The Looming U.S. Debt Ceiling Crisis

The U.S. faces a debt ceiling crisis, risking economic turmoil, market volatility, and global instability if Congress fails to act.

The U.S. is once again facing a debt ceiling crisis, with serious economic consequences if Congress fails to act. The Congressional Budget Office (CBO) warns that the government could run out of money as early as May or August 2025, putting the nation at risk of defaulting on its $36.6 trillion debt. The resolution of this crisis depends on political negotiations, economic performance, and investor sentiment.

What Is the Debt Ceiling?

The debt ceiling is the legal limit on how much the federal government can borrow to pay for existing obligations, such as Social Security, Medicare, military salaries, and interest on national debt. Raising the debt ceiling does not authorize new spending—it simply ensures the government meets commitments already approved by Congress. Since its introduction in 1917, the debt ceiling has been raised or suspended over 100 times.

Current Picture

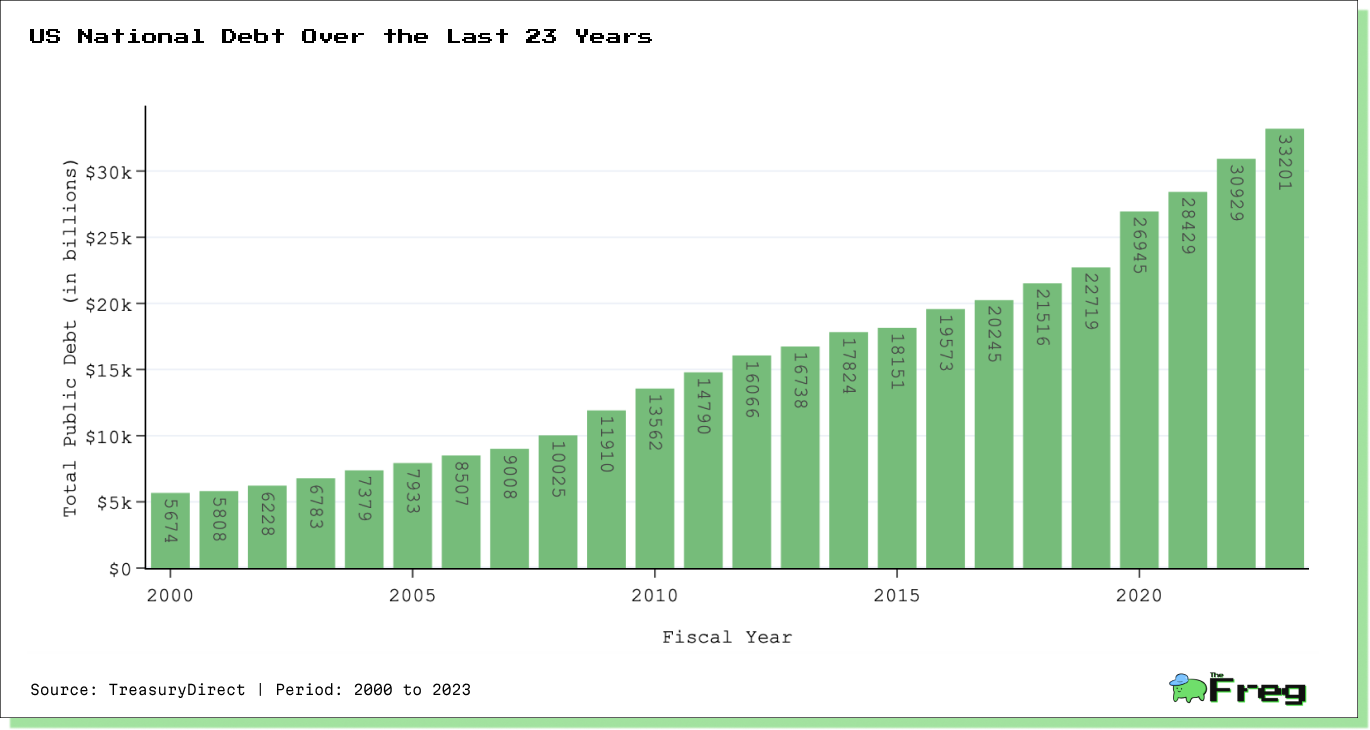

This data shows a consistent upward trend in the national debt over the past two decades.

The debt has more than quintupled since 2000, growing from $5.67 trillion to over $33 trillion by the end of fiscal year 2023. This rapid increase has raised concerns about long-term fiscal sustainability and has contributed to the ongoing debates about the debt ceiling.

It's important to note that while the absolute dollar amount of the debt has increased significantly, it's also crucial to consider this debt in relation to the size of the U.S. economy (GDP) for a more comprehensive understanding of its impact.

What Happens If the U.S. Defaults?

If Congress does not raise the debt ceiling, the consequences could be severe:

- Economic Recession: A short-term breach could lead to 2 million job losses and wipe out trillions in household wealth (Moody’s Analytics estimate).

- Delayed Payments: Social Security, Medicare, and government salaries could be delayed, disrupting millions of households.

- Global Financial Turmoil: A U.S. default could destabilize financial markets and undermine confidence in the U.S. dollar as the world’s reserve currency.

- Stock Market Crash: U.S. stocks could fall by up to 45%, erasing nearly $10 trillion in household wealth.

- Higher Borrowing Costs: Interest rates would rise, making loans more expensive for businesses and consumers.

Emerging markets that rely on U.S. exports and investments could also suffer economic slowdowns.

Key Dates to Watch in 2025

- January 2: Debt ceiling reinstated at $36.1 trillion.

- Late May/June: Earliest possible default if tax revenues fall short.

- Mid-June: Key tax payment deadline that could affect Treasury’s resources.

- June 30: Additional emergency measures become available.

- August/September: Most likely window for reaching the "X-date," when the government runs out of funds.

Treasury Secretary Scott Bessent is expected to provide a more precise estimate in May.

Fixes and Hurdles

Temporary Fixes: Extraordinary Measures

To delay default, the U.S. Treasury is using "extraordinary measures," including:

- Suspending investments in federal retirement funds.

- Halting reinvestment in certain government securities.

- Pausing issuance of specific bonds.

These actions free up cash but are only temporary solutions.

Political Stalemate: The Biggest Hurdle

A divided government makes negotiations difficult:

- Republicans: Demand spending cuts in exchange for raising the debt ceiling.

- Democrats: Push for a "clean" increase without conditions.

This political brinkmanship increases uncertainty and makes a swift resolution unlikely.

Credit Rating and Market Impact

Credit rating agencies are already sounding alarms:

- S&P downgraded the U.S. from AAA to AA+ in 2011.

- Fitch followed in 2023 due to governance concerns.

- Moody’s has placed the U.S. on negative outlook, warning of further downgrades.

A default would trigger additional downgrades, raising borrowing costs for both the government and everyday Americans.

Investor sentiment remains cautious, with heightened market volatility. Bond yields are rising, and stocks are fluctuating as uncertainty looms

What’s Next?

While analysts estimate a 90% chance of a last-minute deal, prolonged uncertainty can still damage the economy. The recurring debt ceiling crisis highlights the need for long-term fiscal reforms to prevent future brinkmanship.

For now, businesses, markets, and everyday Americans remain on edge, waiting for Congress to take action and avoid a financial disaster.