The Digital Safe Haven in a Shifting Financial Landscape

Stablecoins are transforming finance—offering stability, speed, and accessibility across payments, DeFi, and global markets amid growing economic uncertainty.

As financial markets flinch under the weight of inflation, geopolitical instability, and banking uncertainty, a surprising source of stability has emerged—not from Wall Street, but from the blockchain. Stablecoins, digital assets designed to maintain a consistent value by being pegged to fiat currencies like the US dollar or commodities like gold, are quietly reshaping global finance.

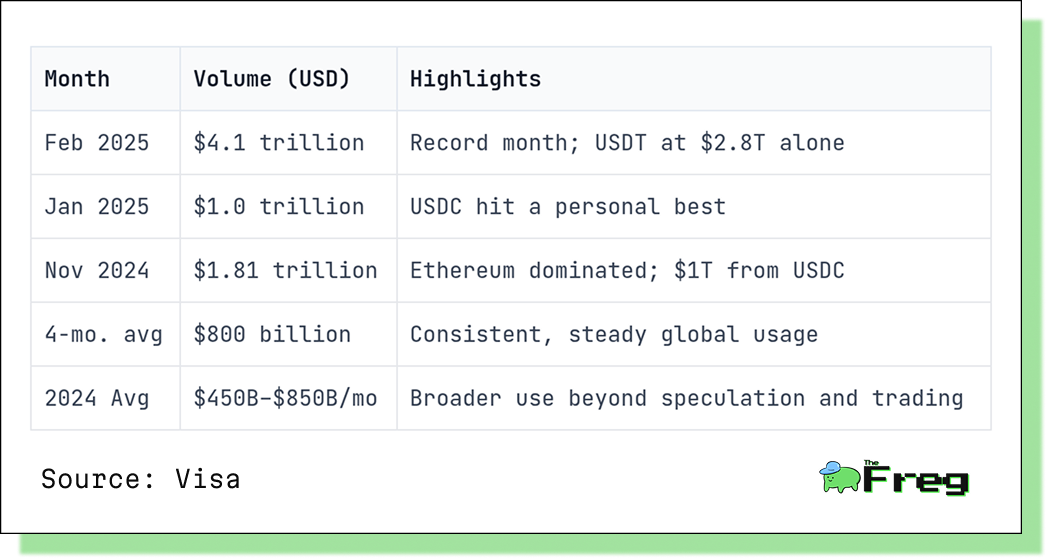

With over $14 trillion in transaction volume in 2024—surpassing Visa—they are becoming a cornerstone of digital payments and a refuge for those seeking financial security in volatile times.

From Speculation to Stability

Traditional cryptocurrencies, while innovative, are notorious for their price volatility. This makes them unsuitable for daily transactions or long-term savings. Stablecoins, on the other hand, are engineered for stability. By maintaining a 1:1 peg with fiat currencies or tangible commodities, they offer a reliable medium of exchange, particularly valuable during inflation or market turmoil.

Whether used for everyday payments, cross-border payroll, or DeFi trading, their core appeal remains the same: stability. In economies facing hyperinflation—like Venezuela or Argentina—demand for dollar-pegged stablecoins has soared, as citizens seek to escape the erosion of local currency value.

“Stablecoins are the closest thing to digital dollars that many people around the world can access—especially those without a bank account, and that access is growing exponentially.”

The ecosystem is now valued at $220+ billion, with projections aiming as high as $2 trillion by 2028 if favourable legislation is passed in the U.S.

Powering Global Payroll and Inclusion

For global companies, stablecoins are revolutionizing how payroll is handled across borders. Instead of waiting days for traditional wire transfers and paying hefty fees, businesses can now settle salaries in minutes, with costs slashed by 3–5% on average.

This transformation isn't just about efficiency—it’s about access. In regions with limited banking infrastructure, stablecoins offer a way for workers to receive income directly into mobile wallets. No banks, no delays, no FX headaches. It’s a level of inclusivity that was previously unimaginable.

The Backbone of DeFi

Beyond payroll, stablecoins play a key role in decentralized finance (DeFi). On platforms like Uniswap and Aave, they make it easy to trade, lend, and

provide liquidity without the worry of sudden price swings. Because their value stays stable, users can move in and out of positions with confidence—something that's important for both everyday investors and professional traders.

People who provide liquidity can deposit stablecoins into smart contracts and earn rewards, either from trading fees or special tokens. This not only creates a way to earn passive income, but also helps DeFi platforms run more smoothly by improving liquidity and reducing the gap between buy and sell prices.

Riding the Wave of Inflation

In high-inflation economies, stablecoins are increasingly viewed as a

digital inflation hedge. Unlike local currencies that can lose value by the hour, stablecoins provide a store of value tied to stronger economic benchmarks.

Some issuers have gone even further by launching inflation-linked stablecoins—like USDi, which adjusts based on the U.S. Consumer Price Index. These innovations are not just helpful—they’re essential for individuals and businesses trying to preserve wealth amid economic freefall.

Risks on the Horizon

Stablecoins are no longer a niche. They now account for over 1% of the global M2 money supply, and analysts predict this figure could hit 10% in the coming years. They’ve also become the 18th-largest holder of U.S. Treasuries, signalling real-world financial integration.

But this scale brings scrutiny. Experts warn of redemption risk—what happens if too many holders try to cash out at once? Without transparent reserves and proper regulation, stablecoins could face the digital equivalent of a bank run.

To address this, regulators and industry leaders are pushing for real-time reserve audits, on-chain transparency, and "circuit breakers" to halt panic withdrawals. Without these safeguards, a crisis of confidence could unravel the entire ecosystem.

The Final Catalyst

The biggest leap forward might come from Washington. The proposed GENIUS and STABLE Acts are set to bring regulatory clarity to the space, requiring full 1:1 reserves, third-party audits, and strict anti-money laundering rules.

If passed, these bills could turbocharge stablecoin adoption, especially among institutions and traditional financial players. Standard Chartered projects the market could grow tenfold to $2 trillion by 2028—powered not just by speculation, but by compliance, trust, and usability.

The Future Is (Surprisingly) Stable

Stablecoins may have started as an afterthought in the crypto boom, but they are now taking center stage. They’re redefining how money moves—across borders, platforms, and people.

From digital dollars to inflation shields, from DeFi anchors to payroll disruptors, stablecoins are proving one thing: stability is the new innovation.