The Trade War Strikes Again: China’s Yuan Hits New Lows

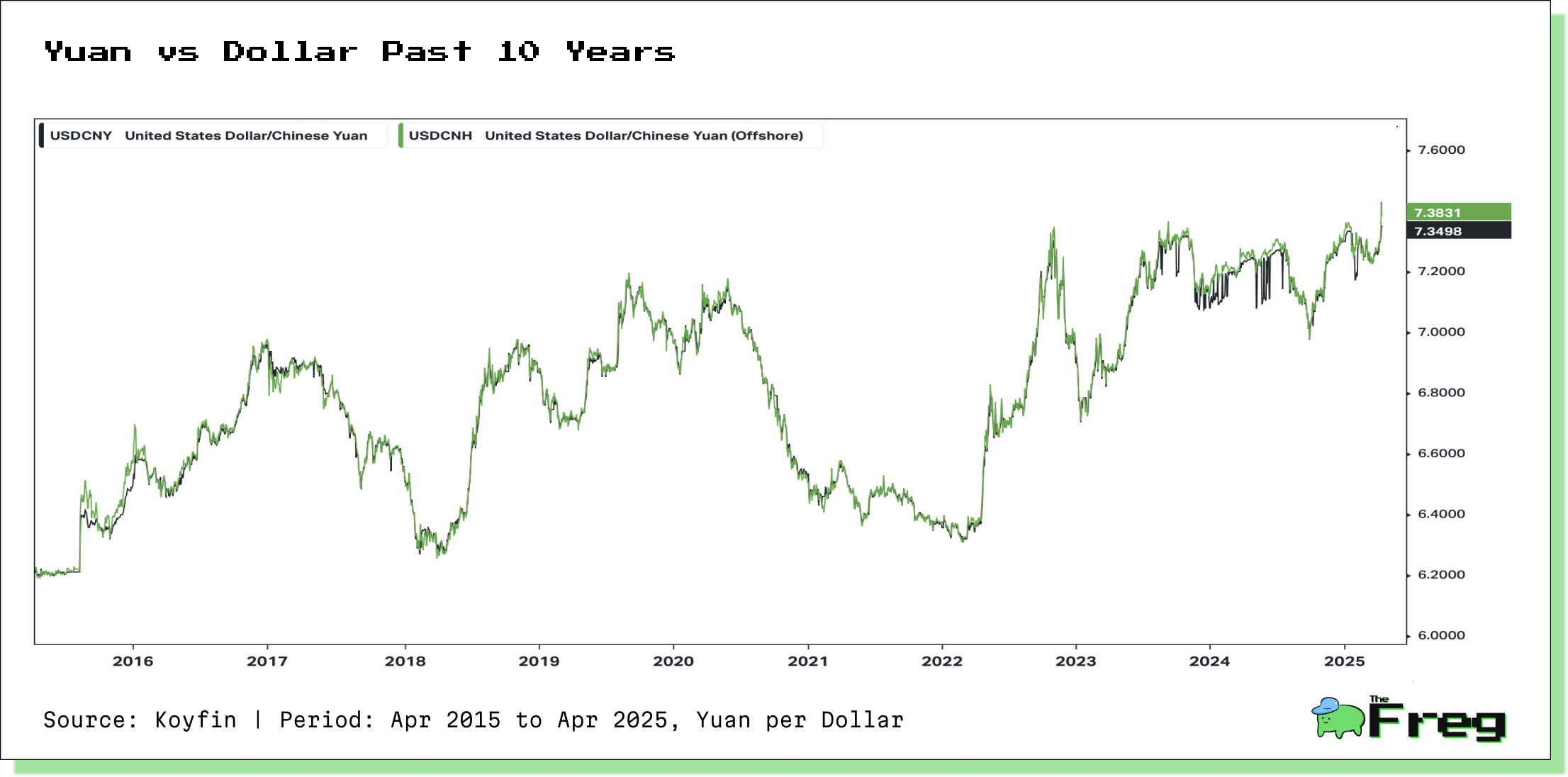

China’s currency is under pressure. The yuan has slumped to its weakest levels since 2023, driven by a sharp escalation in U.S.-China trade tensions and a dramatic policy shift by Beijing.

China’s currency, the yuan, has fallen to its lowest level in over 19 months against the U.S. dollar, amid intensifying trade tensions with the United States and growing global uncertainty.

The onshore yuan (CNY) dropped to 7.35 per dollar—its weakest point since September 2023—while the offshore yuan (CNH), which is less regulated, sank to a historic low of 7.38, the lowest since its international debut in 2010.

What Happened?

This sharp depreciation comes as the Trump administration announced sweeping 104% tariffs on Chinese imports—an unprecedented escalation in the trade war between the world’s two largest economies.

The move has rattled global financial markets, with the S&P 500 losing

$5.8 trillion in market value since the announcement. China, refusing to back down, has vowed to “resist until the end,” accusing the U.S. of economic intimidation.

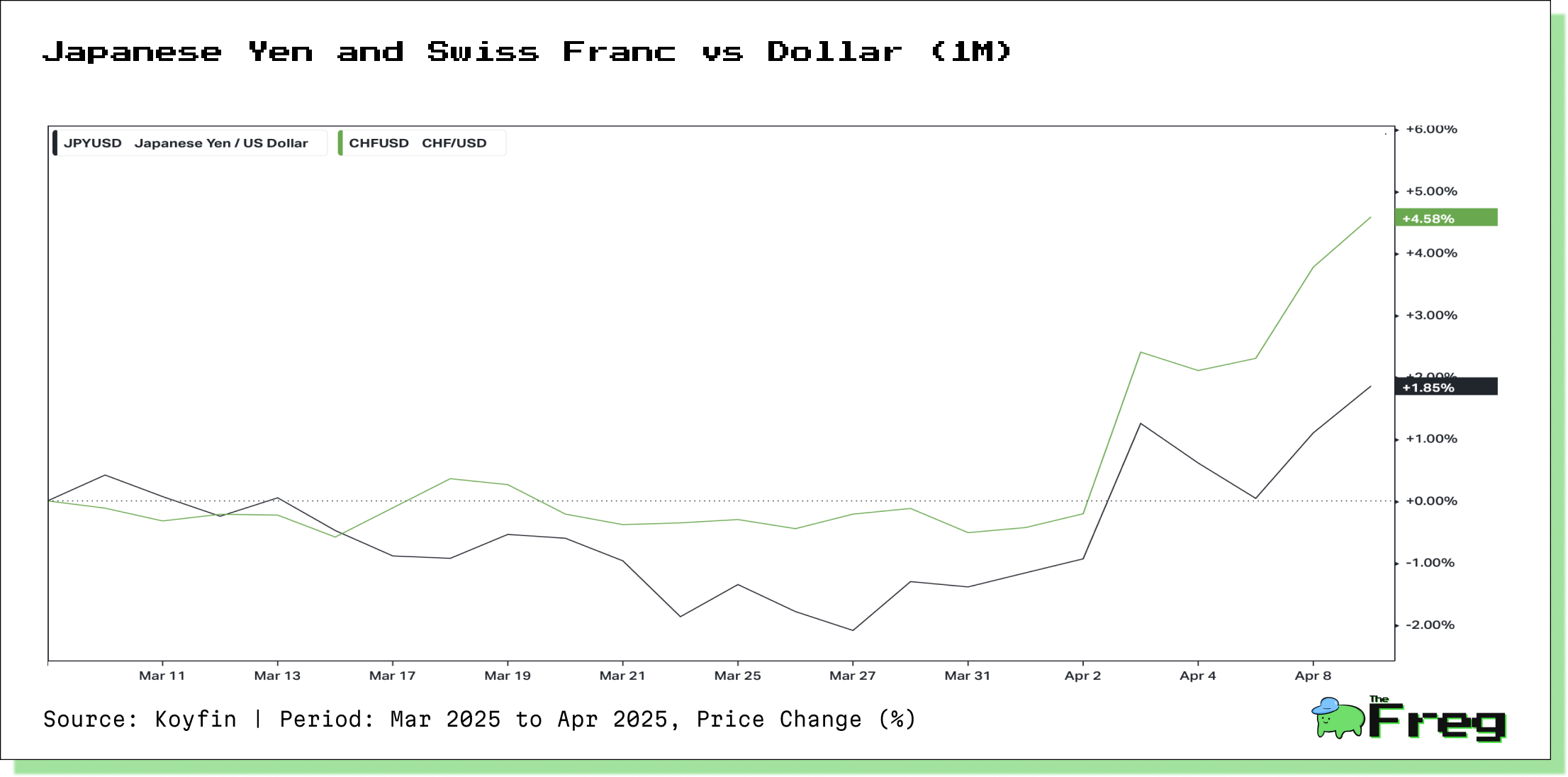

Safe-haven assets such as the Japanese yen and Swiss franc gained strength as investors sought stability.

Currency Policy Shift

The People’s Bank of China (PBOC) has responded by setting the official daily reference rate for the yuan at 7.2038 per dollar, marking the first time since late 2023 that the rate was set above the psychologically significant 7.2 threshold.

This signals a subtle but meaningful shift in China’s currency policy: allowing greater depreciation to buffer the impact of U.S. tariffs on Chinese exporters.

A weaker yuan makes Chinese goods cheaper in international markets, offering a competitive edge to exporters. However, it also carries significant risks—higher import costs, potential capital outflows, and inflationary pressures. Analysts now speculate that the yuan could weaken further, potentially approaching the 7.4 mark.

Diverging Trends: Offshore vs. Onshore Yuan

The widening gap between the offshore and onshore yuan underscores the delicate balancing act Beijing is attempting. The offshore yuan, driven by market forces, has depreciated faster, while the more tightly controlled onshore rate is being managed to prevent excessive volatility. This divergence reveals diverging investor sentiment and policy intent—markets are bracing for further depreciation, while authorities appear to be pursuing a more gradual slide.

Despite the weakening trend, the PBOC has kept its daily fix stronger than many market forecasts, indicating that Beijing still seeks to avoid triggering panic or a disorderly decline.

Global Ripple Effects

The yuan’s depreciation has broader implications, especially for emerging markets that are closely tied to China’s economic orbit. As Chinese goods become cheaper, exporters in other developing nations face rising competition. This could erode their market share and put pressure on local businesses, particularly in sectors like electronics, machinery, and textiles.

Moreover, many emerging market currencies have become increasingly correlated with the yuan. As the yuan weakens, currencies in countries like India, Indonesia, and Brazil often follow suit, increasing the risk of capital flight and financial instability. For trade-dependent economies with existing deficits—like India—the yuan’s fall could worsen imbalances and strain external accounts.

The Double-Edged Sword of Devaluation

Currency devaluation is often used as a tool to boost exports and stimulate growth. But in today’s interconnected global economy, the benefits are far from guaranteed. While exporters may enjoy short-term relief, the cost of imports rises, reducing purchasing power and potentially stoking inflation.

Additionally, aggressive devaluation can spark retaliatory measures from trading partners, raising the risk of a broader currency war. For countries with high levels of foreign-denominated debt, a weaker local currency also increases repayment burdens.

Ultimately, China’s currency move reflects both strategic intent and a reaction to global pressures. As the trade war deepens and economic uncertainty rises, the yuan’s trajectory will remain a key indicator to watch—not just for China’s economy, but for global markets as a whole.