What’s Driving India’s Financial Outlook? A Sector-Wise Breakdown

India's economic outlook remains strong, with key sectors like IT, healthcare, renewable energy, e-commerce, and FinTech driving growth

India's economic outlook remains strong, with key sectors set to drive growth in the coming years. Despite minor adjustments, the World Bank recently revised its growth forecast for India to 7% for FY25, up from an earlier estimate of 6.6%. This optimism is fueled by improved monsoon conditions and a rebound in private consumption. Meanwhile, the Reserve Bank of India (RBI) maintains a slightly lower projection of 6.6% for the same period.

While the macroeconomic outlook remains positive, India’s growth story is deeply intertwined with the performance of specific high-potential sectors.

Key Sectors Driving India’s Growth

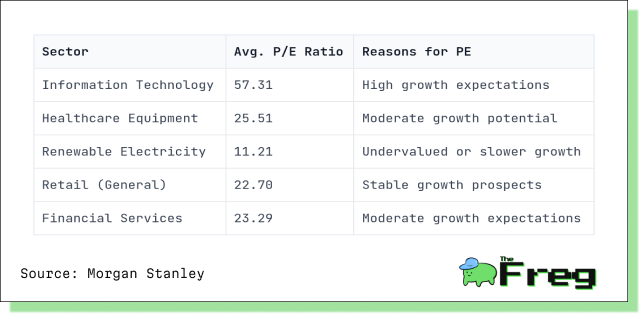

1. Information Technology (IT)

The IT sector continues to be a powerhouse, contributing 7.4% to India’s GDP. With an expected 17% CAGR from 2025-2030, it is evolving beyond traditional software services to focus on AI, cloud computing, and data analytics. As global demand for digital transformation surges, Indian IT firms are well-positioned to capitalize on this trend.

2. Healthcare and Pharmaceuticals

Dubbed the “pharmacy of the world,” India’s pharmaceutical industry is witnessing unprecedented growth. The sector is projected to expand at an 18% CAGR from 2025-2030, driven by increased healthcare awareness, advancements in telemedicine, and a growing focus on R&D.

3. Renewable Energy

India’s ambitious push toward sustainability is propelling the renewable energy sector forward. With a targeted 500 GW of renewable capacity by 2030, this industry is growing at a 12% CAGR. Government incentives and international investments in green energy are further accelerating its expansion.

4. E-commerce and Retail

India’s digital revolution is reshaping consumer behavior. With rising internet penetration and a growing middle class, the e-commerce sector is expected to reach $200 billion by 2026. Companies are investing heavily in logistics, AI-driven personalization, and omnichannel strategies to enhance customer experience.

5. Financial Technology (FinTech)

India is at the forefront of digital financial services, thanks to UPI, digital lending, and blockchain-based solutions. The FinTech sector is poised for explosive growth as digital payments and banking services expand to rural and semi-urban areas, driving financial inclusion.

Global Trends and Their Impact on India’s Economy

India’s economic trajectory is not just shaped by domestic factors but also by global market dynamics. Key external challenges and opportunities include:

1. Recession Fears

A potential global slowdown poses risks to India’s export-driven sectors, particularly IT and manufacturing. Reduced demand from Western economies may slow growth, but it has also encouraged diversification into labor-intensive industries like textiles and electronics.

2. Oil Price Volatility

As a net oil importer, India benefits from falling crude prices, which reduce inflation and fiscal deficits. However, if declining oil prices signal a broader global slowdown, it could dampen Indian equities and export demand. To mitigate risks, India is aggressively investing in renewable energy and energy security initiatives.

3. Geopolitical Risks

Rising global tensions are disrupting supply chains and increasing economic uncertainty. Research shows that a one standard deviation rise in India's Geopolitical Risk Index (GPRI) leads to a 0.9 percentage point drop in trade volumes. In response, India is prioritizing domestic manufacturing and reducing dependency on imports, particularly in electronics and pharmaceuticals.

The Road Ahead

India's economic resilience and sector-specific growth drivers provide a strong foundation for sustained expansion. While external risks persist, technological advancements, strategic investments, and proactive government policies will play a crucial role in shaping India's financial future.