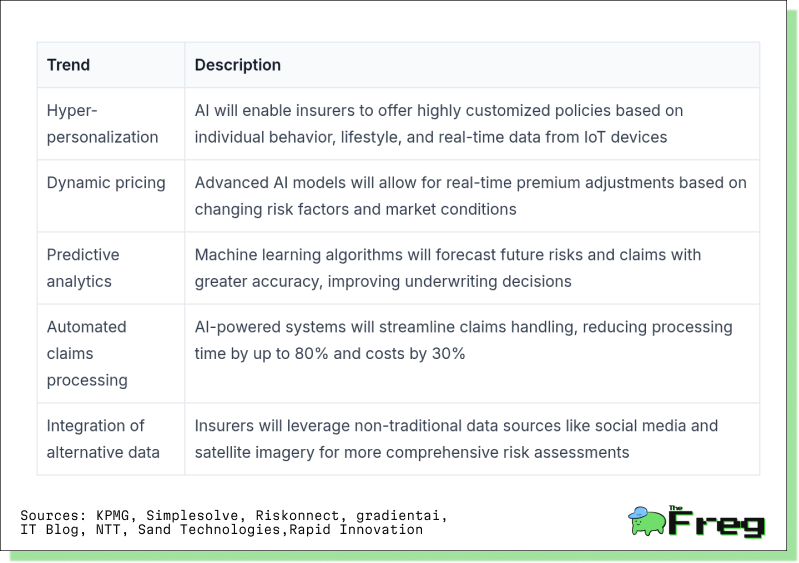

The integration of AI into insurance will continue to drive innovation and reshape industry practices. Insurers are increasingly adopting hyper-personalized policies, predictive analytics, and automated claims processing to enhance efficiency and customer experience. Blockchain technology is also being explored to improve policy management and claims transparency.

Key Future Trends in AI Insurance

As insurers balance AI-driven innovation with ethical considerations and compliance, they must remain vigilant to ensure fairness, transparency, and accountability in their practices.

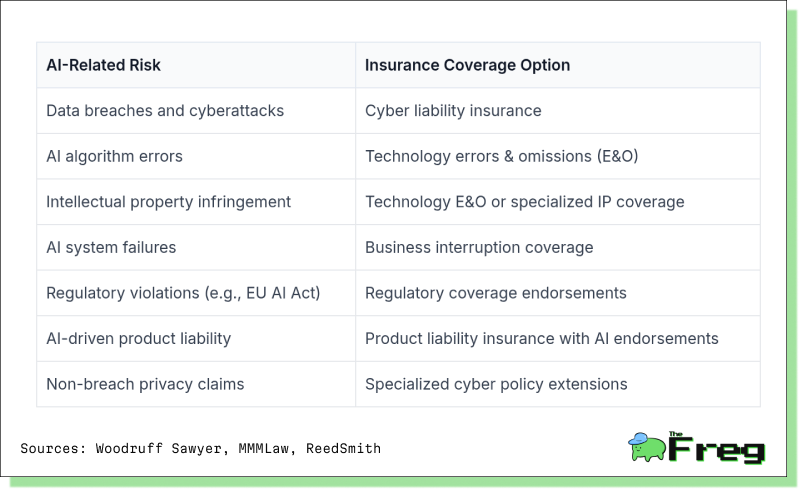

AI Insurance Risk & Coverage Options

With AI risks spanning multiple domains, insurers are tailoring coverage options to address emerging challenges. Below is an overview of AI-related risks and corresponding insurance solutions:

Leading insurers are developing AI-focused endorsements, such as AXA XL’s expanded cyber coverage, which includes protection against data poisoning and regulatory violations. Businesses investing in AI should conduct thorough risk assessments and seek policies that offer adaptive coverage for evolving risks.

The AI Insurance Outlook: Innovation Meets Risk Management

As AI continues to transform the insurance industry, businesses must take a proactive approach to risk management. Companies investing in AI should conduct thorough risk assessments, ensuring they understand the specific vulnerabilities associated with their implementations. Seeking dynamic insurance policies that can adapt to evolving AI-related risks is essential for comprehensive coverage. Transparency in AI decision-making will be crucial to mitigating liability, particularly as regulators scrutinize algorithmic fairness and data governance. Organizations must also prioritize strong cybersecurity measures to protect against data breaches and maintain compliance with rapidly changing regulations. As AI-driven risk assessment reshapes the industry, insurers that successfully integrate AI into their models while addressing ethical and regulatory challenges will gain a competitive edge in this evolving landscape.