The Shaky Ground Beneath the Bond Market

The U.S. Treasury market’s growing fragility threatens global finance, amplifying volatility, constraining policy, and unsettling investors worldwide.

The U.S. Treasury market is often seen as the unshakable bedrock of global finance—a deep, liquid, and dependable place where governments, corporations, and investors go to anchor their portfolios and policies. But lately, this cornerstone is showing cracks.

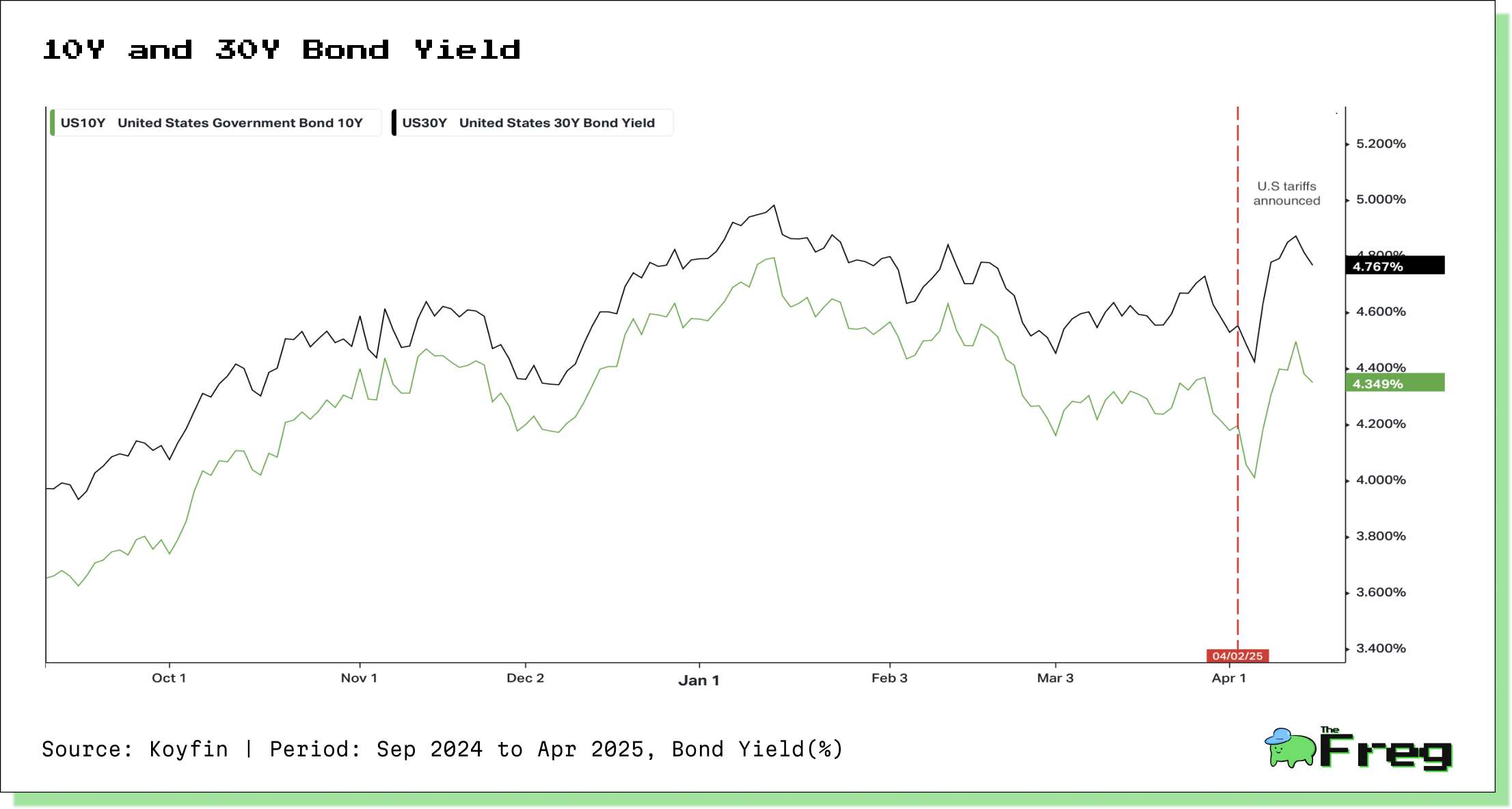

The Market's Reaction to Tariffs

In early April 2025, the 10-year Treasury yield surged by more than 50 basis points in just two days. For a market that typically moves in millimeters, this was a seismic shift. The catalyst?

A cascade of new tariffs announced by the Trump administration, followed by a sudden policy reversal that excluded key electronics categories. Traders scrambled, hedge funds unwound leveraged bets, and bid-ask spreads ballooned—classic signs of market stress.

The Liquidity Problem: More than Just a Buzzword

Liquidity in the Treasury market—the ability to buy or sell without drastically moving prices—has eroded. In part, this stems from regulatory changes following the 2008 financial crisis.

While stricter capital standards made banks safer, they also discouraged traditional dealers from making active markets in Treasuries. Enter principal trading firms and hedge funds, which have filled the void with high-speed, algorithmic trading—but with far less capital backing their positions.

The result? A market that looks liquid on a calm day but buckles under stress. When volatility spikes, these new players often step back, leaving the market vulnerable to abrupt swings. As Susan Collins of the Boston Fed noted, the Federal Reserve stands ready to step in if needed—but the very need for that assurance speaks volumes.

The Return of the Bond Vigilantes

Adding to the complexity is the return of the so-called “bond vigilantes”—investors who demand higher yields in response to fiscal excess. In the past, they’ve forced governments to rethink their spending plans, from Clinton-era deficits in the 1990s to the UK’s mini-budget crisis under Liz Truss.

Now, they’re eyeing Washington’s ballooning debt and inflationary pressures. Their message is simple: keep spending irresponsibly, and we’ll make you pay for it through higher borrowing costs. It’s a powerful check on fiscal policy—but also a destabilizing force when combined with a fragile market structure.

Hedge Funds and the Leverage Labyrinth

Hedge funds, especially relative value strategies, are deeply entrenched in Treasury trading. Some use leverage ratios north of 30:1. These positions, while often low-risk in theory, can turn toxic fast when markets move suddenly. In April’s selloff, forced unwinds of “basis trades”—where funds short Treasury futures and go long cash bonds—exacerbated the chaos. This isn’t the first time we’ve seen such dynamics, and it won’t be the last.

The problem isn’t just that hedge funds take risks. It’s that their actions, when amplified through leverage, ripple across the entire market. A 12-basis-point yield jump in response to a Fed move might not sound like much—but it’s a 33% bigger impact than in periods with lower hedge fund exposure.

Geopolitics Meets the Bond Market

Then there’s China. With around $760 billion in U.S. Treasury holdings, it remains the second-largest foreign creditor to the U.S. But that number is shrinking—and fast. As trade tensions escalate, speculation has grown that China could weaponize its holdings in a financial showdown. The mere perception of such a move has the power to send yields soaring, especially when other foreign holdings have already fallen from 50% to 30% of the market.

Why This All Matters—and What Comes Next

The Treasury market isn’t just a place for government IOUs. It’s the keystone of the global financial arch. It anchors interest rates for mortgages, student loans, corporate bonds—you name it. It’s also how the Federal Reserve transmits monetary policy. But when liquidity is scarce, leverage is high, and geopolitics are volatile, that transmission becomes unpredictable.

Policy moves that would normally cause minor ripples can now unleash tidal waves. And the Fed’s job—already complicated by inflation and growth concerns—becomes that much harder.

So where is the Treasury market headed? More volatility seems likely. Investors and policymakers alike will need to navigate a landscape where every headline, hedge fund trade, or policy misstep could trigger exaggerated responses. This doesn’t mean the system is broken—but it’s far more fragile than it used to be.

“Even the perception that foreign investors are trying to step away from Treasury markets can trigger significant panic.”