Top-Performing Indian Funds: Snapshot Amid Trump Tariffs

India’s market outlook remains cautious amid tariff tensions, with defensive sectors, domestic themes, and long-term innovation plays likely to drive investor strategy.

As market volatility surged following Trump’s 26% tariff on Indian imports, select funds defied gravity. Here's a quick look at India’s best-performing funds over the last week and the themes driving them.

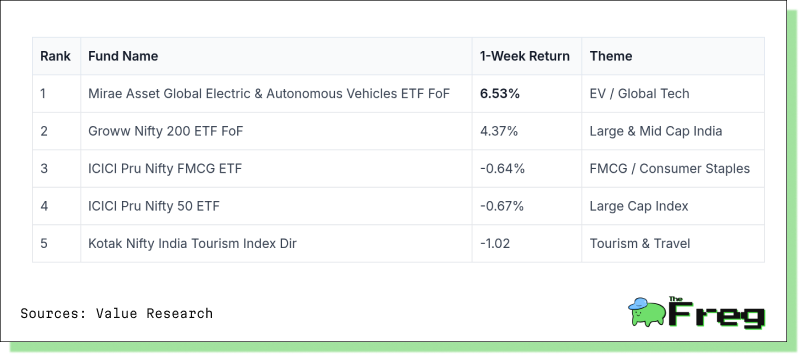

Weekly Top Fund Performers

Why They Outperformed

- Mirae Asset Global EV ETF: Despite a sharp 1Y drop (-16.98%), global push toward clean tech keeps EV themes relevant.

- Groww Nifty 200 ETF: Broad-market index with exposure to stable IT and Pharma supported returns.

- ICICI FMCG ETF: Defensive sectors like consumer staples helped limit downside.

- ICICI Prudential Nifty 50 Index Fund: Index-based recovery with large-cap pullbacks easing, offering a stabilizing effect amid broader volatility.

- Kotak Tourism Index: Travel optimism remains, with India seen as a resilient tourist hotspot.

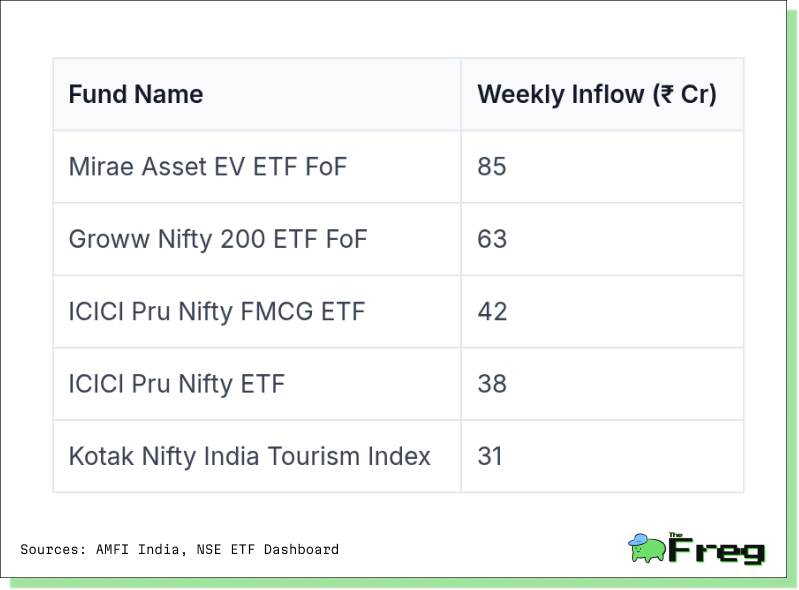

Fund Inflows This Week

Snapshot Themes

India’s equity funds weathered the tariff tremor with surprising resilience. Investors are tilting toward global thematic funds like EVs and sticking to domestic safe zones like FMCG and diversified Nifty ETFs. The week shows that while tariffs may rattle the broader market, investors are doubling down on long-term growth themes and domestic demand plays.

- EV & Global Tech: Still attracting inflows as investors bet on long-term innovation trends.

- FMCG: A defensive favorite — Nifty FMCG fell just -1.9%, outperforming broader Nifty 50’s -5% drop.

- Broad Market ETFs: As FIIs exit, domestic investors continue to back large and mid-cap diversification plays.

- Tourism Optimism: Global travel rebounds post-COVID; tourism and hospitality funds benefit from rising demand.

- Tariff Risk: Export-heavy sectors (auto components, textiles) remain vulnerable. Key risks: Bharat Forge, Gokaldas Exports.

What Lies Ahead

Looking ahead, market sentiment is expected to remain sensitive to tariff developments, with India’s 26% import levy likely prompting further trade frictions. Export-oriented sectors such as auto components and textiles may continue to face headwinds. In contrast, defensive themes like FMCG, healthcare, and broad-market ETFs are likely to attract steady inflows, offering relative stability. While global tech and EV-focused funds have seen short-term setbacks, long-term growth trends in these sectors remain intact, potentially offering upside once volatility cools. Domestic-driven sectors like tourism and infrastructure are also gaining traction, supported by strong post-pandemic recovery trends. With foreign institutional investors pulling back, retail investors and SIP inflows are expected to provide underlying market support, especially in diversified passive funds.