Where to Bet for the Next Market Rebound

Certain equity factors lead recoveries despite higher risk, while others offer balanced performance across both downturns and upturns.

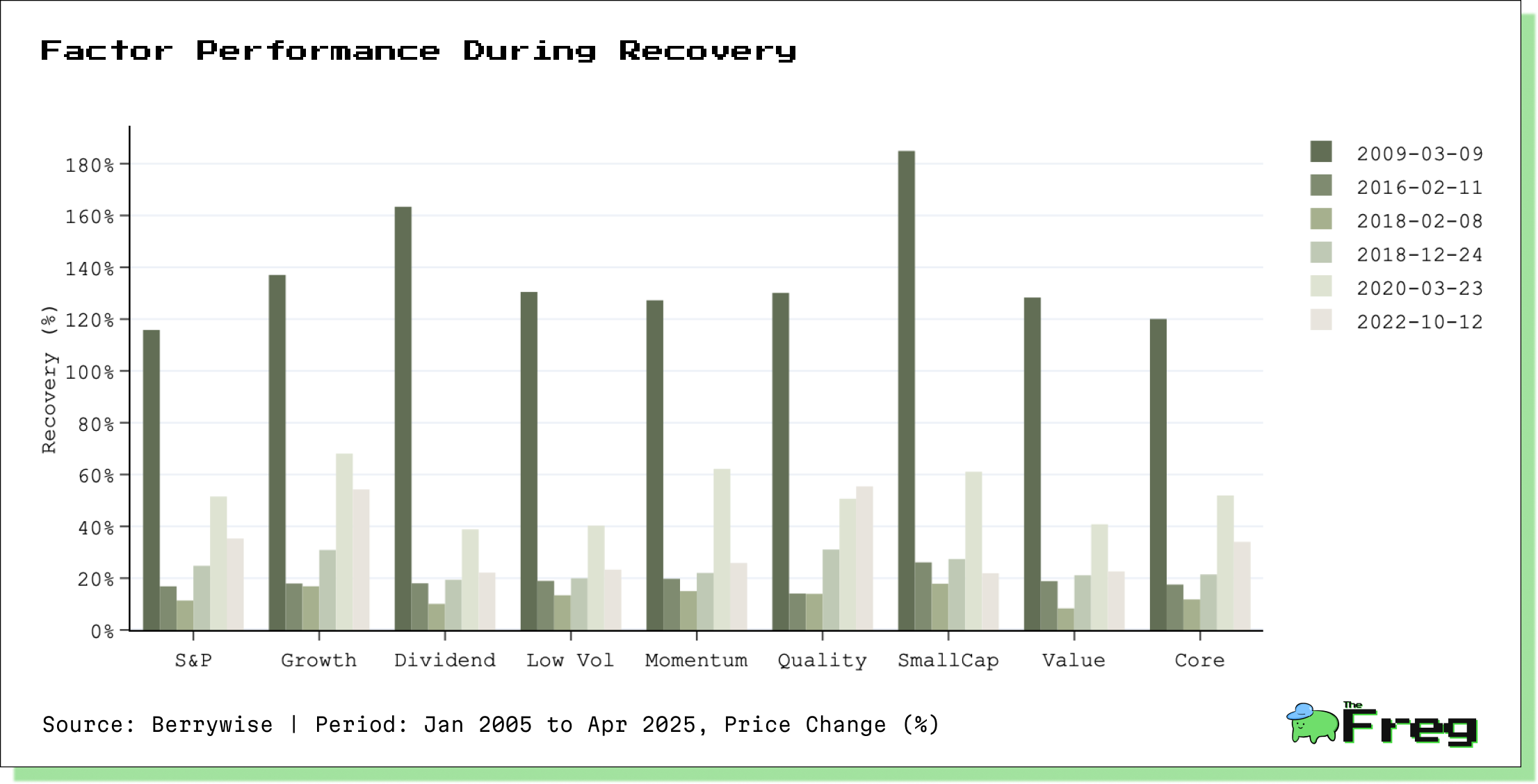

As markets cycle through periods of volatility, investors constantly seek answers to a perennial question: Which equity factor offers the best chance for recovery gains? By analyzing historical drawdowns and subsequent recoveries across different U.S. equity factors, we can glean powerful insights for positioning portfolios ahead of potential rebounds.

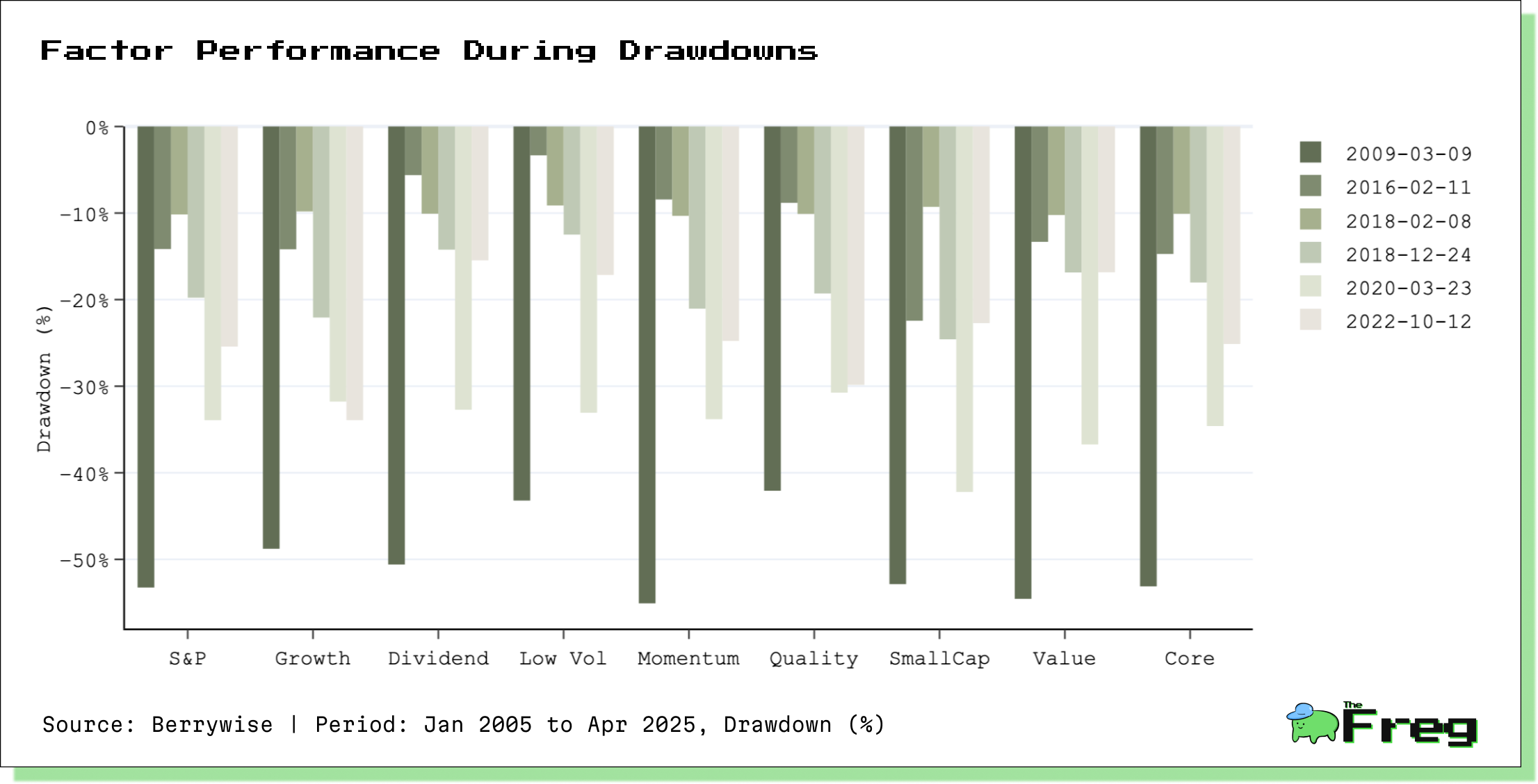

Understanding the Setup: Drawdown and Recovery Profiles

We examined eight major U.S. equity factors—Growth, Dividend, Low Volatility, Momentum, Quality, Small-Cap, Value, and Core—relative to the S&P 500 during previous market corrections (defined as S&P drawdowns >10%) and the following recovery phases (from the maximum drawdown date till the S&P recovered).

Key Observations:

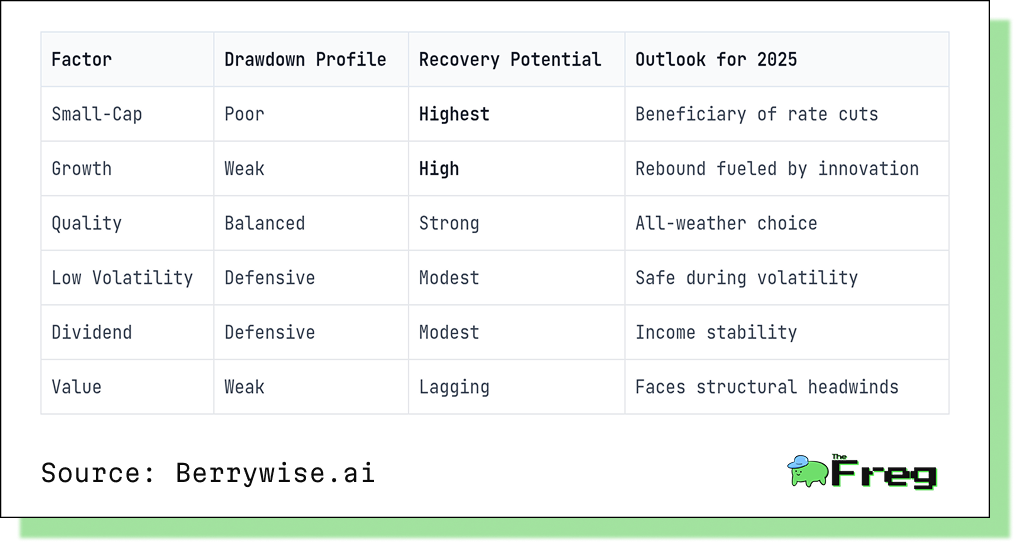

- Small-Cap and Growth were the worst hit during drawdowns but posted the strongest rebounds during recovery periods.

- Low Volatility and Dividend Yield factors weathered drawdowns with the least damage, highlighting their defensive appeal.

- Quality demonstrated a balanced profile, with modest drawdowns and above-average recoveries.

- Value underperformed in both drawdowns and recoveries, reflecting a structural lag in recent cycles.

Why Small-Caps and Growth Shine During Recoveries

Small-Cap Stocks: High Beta with a Kick

Small-cap equities are typically more economically sensitive and carry higher beta—traits that make them underperform in corrections but outshine in recoveries. Their nimbleness allows them to adapt and scale rapidly once economic sentiment turns.

- Historical context: Small-caps have outperformed large-caps during recovery phases and in periods following rate cuts, as confirmed by MSCI data.

- 2025 context: With anticipated rate cuts from the Federal Reserve, small-caps are likely to see tailwinds via lower borrowing costs, improved capital access, and renewed risk appetite.

Growth Factor: Fueled by Optimism and Innovation

Growth stocks rebound sharply due to:

- Heavy reinvestment strategies driving rapid scalability.

- Alignment with innovation and emerging market trends.

- Investor enthusiasm during bull markets, often pushing valuations higher.

Notably, even after sharp drawdowns, growth stocks have been propelled by earnings momentum and technology sector leadership during past recoveries.

Quality Factor: The All-Weather Performer

While small-caps and growth may offer the highest potential returns, they also come with higher volatility. The quality factor, by contrast, delivers consistency:

- During downturns, quality companies demonstrate resilience through stable earnings and low debt.

- In recoveries, they may underperform riskier assets initially but eventually catch up, thanks to sound fundamentals and sustained profitability.

Think of quality as a “barbell” strategy: lower drawdown risk and solid participation in upside, especially for long-term investors.

Low Volatility and Dividend Yield: Steady in Storms

These factors excel during corrections due to their defensive nature, but tend to lag in high-beta recoveries.

- Low Volatility stocks offer risk mitigation, with historically lower drawdowns and higher Sharpe ratios.

- Dividend Yield stocks generate stable income and reside mostly in defensive sectors like utilities and consumer staples.

For conservative investors, these can anchor portfolios during uncertainty but may not be the best bet for recovery alpha.

Value Factor: Lagging the Pack

Traditionally a go-to in recoveries, value has underwhelmed in the post-GFC era. This is largely due to:

- Structural issues in earnings recovery for many value stocks.

- The dominance of mega-cap growth stocks, especially in tech, skewing market returns.

Unless value stocks regain earnings traction, they may remain out of favor during future recoveries.

Bottom Line: Where to Tilt Your Portfolio

- For aggressive investors seeking maximum upside in a recovery, Small-Cap and Growth exposures are key.

- For balanced risk-return, tilt toward Quality.

- For capital preservation, retain allocations to Low Volatility and Dividend.