Trump Tariffs Reshape Global Trade: India at a Crossroads

The Trump tariff hike has jolted India’s export economy. As global supply chains realign, India must pivot fast—diversifying trade and outsmarting emerging rivals to secure its place as a manufacturing powerhouse.

The imposition of a 26% tariff on Indian imports by the Trump administration has sent ripples through global trade, significantly altering India's position within international supply chains. While the move presents formidable challenges, it also opens avenues for strategic pivots that could redefine India's economic trajectory. As India grapples with these tariffs, the nation finds itself at a critical juncture, requiring swift adaptation and innovation to maintain its growth momentum.

India's Manufacturing Ascent: A Decade of Progress

Over the past decade, India has positioned itself as a formidable manufacturing hub, driven by initiatives like the 'Make in India' campaign and the Production Linked Incentive (PLI) scheme. These policies have fostered substantial investments across key sectors, including electronics, pharmaceuticals, and textiles. India's manufacturing prowess is underscored by impressive growth metrics:

- Electronics: Projected to reach $500 billion in output by 2030, with a strong focus on PCBAs and semiconductors.

- Pharmaceuticals: A leading global supplier of generic drugs and vaccines.

- Automotive: The world's largest manufacturer of two-wheelers.

- Textiles: Exports hit $44.4 billion in FY 2021-22, with government-backed initiatives bolstering competitiveness.

India's manufacturing exports have also diversified, with major trade partners including the USA, UAE, Netherlands, China, and Bangladesh. The country’s share of global merchandise exports rose from 1.70% in 2014 to 1.82% in 2023, solidifying its role as an alternative to China in global supply chains.

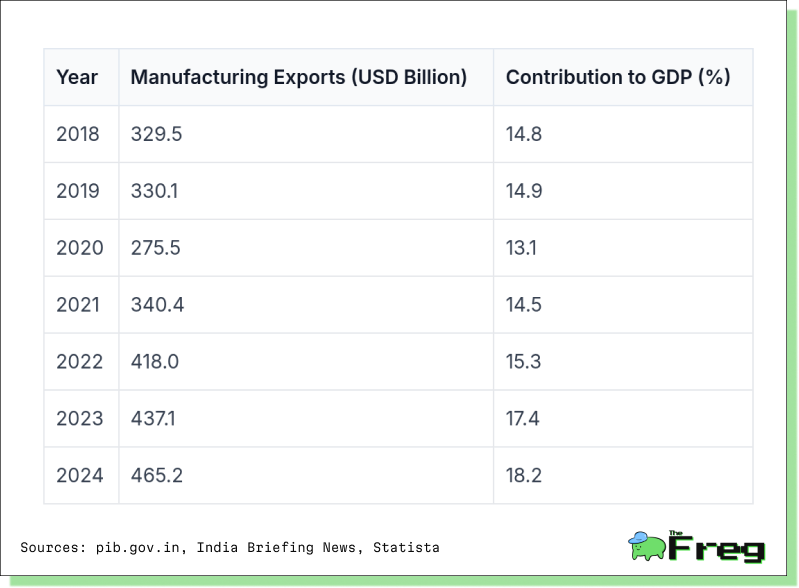

India's Manufacturing Export values and contribution to GDP(%)

Tariff Shock: Immediate and Long-Term Implications

The newly imposed tariffs could lead to a 30-50% decline in exports to the U.S., particularly impacting high-value sectors like gems and jewelry, which account for nearly a third of India’s $33 billion exports to the U.S. The higher costs could push American buyers toward alternative suppliers, dealing a blow to India’s export-driven industries.

Moreover, the employment market in India’s export-dependent sectors could face severe pressure. With the U.S. labor market already showing signs of a slowdown, diminished demand for Indian goods might exacerbate job losses in manufacturing, challenging India’s ambitions of becoming a global manufacturing powerhouse.

Sectoral Vulnerabilities and Opportunities

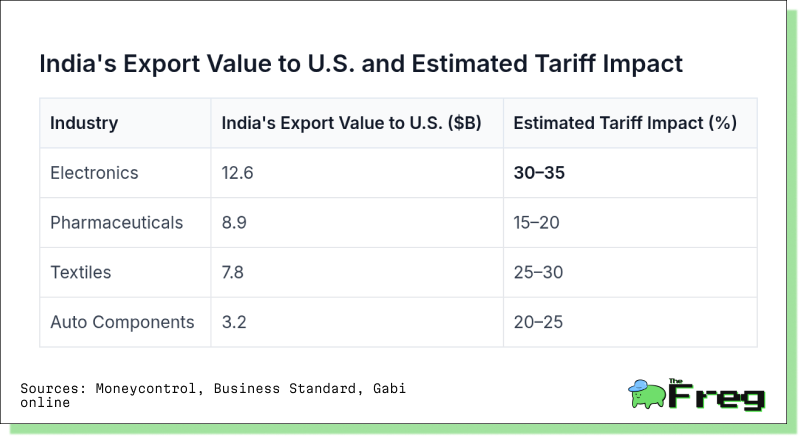

Export value and Tariff Impact for Top Industries

Electronics & Consumer Goods

The sector faces an uphill battle as tariffs could increase prices by nearly 50%, making Indian products less competitive. Short-term disruptions are expected, but long-term prospects remain strong with India's continued push in semiconductor and PCB manufacturing.

Pharmaceuticals

While currently exempted, the industry remains vulnerable to future tariff revisions. With India supplying 47% of U.S. generic drugs, any policy shift could divert demand. The sector's $8.9 billion export value to the U.S. , the EU, and Israel emerging as top competitors.

Textiles & Apparel

Despite the tariff increase, India has an advantage over competitors like Vietnam (46% tariffs) and Bangladesh (37%). This relative edge could help Indian manufacturers secure a larger share of the U.S. textile market. The textile export sector's position remains relatively strong given the steeper tariff burdens faced by rivals.

Automobiles & Components

With a 26% tariff, the automotive sector may experience declining exports and rising costs, affecting major companies like Tata Motors and Samvardhana Motherson. Supply chain disruptions could further hinder growth. The auto components segment, worth $3.2 billion in exports to the U.S., intensifying competition from Mexico.

The Global Trade Chessboard: Emerging Competitors

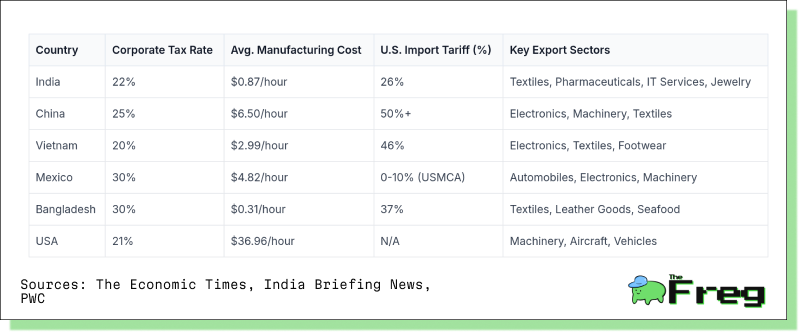

As India navigates these trade barriers, Mexico may stand poised to absorb displaced manufacturing:

India’s Strategic Response: Turning Crisis into Opportunity

To mitigate the effects of the tariffs, India is deploying a broad-based strategy that includes trade diversification, policy reforms, infrastructure development, and diplomatic engagement. The government is actively expanding trade relations with the EU, Middle East, and ASEAN nations to reduce reliance on the U.S. market. Simultaneously, it is exploring new incentives and tax reliefs to support industries most affected by the tariffs. Massive infrastructure investments—ranging from ports to highways—aim to enhance logistics and lower export costs. On the diplomatic front, India is engaging with the U.S. in negotiations over a potential Free Trade Agreement, which could provide long-term stability and improved market access.

Trade volumes for past scenarios and projected scenarios

The Road Ahead: A Pivotal Moment for India's Global Role

The 26% tariff represents both a challenge and an opportunity for India. While short-term setbacks are inevitable, India's ability to innovate, enhance domestic capabilities, and forge new trade alliances will determine its future trajectory. The evolving global supply chain dynamics provide India with an opening to solidify its manufacturing leadership—if it can strategically pivot and capitalize on emerging opportunities. In the face of economic shifts, India's resilience and adaptability will be the ultimate determinants of its success in the new global trade landscape.