Volatility or Opportunity? Understanding the Cyclicality of Indian Small and Midcap Funds

Long-term investors are better off with smallcap funds, as long as they don't mind a minor volatility penalty of smallcaps. But with significant upside and better recovery during drawdowns.

The Indian mutual fund industry has experienced remarkable growth in recent years, with Assets Under Management (AUM) soaring from ₹23.17 lakh crore to ₹66.93 lakh crore. This expansion has been fueled by increased investor participation, particularly in midcap and smallcap funds, which offer the potential for substantial returns. However, these high-reward investments also come with elevated risks.

By examining the cyclical behavior of smallcap, midcap, and largecap funds over the past 15 years, we can better understand the implications for investors.

A Tale of Two Extremes

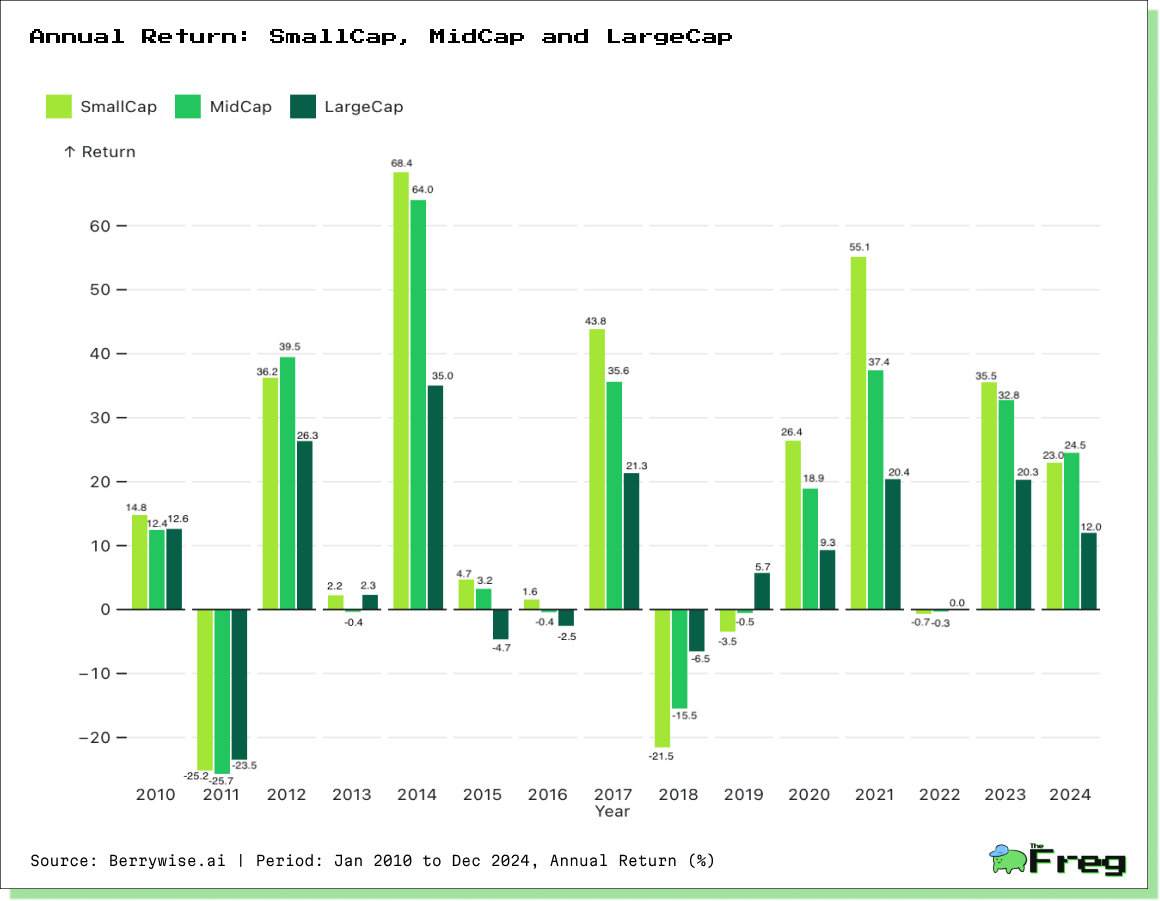

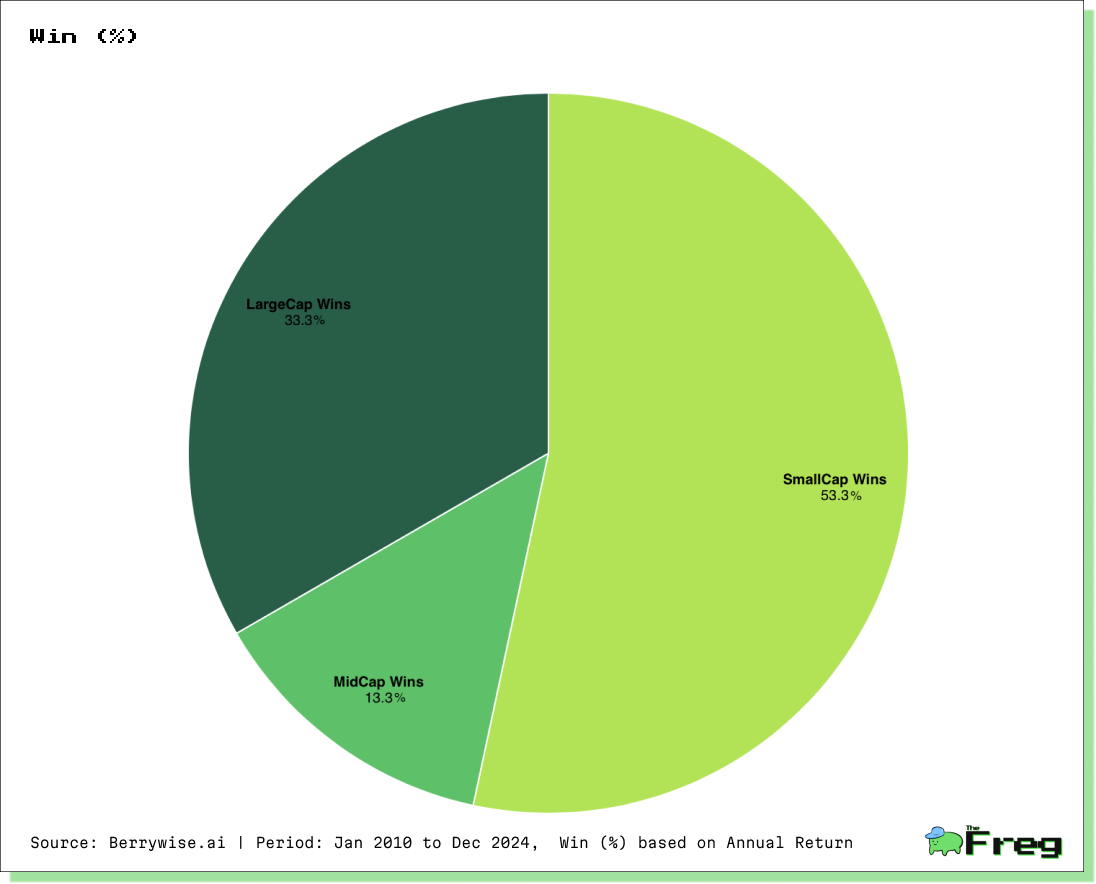

The yearly returns of large, mid, and small-cap funds over the last 15 years reveal distinct trends. Small-cap funds have consistently outperformed in terms of year-on-year returns, but they also experience the highest volatility, characterized by significant highs and lows.

In contrast, large-cap funds demonstrate greater resilience during market downturns, experiencing smaller drawdowns compared to their midcap and smallcap counterparts.

Midcaps seem to be caught in the middle, suffering substantial drawdowns while not achieving the same level of returns as smallcaps during market upturns.

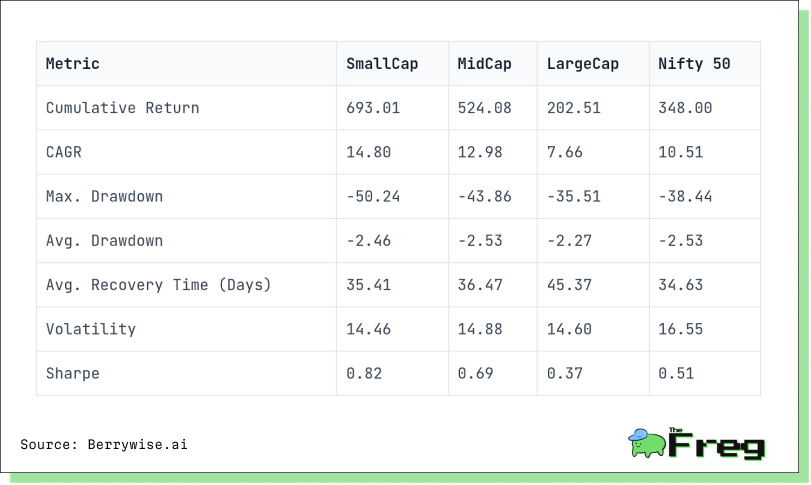

Comparative Performance with Nifty 50

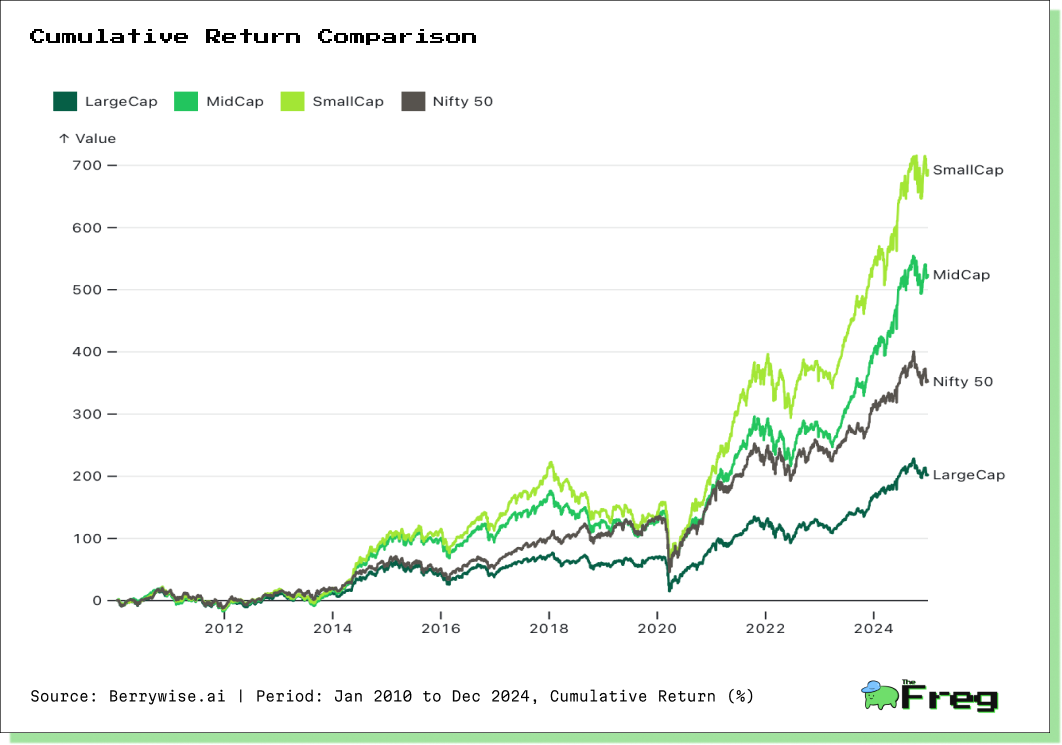

When benchmarked against the Nifty 50 index, large-cap funds have underperformed but have exhibited lower exposure to steep drawdowns. This highlights their relative stability.

Small-cap funds, despite their volatility, exhibit relatively shorter recovery periods. This suggests that while they experience deep dips, investors in this segment may recover losses more quickly—a key consideration for emerging markets.

Interestingly, despite its perceived volatility, the small-cap segment has the lowest annualized volatility among the four categories and offers the best risk-adjusted return, as indicated by a Sharpe ratio of 0.82.

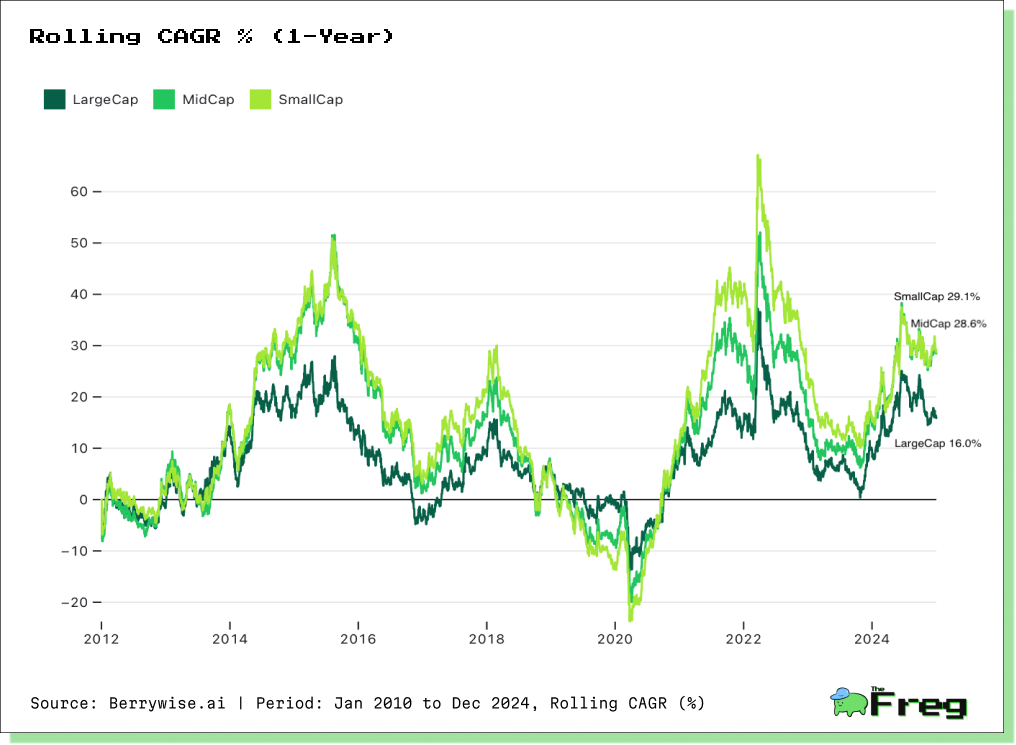

Beyond Total Returns: The Rolling CAGR Perspective

Imagine a car with a rearview mirror that only shows the last three seconds of the road. As the car moves forward, the mirror continuously updates, offering a real-time snapshot of recent events. Rolling CAGR (Compound Annual Growth Rate) functions similarly, providing a moving window of performance data that captures short-term trends and fluctuations.

- Small and midcap funds exhibit significant CAGR fluctuations. However, when the investment horizon exceeds two years, they tend to recover to a positive CAGR.

- Large-cap funds maintain a relatively steady CAGR, allowing for more predictable year-on-year gains.

Factor Exposures: Understanding the Underlying Drivers

Small-cap Funds

- Highest exposure to the smallcap factor, with occasional exposure to the growth factor.

- Negatively correlated with the equity core factor, suggesting a less focused investment strategy.

- Small-cap companies are generally younger and faster-growing, offering high capital appreciation potential, but they are also more vulnerable to market fluctuations and economic downturns.

Midcap Funds

- Strong exposure to the growth factor and consistently negative exposure to the core factor, indicating alignment with a high-growth mandate.

- Growth factor exposure suggests these funds target companies with rapid earnings and revenue expansion.

Largecap Funds

- Consistently high exposure to the core factor, indicating a focus on established companies with significant market influence.

- Largecap funds primarily track the performance of blue-chip companies, which form the foundation of the equity market.

Upside and Downside Betas: Proactive vs. Reactive Management

Analyzing upside and downside betas offers critical insights into market behavior.

- Most funds display higher downside betas, meaning their returns are more sensitive to market downturns than upturns.

- This suggests that many active fund management strategies tend to be reactive rather than proactive.

- These findings highlight the difficulty of consistently outperforming the market, even for actively managed funds.

Key Takeaways for Investors

- Smallcap funds offer the highest return potential but come with significant volatility and inconsistent factor exposure.

- Midcap funds tend to experience substantial drawdowns without necessarily matching smallcap returns during upcycles.

- Largecap funds provide greater stability and lower drawdowns but have underperformed compared to smallcaps.

- Rolling CAGR analysis suggests that investors with a time horizon of over two years may see positive returns despite fluctuations.

- Active fund management strategies often struggle to proactively manage market downturns, leading to higher downside betas.

Understanding these factors can help investors align their risk tolerance, investment horizon, and return expectations with the most suitable fund category.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.