The Perfect Storm Lifting Indian Banking Stocks

A surge in Indian banking stocks is being powered by strong earnings, dovish RBI policy, a steepening yield curve, and renewed foreign investor interest. With credit growth and liquidity on the rise, the sector may be poised for a sustained bull run.

A perfect convergence of macroeconomic conditions, policy shifts, and sector-specific catalysts has propelled Indian banking stocks to historic highs. The Nifty Bank index has soared past the 55,000 mark, gaining nearly 6% in just three trading sessions. This rally, while certainly buoyed by impressive Q4 results from sector giants like HDFC Bank and ICICI Bank, is being driven by a deeper and broader set of structural tailwinds.

Corporate Earnings Spark Momentum

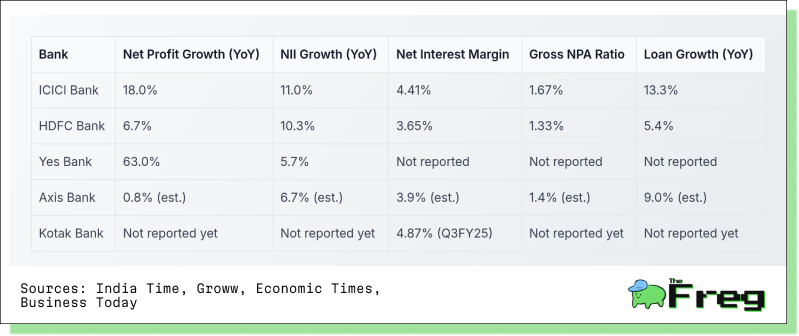

ICICI Bank and HDFC Bank delivered robust quarterly earnings, setting the tone for the banking rally. ICICI Bank posted an 18% YoY surge in standalone net profit to ₹12,630 crore, outpacing expectations despite macroeconomic headwinds. Its net interest income (NII) climbed 11% to ₹21,193 crore, and the net interest margin (NIM) improved to 4.41%.

HDFC Bank, meanwhile, recorded a 6.7% YoY increase in net profit to ₹17,616 crore—beating analyst projections of 3.3% growth. NII rose 10.3% to ₹32,066 crore. Asset quality at both banks also improved, reinforcing investor confidence in their fundamentals.

Tailwinds from Monetary Easing

The Reserve Bank of India's dovish stance has played a key role in the sector’s rally. A 25 basis point cut has brought the repo rate to 6%, with further reductions likely to bring it down to 5.50% by the end of 2025. While initially compressing margins, this cycle of easing is expected to benefit banks in the medium term as deposits reprice, stabilizing NIMs.

Lower interest rates also improve borrower affordability and enhance asset quality. Wholesale-funded lenders and NBFCs gain faster, but all banks benefit from better credit performance and margin expansion as the yield curve steepens.

Yield Curve: The Silent Driver

India's yield curve is steepening as short-term yields decline faster than long-term rates. This dynamic favors banks that borrow short-term and lend long-term. The 10-year benchmark yield is expected to drop to around 6.25-6.30% by September 2025, driven by increased bond issuances, enhanced liquidity, and expectations of further rate cuts.

This "bull-steepening" pattern supports bank margins and profitability, especially for cooperative and savings banks. With another 50-75 basis points of rate cuts on the horizon, banks stand to gain structurally.

Macroeconomic Stability and Inflation Control

Softening inflation—from 6.21% in October 2024 to 3.61% in February 2025—has provided the RBI room to maneuver. The central bank’s liquidity measures could unlock ₹3 lakh crore in capital, potentially spurring credit growth by 2%.

India's macroeconomic position remains resilient amid global trade volatility, making domestic-oriented banking stocks a safer bet. With minimal international exposure and government support for growth, the sector is well-positioned to outperform.

Resurgence of Credit Growth

Liquidity injections from the RBI are expected to release ₹2.5–3 lakh crore of deployable capital. Macquarie and Morgan Stanley project a 1.4–2% uplift in credit growth and a modest margin improvement.

Sectoral lending patterns are also evolving. Banks are rebalancing from retail toward corporate loans, particularly in infrastructure and energy. This diversification mitigates risk and positions banks for continued growth. IDFC First Bank, for instance, aims to expand its loan book by 20% following a ₹7,500 crore capital raise.

Foreign Investors Pivot Back

FIIs have reversed course dramatically. After withdrawing over $15 billion in 2025, they have invested ₹14,670 crore into the Indian market in just three days (April 15–17), with banking stocks as the primary beneficiaries. This rotation is concurrent with a selloff in IT stocks, reflecting a broader pivot to domestic growth themes.

With over $800 billion still parked in Indian equities, renewed FII interest is a strong signal of global investor confidence in the financial sector’s potential.

Institutional Flows Support the Rally

March marked a turning point as FIIs turned net buyers, injecting ₹11,111 crore on March 27 alone—the highest single-day investment in 2025. DIIs have consistently supported the market, balancing out volatility from FII flows.

Banking Sector Performance at a Glance

ICICI leads the pack with superior profit and loan growth, while HDFC remains a steady performer. Yes Bank's 63% profit spike signals a promising turnaround.

Sustainability of the Rally

Technical indicators and institutional flows suggest that the rally has legs. Bank Nifty recently closed at 55,304, up 1,014 points, and analysts believe it could rise another 2% if it maintains support above 54,000. Key drivers include:

- Continued FII and DII support

- Accommodative monetary policy

- Robust liquidity and credit conditions

- Low global exposure and stable valuations

Still, global risks loom. Any shift in U.S. Federal Reserve policy or escalation in geopolitical tensions could affect sentiment. As always, investors should watch RBI's policy direction, earnings from mid-tier banks, and global macro trends.

Outlook: Cautious Optimism

The Indian banking sector stands at a promising crossroads. Strong fundamentals, supportive policy measures, and returning investor confidence have created fertile ground for sustained growth. Yet, amid the optimism, selectivity and vigilance remain essential.

If macro conditions remain favorable and policy momentum continues, the Bank Nifty could well target 56,000 in the near term. But as global uncertainties persist, the market will continue to reward prudence, discipline, and a close watch on institutional behavior.