Trumponomics: Boom, Bust, and Whiplash

Trump’s economic policies have fueled market turbulence, hitting tech stocks and driving investors toward safe-haven assets like gold.

President Trump’s economic policies have sent the stock market on a wild ride. With tariff threats, tax shifts, and clashes with the Federal Reserve, his unpredictable approach has kept investors on edge, fueling market swings and shaping the economic landscape in ways that continue to unfold.

Tariffs, Trade Wars, and Market Jitters

Trump’s ever-shifting stance on tariffs has been a major driver of market volatility. Announcements of delays, reciprocal duties, and abrupt policy shifts have left investors scrambling. The S&P 500 tumbled ~5% in 2025, and the Nasdaq plunged into correction territory as uncertainty took hold. Businesses struggled to plan, global growth slowed, and market sentiment wavered, making volatility the new normal.

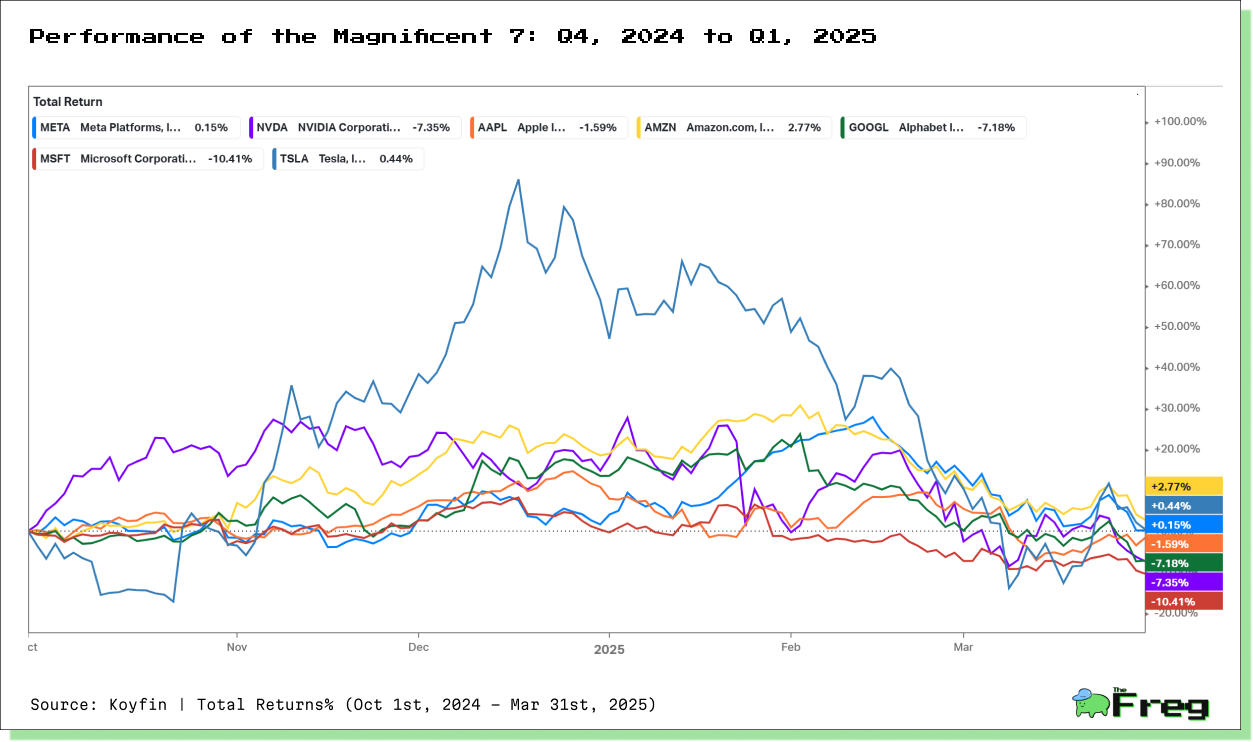

Tech Stocks Hit Hard by Trade Tensions

Nowhere has the impact of Trump’s policies been felt more acutely than in the tech sector. The "Magnificent Seven" tech giants—Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla—have faced a turbulent landscape. Tariff policies have driven up costs for Apple and Amazon, while Nvidia could see profitability threatened by proposed semiconductor duties. Meanwhile, relaxed merger regulations and tax cuts have provided growth opportunities, particularly for Microsoft, which is pushing for export rule changes. The uneasy relationship between Trump and Big Tech, with threats of regulatory action or direct intervention, has only added to market uncertainty.

The Fed Walks a Tightrope

Trump’s public clashes with the Federal Reserve have added another layer of market anxiety. In March 2025, the Fed opted to hold interest rates steady at 4.25%–4.5%, balancing economic uncertainty with the pressures of the administration’s policies. With tariffs, workforce reductions, and economic restructuring all in play, the Fed’s decisions carry significant weight. Investors remain watchful, knowing that future rate moves could either stabilize or further shake the markets.

How Investors React to Uncertainty

Market volatility triggers familiar investor behaviors. Many flee to safety, shifting capital into government bonds and gold. Others follow the herd, amplifying market swings. Fear-driven decisions lead to overreactions, while those who maintain a long-term view tend to fare better. Understanding these tendencies is key to navigating uncertain markets.

Asset Inflow Comparison

The recent market dynamics have shown significant shifts in investor preferences across different asset classes. Here's a comparison of inflows into gold, treasury bonds, and equity funds over the last two quarters:

Gold inflows more than doubled in Q1 2025, driven by geopolitical tensions and economic uncertainty, reinforcing its status as a safe-haven asset. Treasury bonds also saw a sharp rise, as investors sought stability amid market turbulence. Meanwhile, equity funds reversed course, experiencing outflows as investors pulled back from riskier assets, a move reflected in the S&P 500’s decline.

Bitcoin, traditionally viewed as a gold alternative, is increasingly behaving like a tech asset. BlackRock’s spot Bitcoin ETF (IBIT) now shows a 70% correlation with the Nasdaq 100, signaling a shift in how digital assets are perceived in the market.

Lessons from the Trump Era

The past several years have provided a crash course in market resilience. Trump’s policies reinforced the need for diversification, long-term strategic planning, and a keen understanding of geopolitical risks. Key takeaways include:

- The short-term gains of tax cuts come with long-term deficits.

- Trade wars disrupt supply chains and increase costs for consumers.

- Clear communication in monetary policy is essential to market stability.

- Policy uncertainty can rattle economic forecasts and investor confidence.

As the dust settles, one thing is clear: markets thrive on stability. Whether future leaders will learn from this era remains to be seen, but for investors, the lesson is undeniable—expect the unexpected and prepare accordingly.