US-Focused Indian Mutual Funds Have Outperformed Indian Counterparts In 2024

US market's continued dominance in AI and tech sectors could sustain outperformance of US-focused funds.

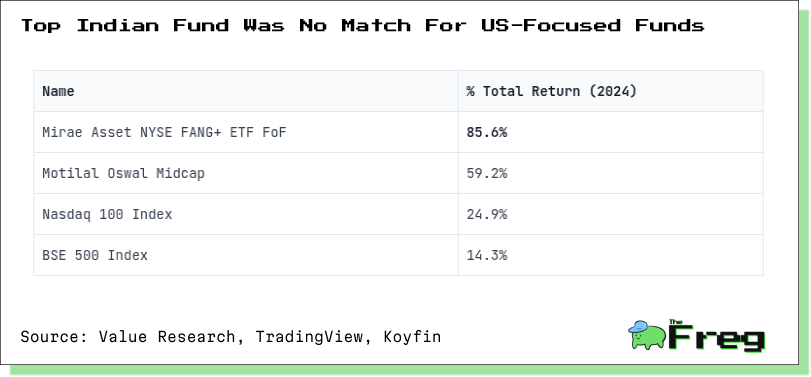

US-focused Indian mutual funds have outshined domestic counterparts in 2024, driven by robust US market performance fueled by AI enthusiasm and economic growth. Leading funds like Mirae Asset NYSE FANG+ETF Fund of Funds delivered returns as high as 85.6%, capitalizing on gains in tech-heavy indices such as the Nasdaq 100, which surged 24.8%, and benefiting from standout stocks like Nvidia, which rose 171.7%.

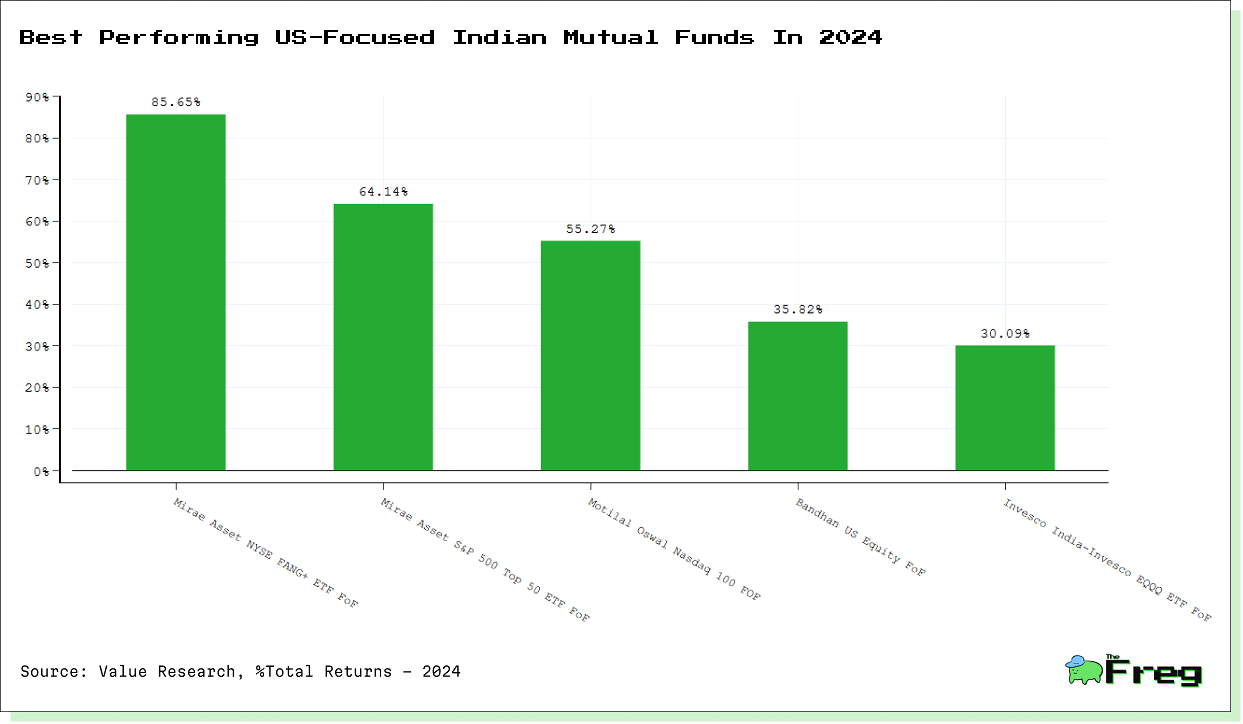

Top Performing US-Focused Funds

In the world of US-focused Indian mutual funds, 2024 has been a stellar year with some standout performers stealing the show. Leading the pack is the Mirae Asset NYSE FANG+ ETF Fund of Funds, which delivered an eye-popping 85.65% return. Not far behind, the Mirae Asset S&P 500 Top 50 ETF FoF and Bandhan US Equity FoF also impressed with returns of 64.14% and 35.82% respectively.

These top-tier funds have capitalized on the strength of the US market, particularly the tech sector's continued dominance. The "Magnificent 7" - Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla - have been the driving force behind this growth.

Impact Of AI On Returns

The impact of AI on investment returns has been significant in 2024, with AI-focused stocks and funds driving market gains.

AI's influence extends beyond direct investments, reshaping investment strategies and decision-making processes:

- 91% of asset managers are currently using or planning to use AI within their investment strategies or asset-class research.

- AI algorithms are optimizing portfolio allocations, enhancing risk management, and improving investment research efficiency.

- JPMorgan predicts that AI benefits will expand beyond large tech companies, potentially driving another decade of US stock market dominance.

However, experts caution that while AI offers powerful tools for analysis and decision-making, human oversight remains crucial in final decisions.

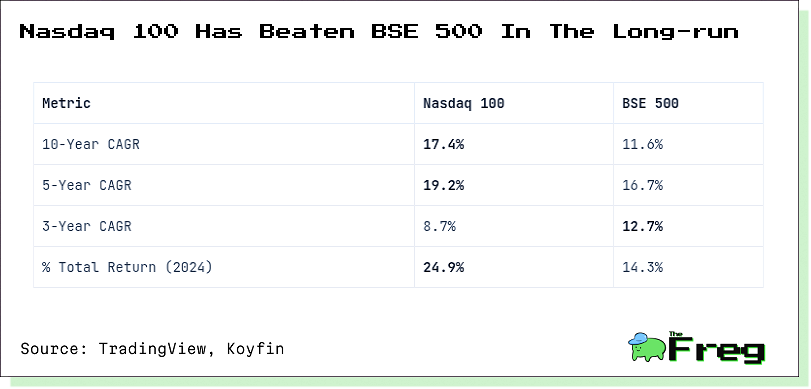

Comparison: Nasdaq 100 vs BSE 500

The Nasdaq 100 has consistently outperformed the BSE 500 over various time horizons, showcasing the strength of US technology-focused stocks compared to the broader Indian market. Here's a comparison of key performance metrics:

However, investors should note that past performance doesn't guarantee future results, and the Nasdaq 100's tech-heavy composition may lead to higher sectoral concentration risk compared to the more diversified BSE 500.

Outlook: India vs US

Some Indian mutual funds had a banner year in 2024, the party might not last as US-focused funds steal the spotlight and economic headwinds loom on the horizon.

While India's economy continues to grow, there are signs that the pace might be slowing down. The country's GDP growth dampened throughout 2024, hitting a low of 5.4% between June and September. This figure fell short of economists' projections and the Reserve Bank of India's estimates, hinting at potential headwinds for the Indian economy.

Meanwhile, US-focused mutual funds have been stealing the show, outperforming their domestic Indian counterparts. These funds are riding high on the back of the US market's robust performance, particularly in the tech sector. As the US continues to lead in areas like AI and cloud infrastructure, it's looking like these funds might keep their winning streak going. So, for Indian investors looking to diversify and potentially outpace domestic options, US-focused funds could be the ticket to ride the wave of innovation and growth in the near future.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.