Trade on the Edge: India's Sectoral Stress After Trump’s 26% Tariff Blow

A week after Trump’s 26% import tariff shocks Indian markets, hitting MSMEs, autos, FMCG, and metals. Pharma and IT emerge resilient.

A sweeping 26% tariff on Indian imports, announced by U.S. President Donald Trump and effective from April 2, 2025, has jolted Indian markets and disrupted trade outlooks across multiple sectors. The move, part of a broader global tariff regime targeting over 180 countries with a minimum 10% levy, has triggered sharp investor reactions and prompted concerns over GDP growth, sectoral disruptions, and India's export competitiveness.

A Global Tariff Shock

The U.S. administration’s decision to impose a uniform 10% tariff on all imports and a punitive 26% duty on countries with large trade surpluses, including India, marks a significant departure from previous global trade norms. These are not retaliatory measures but part of a broader “reciprocity” push from the White House, intended to balance trade terms in favor of the U.S.

The immediate impact was evident: Indian equity markets suffered a steep decline, with the BSE Sensex plunging over 3000 points at opening. The Nifty50 dipped below 23,200, and foreign institutional investors (FIIs) exited aggressively,

pulling out over ₹10,000 crore by April 5. The rupee tumbled to 85.8350 per dollar, its sharpest single-day fall in three months.

MSMEs Bear the Brunt

Among the hardest hit are India’s micro, small, and medium enterprises (MSMEs), particularly in export-heavy sectors like electronics, garments, machinery, and precious stones. With limited resources to absorb shocks, many MSMEs now face serious risks:

- Shrinking margins and potential layoffs

- Cancellations of existing export orders

- Revenue declines between 10–20% for U.S.-focused firms

- Market share loss to Vietnam and Bangladesh

While India is not among the top ten U.S. import sources in the affected categories, the disproportionate hit to smaller exporters has prompted the Indian government to consider relief measures. These include lower-interest credit schemes, expanded credit guarantees, and support to access alternative markets.

Pharma’s Rare Exemption

In contrast to the broader turmoil, the pharmaceutical sector has emerged as a rare beneficiary. Indian pharma exports to the U.S. — worth $8.7 billion in FY24 — have been exempted from the new tariffs, highlighting their critical role in U.S. healthcare.

Key highlights:

- Indian pharma supplies 40% of generic drugs in the U.S.

- Major players like Sun Pharma, Cipla, and Dr. Reddy’s saw a post-announcement stock rally

- The exemption protects the affordability of U.S. healthcare amid rising global costs

The move also aligns with the bilateral “Mission 500” initiative aimed at doubling trade volumes between the two countries to $500 billion.

Auto Industry: A Downshift

The Indian auto sector, especially auto components, faces acute pressure under the new tariff regime. With the U.S. accounting for 32% of India’s $21.2 billion auto parts exports in FY24, the 26% duty threatens to dent both margins and global competitiveness.

Key challenges include:

- Supply chain inefficiencies and lack of scale

- Quality control gaps versus global peers

- Component-level tariffs inflating production costs

- Risk of losing share to Mexico, Canada, and China

Despite India's low labor costs, automakers now face the real possibility of reshoring or cutting U.S.-bound output if competitiveness erodes further.

Metals & Mining: Hit Hardest

The metals and mining sector has suffered the most severe blow, with its index plummeting 12.3%. Tariffs on Indian steel and aluminum exports directly impacted earnings, while retaliatory tariffs from other countries further clouded the outlook. The risk of global oversupply and falling prices adds to the industry’s headwinds.

Some analysts suggest a pivot toward domestic infrastructure projects to absorb excess capacity and stimulate demand, but uncertainty remains high.

FMCG: Squeezed by Costs

The fast-moving consumer goods (FMCG) sector saw a 4.5% drop in its index, driven by surging costs of imported inputs such as packaging materials and palm oil — the latter having risen 20–30% year-on-year. Although largely domestic-facing, the sector remains vulnerable to global commodity price volatility.

Companies like Britannia have signaled the need for price increases to safeguard margins, especially in products using wheat, cocoa, and edible oils. However, subdued rural demand may limit their ability to pass on costs, putting pressure on volume growth.

IT & Services: A Resilient Bright Spot

In contrast to many sectors, Indian IT services emerged relatively unscathed, with the sectoral index rising. Benefiting from the rupee’s depreciation — where every 1% drop adds 30–40 basis points to margins — IT companies are well-placed to meet rising global demand for cost-effective digital transformation services.

U.S. clients may increase outsourcing to optimize costs amid tariff-induced inflation. However, some analysts caution that price negotiations could intensify if currency advantages are perceived as windfall gains.

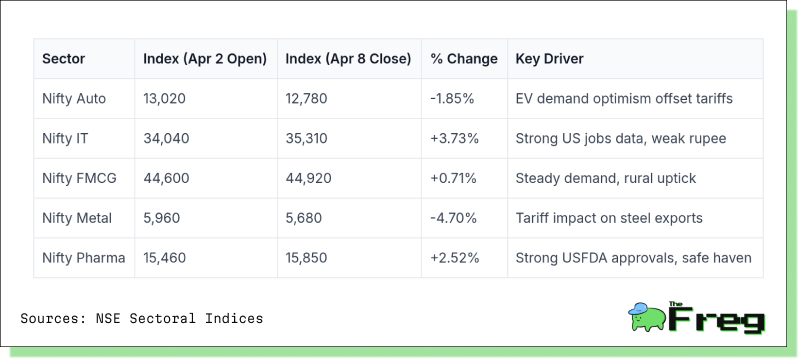

Sectoral Snapshot: Winners and Losers

(Apr 2nd - Apr 8th)

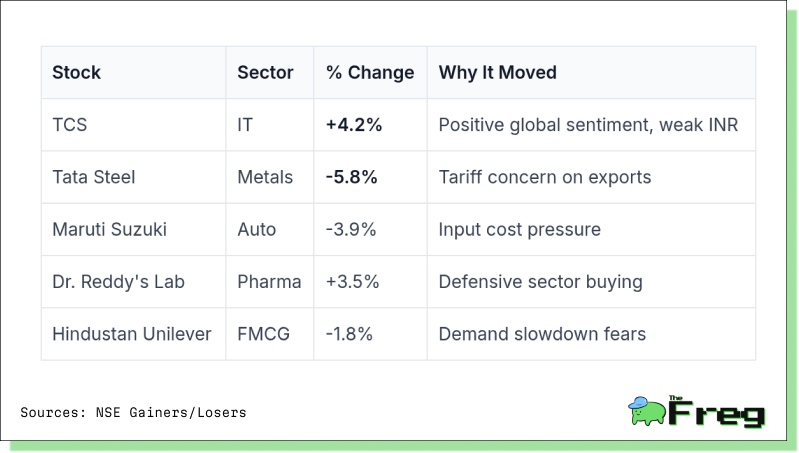

Top Gainers & Losers (Apr 2nd - Apr 8th)

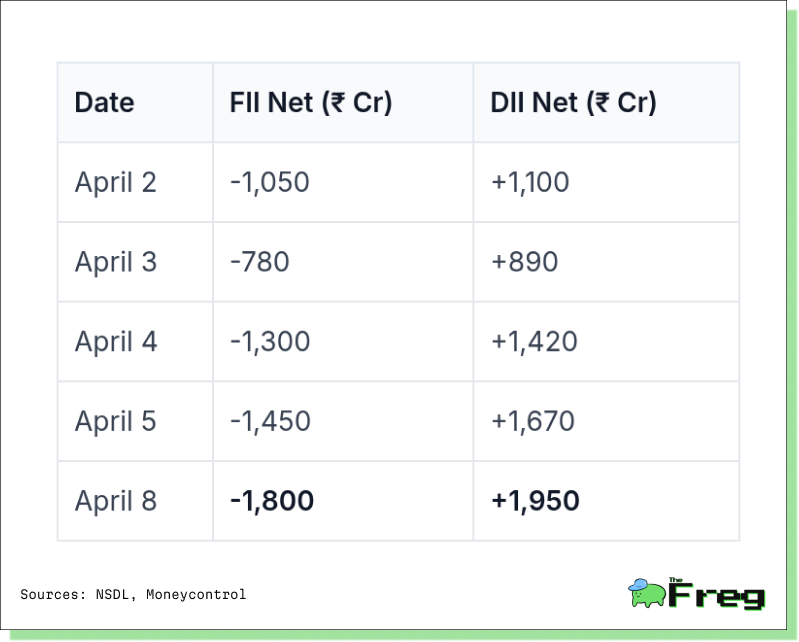

Institutional Sentiment & Market Dynamics

FIIs have reacted swiftly to the trade disruption, offloading ₹13,372 crore in Indian equities on April 7 alone. In contrast, Domestic Institutional Investors (DIIs) stepped in, absorbing ₹22,412 crore to stabilize the markets. The India VIX spiked 28% to 24.5, underlining heightened volatility.

To curb further panic, the Indian government is considering sector-specific subsidies and export promotion initiatives. Meanwhile, the RBI has intervened in forex markets to manage rupee depreciation.

Broader Economic Implications

The aggregate economic impact could be meaningful. Economists project a 0.8–0.9% drag on India’s GDP due to reduced exports and supply chain disruptions. Inflationary pressures and rupee volatility may further weigh on consumer sentiment.

Yet amid the turbulence, some sectors — notably IT and pharmaceuticals — are well-positioned to thrive, thanks to their limited direct tariff exposure and global demand strength. For now, analysts recommend a wait-and-watch approach as investors navigate the uncertainty and await policy countermeasures.