UPI Transactions Hit Record

India has nearly fully embraced digital cashless transactions.

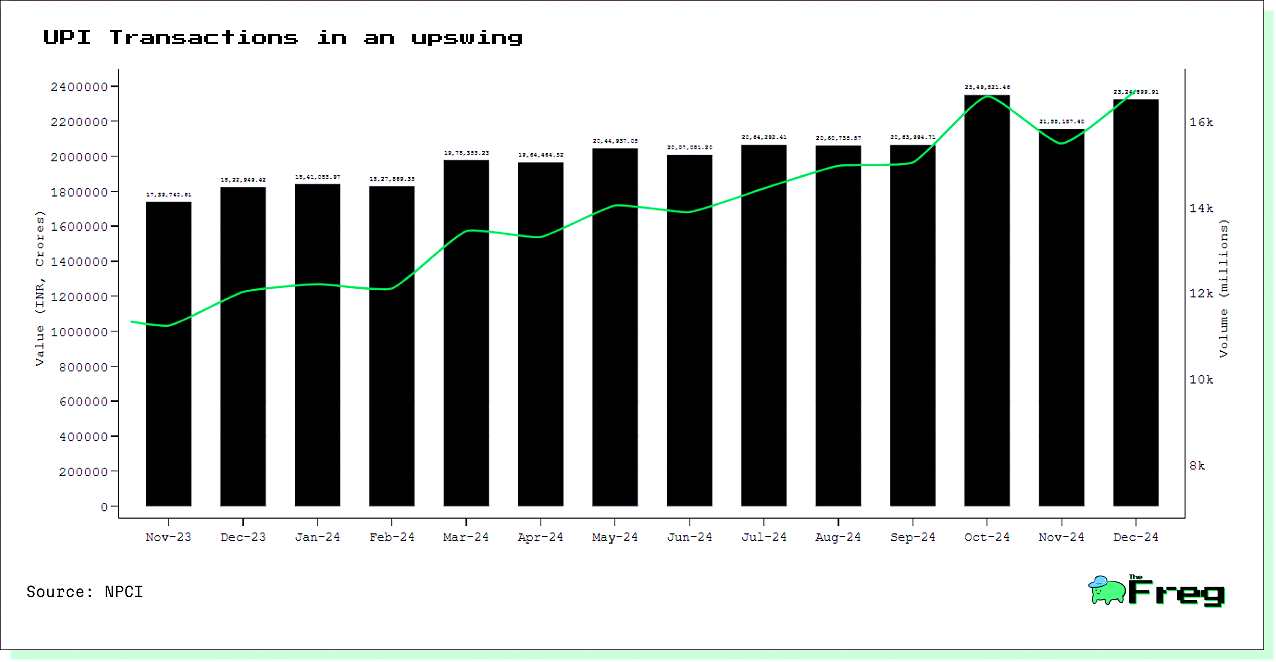

According to data from the National Payments Corporation of India (NPCI), Unified Payments Interface (UPI) transactions reached a record high of 16.73 billion in December 2024, marking an 8% increase from November's 15.48 billion transactions and a 39% year-on-year growth.

The record-breaking UPI transactions in December 2024 were accompanied by a significant increase in transaction value, reaching ₹23.25 lakh crore, up 8% from ₹21.55 lakh crore in November. This surge in both volume and value reflects the growing adoption of UPI for daily transactions, with an average of 539.68 million transactions processed daily in December, compared to 516.07 million in November.

Transactions increased by 46% YoY

This consistent growth in transactions underscores UPI's expanding role in India's digital payment ecosystem, with micro-transactions emerging as a significant driver of this surge.

- For the entire year 2024, UPI processed approximately 172 billion transactions, marking a 46% increase from 118 billion in 2023.

- The total transaction value for 2024 surged by 35% to ₹247 lakh crore, up from ₹183 lakh crore in 2023.

- Person-to-merchant transactions contributed significantly to this growth, indicating increased adoption of UPI for everyday purchases.

- The average ticket size of UPI transactions continued to decrease, suggesting its increasing use for smaller payments and enhancing its sustainability.

The rise of microtransactions has been a key driver in UPI's explosive growth. These small-value payments, typically under ₹100 ($1.16), have become increasingly prevalent for everyday purchases like groceries, utility bills, and public transport. The removal of the merchant discount rate (MDR) for UPI in 2019 significantly boosted low-value transactions, making it more attractive for both consumers and merchants. This shift has been particularly beneficial for small and medium-sized enterprises (SMEs) and street vendors, who can now accept digital payments without incurring hefty transaction fees.