The Art of The Deal: Trump's Trade Reset

China retaliates, Vietnam capitulates. As global markets reel and recession fears mount.

Just when you thought your newsfeed was already drowning in tariff updates, another trade war twist grabs the headlines.

President Donald Trump's sweeping new tariffs, announced in April 2025, have sent shockwaves through the global economy, with many experts warning of potential recession risks and trade disruptions. According to reports from Reuters and The Atlantic, Trump's strategy aims to reset the world trade order and pressure other nations to lower their trade barriers, but it could have far-reaching consequences for both the U.S. and global economies.

China's Retaliatory Tariffs

China has responded to President Trump's tariffs with a sweeping retaliation of its own, announcing a 34% tariff on all U.S. imports effective

April 10, 2025. This move matches the rate of Trump's recent "reciprocal" tariff on Chinese exports, escalating the trade war between the world's two largest economies. In addition to the tariffs, China has implemented several other countermeasures:

- Export controls on medium and heavy rare earth elements, including samarium, gadolinium, and terbium, which are crucial for high-tech industries.

- Addition of 16 U.S. entities to an export control list, banning the export of dual-use items to these companies.

- Placement of 11 U.S. firms on an "unreliable entities" list, allowing for punitive actions against them.

- Filing a lawsuit with the World Trade Organization over the tariff issue.

These actions represent a significant escalation in China's response to U.S. trade policies, moving beyond targeted measures to a comprehensive approach that matches the breadth of Trump's tariffs.

Global Reactions to US Levies

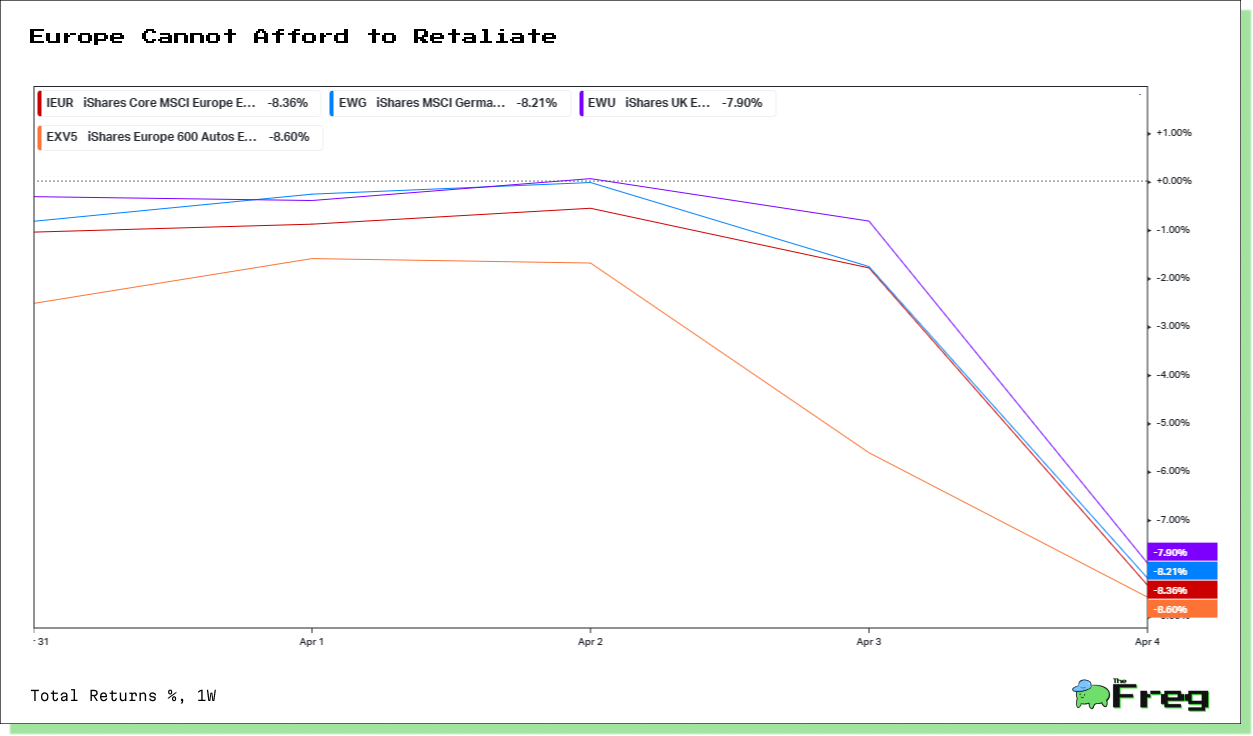

The announcement of Trump's sweeping tariffs has triggered a wave of global reactions, with many world leaders expressing concern and promising countermeasures. The European Union, through Commission President Ursula von der Leyen, called the tariffs a "major blow to the world economy" and warned of dire consequences for millions worldwide. China, facing a 34% tariff on top of existing duties, implemented countermeasures to protect its interests.

Other nations have responded with varying degrees of alarm and caution:

- Japan described the 24% tariff as "extremely regrettable" and will seek exemptions.

- South Korea, hit with a 25% tariff, is preparing emergency support measures for affected industries.

- Canada pledged to "combat these tariffs with counteractions".

- Colombia's President Gustavo Petro suggested Latin American countries could potentially benefit from the situation.

- Fiji called the tariffs "disproportionate" and "unfair".

The global response reflects a mix of dismay, threats of retaliation, and attempts to negotiate, highlighting the far-reaching impact of Trump's trade policy on international relations and the global economy.

Vietnam's Tariff Reversal

Vietnam's swift response to Trump's 46% tariff announcement demonstrates the effectiveness of his aggressive trade strategy. Just days after the tariff revelation, Vietnamese Communist Party General Secretary To Lam signaled willingness to slash tariffs on U.S. goods to zero, pending a broader agreement. This dramatic shift highlights Trump's aim to reset trade relations and secure more favorable terms for the U.S.

Key developments in Vietnam's response:

- Offer to cut tariffs to zero on U.S. imports.

- Request for a 1-3 month delay in implementing U.S. tariffs.

- Plans to increase purchases of U.S. goods, including aircraft and LPG.

- Commitment to facilitate American investment in Vietnam.

Trump's strategy appears to be yielding results, as countries scramble to negotiate better terms and avoid punitive tariffs. This approach aligns with his goal of reshaping global trade dynamics to prioritize U.S. interests and manufacturing.

Manufacturing Revival or Decline? Is it Even Worth it?

The Trump administration's tariff strategy aims to revitalize U.S. manufacturing, but experts are divided on its potential success. While President Trump claims that "jobs and factories will come roaring back" due to these policies, the reality may be more complex. The manufacturing sector, which once employed nearly 20 million Americans and constituted over a quarter of the total workforce, now accounts for only about 8% of national employment.

Despite some companies announcing plans to relocate factories to the U.S., economists argue that significant reshoring is unlikely due to established global supply chains and worker shortages. Studies show that previous tariffs led to more job losses in industries paying higher duties than gains in protected sectors. The steel industry, for instance, saw increased profitability but limited job creation, while downstream industries suffered job losses due to higher input costs. Overall, the tariffs' impact on manufacturing remains uncertain, with potential benefits offset by increased production costs, reduced export competitiveness, and the risk of retaliatory measures from trading partners.

Its Different This Time! A Week of Regime Shift.

The first week of April 2025 has been marked as one of the most tumultuous in global financial markets in over a decade, with major shifts in economic outlooks and spiking recession probabilities. J.P. Morgan dramatically increased its forecast for the likelihood of a global recession to 60%, up from its previous estimate of 40%. This significant revision was echoed by other financial institutions, with Goldman Sachs raising its recession probability from 20% to 35% within the next year.

The market reaction to these developments has been severe:

- The S&P 500 experienced its largest weekly drop since March 2020.

- The Nasdaq Composite entered bear market territory, falling over 20% from its December peak.

- The Cboe Volatility Index, a key measure of market fear, surged to its highest level since April 2020.

- Global financial markets saw trillions wiped off stock market values.

One of The Worst Week For Global Markets Since 2020

Federal Reserve is now between a rock and a hard place. Trump resets, Fed will have to cut rates.

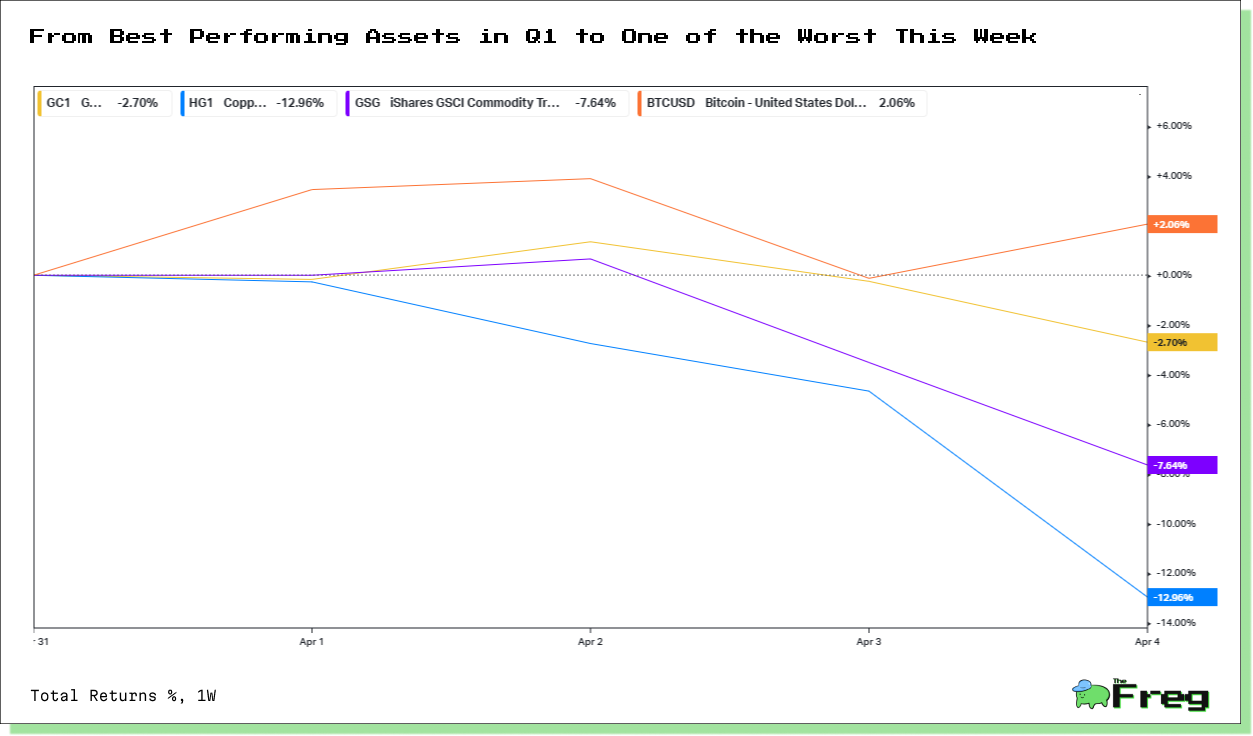

Commodities are signaling a world-wide slowdown.

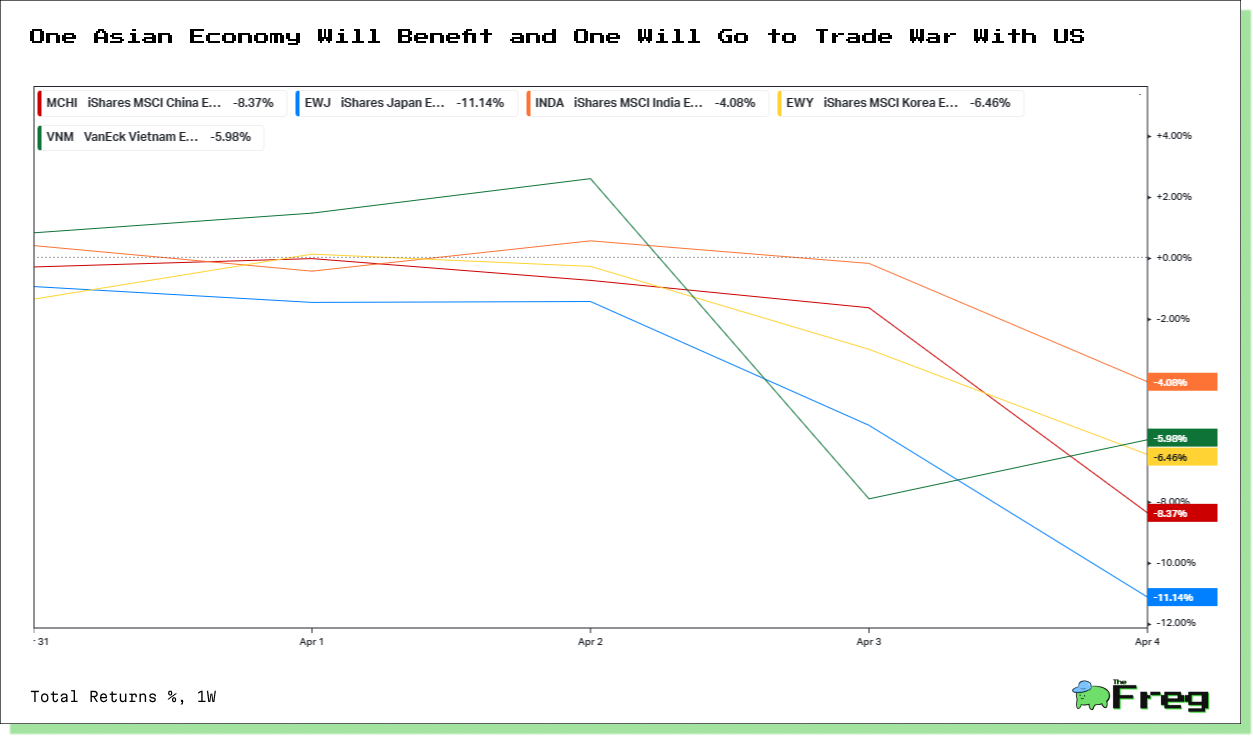

Asian countries will have to make difficult choices.

These dramatic shifts are largely attributed to the escalating trade tensions and the implementation of sweeping tariffs by the Trump administration, which have rattled investor confidence and raised concerns about global economic growth. The sudden change in market dynamics has led many analysts to declare a fundamental shift in the economic regime, with potential long-term implications for global trade, inflation, and economic interdependence.