US-Iran Oil Showdown Looms

U.S. sanctions on Iran's oil trade face challenges as China remains the primary buyer, while a potential naval interception strategy threatens to escalate tensions and disrupt global oil flows through critical maritime chokepoints.

As reported by Reuters, the escalating trade conflict between the United States and China could significantly undermine President Donald Trump's "maximum pressure" campaign against Iran, which generates billions annually from oil exports to China. The renewed focus on Iranian oil exports comes as the U.S. administration considers more aggressive measures to curtail Tehran's crude shipments, potentially including intercepting tankers at sea, which could send global oil prices soaring amid already heightened geopolitical tensions.

Naval Interception Strategy

The U.S. is considering more aggressive measures to curb Iran's oil exports, including the potential use of naval forces to track and intercept Iranian tankers. According to reports, the Trump administration is evaluating a strategy to halt and examine Iranian oil tankers at sea under the framework of the Proliferation Security Initiative, an international agreement aimed at countering the spread of weapons of mass destruction.

This escalation in tactics could involve U.S.-aligned countries intercepting vessels passing through critical maritime chokepoints like the Strait of Malacca. While not explicitly confirming naval involvement, U.S. officials suggest these actions would create uncertainty within Iran's illicit trading network, potentially delaying oil deliveries and exposing facilitators to reputational damage and sanctions. The move comes as part of the renewed "maximum pressure" campaign, which has already seen the U.S. impose sanctions on individuals and entities involved in Iran's "shadow fleet" operations, including an Indian national and India-based companies accused of transporting Iranian oil.

Impact of Sanctions on Teapot Refineries

The U.S. sanctions targeting China's "teapot" refineries mark a significant escalation in efforts to curb Iran's oil exports. These small, independent refineries in Shandong province have become a key lifeline for Iranian crude, with the U.S. Treasury accusing one such refinery of purchasing approximately $500 million worth of Iranian oil. The sanctions aim to disrupt Iran's "shadow fleet" of tankers that supply these refineries, with 19 additional entities and vessels sanctioned for shipping millions of barrels of Iranian oil.

The impact on teapot refineries has been notable, with capacity utilization rates dropping to around 46% in March 2025, well below the 65% seen in late 2023. This decline is attributed not only to U.S. sanctions but also to weak domestic fuel demand and Beijing's new policies on fuel oil tariffs. The sanctions have forced these refineries to seek alternative suppliers or potentially reduce production, which could have ripple effects on China's fuel exports and global oil markets. As the U.S. continues its "maximum pressure" campaign against Iran, the resilience of China's teapot refineries and their ability to adapt to these new constraints will be crucial in determining the effectiveness of the sanctions regime.

China's Role in Iranian Oil Trade

China has emerged as the primary lifeline for Iran's oil exports, defying U.S. sanctions and significantly impacting global energy markets. In March 2025, China's imports of Iranian oil reached record levels, with estimates ranging

from 1.37 to 1.91 million barrels per day. This surge in imports coincided with increased inventory levels in China's independent refining hub of Shandong province.

Key aspects of China's role in the Iranian oil trade include:

- Sanctions evasion: China employs complex networks, including "dark fleet" tankers and rebranding of oil origins, to circumvent U.S. sanctions.

- Economic impact: China's continued purchases provide a crucial economic lifeline for Iran, with approximately 90% of Iran's oil exports now flowing to China.

- Payment mechanisms: Transactions are typically conducted in Chinese yuan through smaller banks to avoid U.S. financial scrutiny.

As the U.S. intensifies its "maximum pressure" campaign against Iran, the effectiveness of these sanctions will largely depend on China's cooperation or continued defiance.

OPEC+ Production Adjustments Amid Sanctions

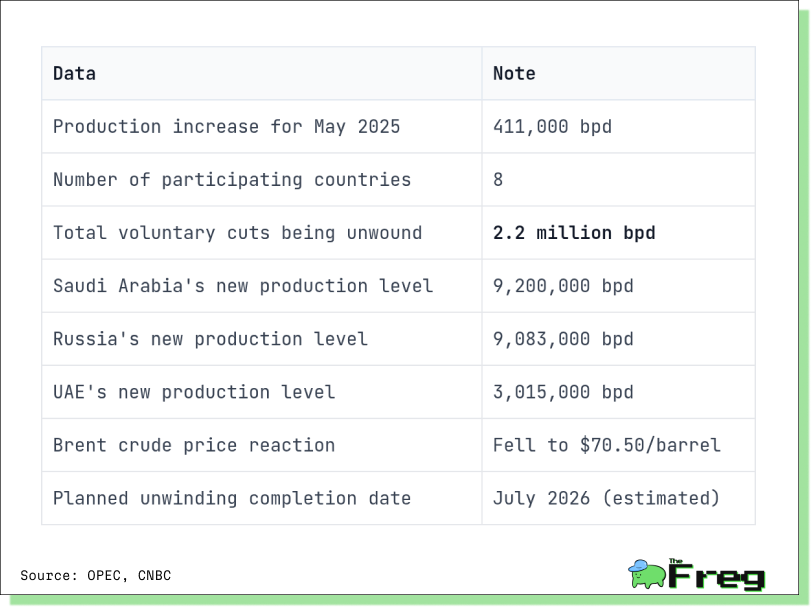

In a surprising move, OPEC+ announced a significant increase in oil production for May 2025, accelerating their plan to unwind previous output cuts. Eight key OPEC+ producers, including Saudi Arabia, Russia, and the UAE, agreed to

boost their collective crude oil production by 411,000 barrels per day (bpd), which is equivalent to three monthly increments of their original plan.

Here's a table summarizing the key datapoints of the OPEC+ decision:

This decision reflects OPEC+'s assessment of "continuing healthy market fundamentals and the positive market outlook". However, the group emphasized that these increases may be paused or reversed based on evolving market conditions, maintaining flexibility to support oil market stability. The move caused an immediate impact on oil prices, with Brent crude futures falling below $70 per barrel and now hovering around $63 post-tariffs mayhem.

The U.S. "maximum pressure" campaign against Iran faces significant challenges, with China's continued oil purchases and OPEC+'s production adjustments complicating efforts to curb Iranian exports. As tensions escalate, the potential for naval interceptions and further sanctions could lead to increased volatility in global oil markets.