Will Indian IPO Boom Continue?

India's robust economic fundamentals and growing domestic investor base provide a solid foundation for continued IPO market strength in 2025.

India's IPO market is witnessing an unprecedented boom, with 2024 marking historic milestones such as Hyundai Motor India's record-breaking ₹27,870.16 crore debut and 2025 poised for a dynamic surge driven by start-ups and emerging sectors like EVs and ESG-focused businesses. This vibrant landscape underscores India's growing influence as a global IPO hotspot, offering investors a diverse array of opportunities across traditional and innovative industries.

Hyundai Motor India's Record IPO

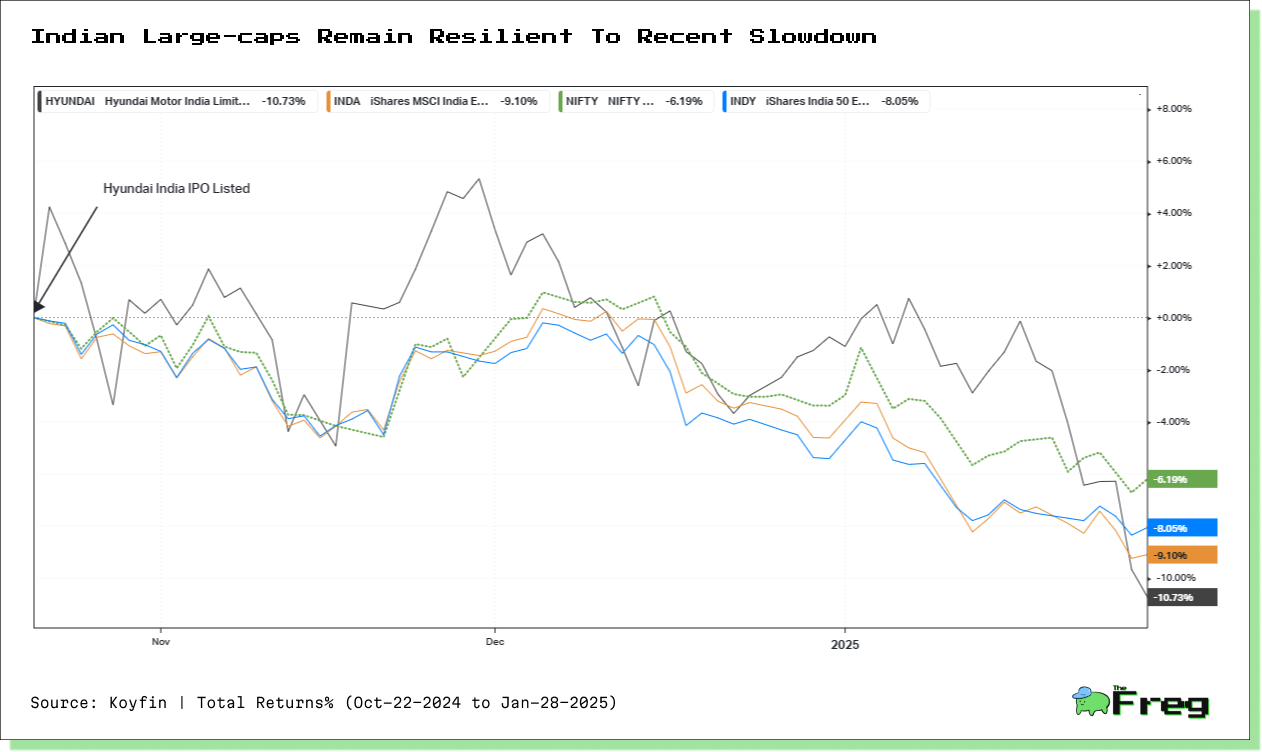

Hyundai Motor India made a splash in the Indian stock market with its record-breaking IPO in October 2024, raising a whopping ₹27,870.16 crores ($ 3.3 Billion). This automotive giant's debut was like a shiny new car rolling off the assembly line - eagerly anticipated but with a few unexpected bumps along the way. Despite being the largest IPO in India's history, Hyundai's shares initially listed below their issue price, opening at ₹1,934 on the NSE. However, like a well-tuned engine, the stock quickly picked up speed, with analysts remaining optimistic about its long-term performance.

- The IPO was priced between ₹1,865 to ₹1,960 per share.

- It included an offer for sale of 14.22 crore shares.

- The listing date was October 22, 2024.

- Hyundai plans to use the funds to boost EV technology and expand production capacity.

Start-Up IPO Frenzy in 2025

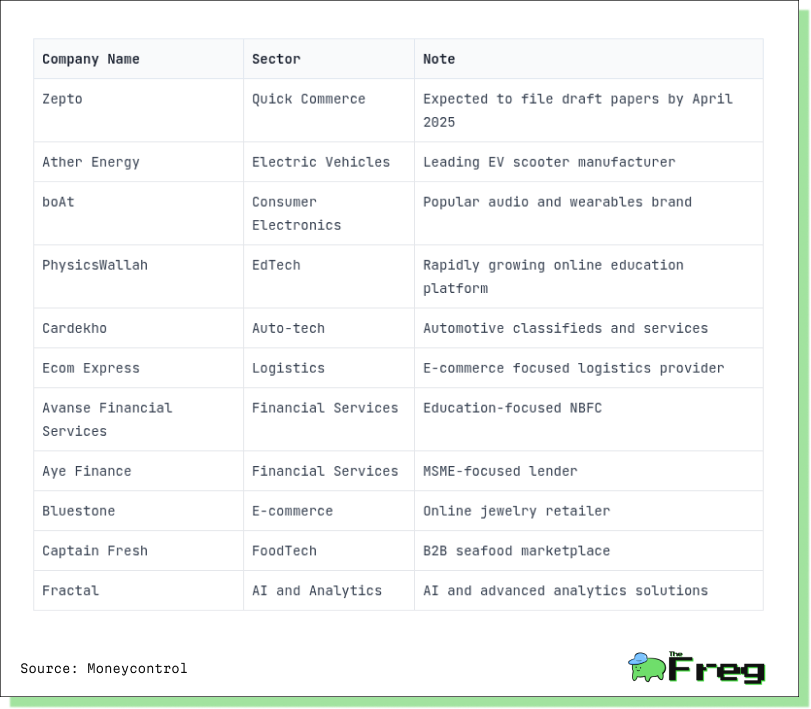

The Indian IPO market is gearing up for an unprecedented start-up frenzy in 2025, with over 25 new-age companies expected to make their public debut. This surge in start-up IPOs represents a significant increase from 2024, potentially setting a new record for the highest number of start-up listings in a single calendar year. Here's a snapshot of some key start-ups expected to launch their IPOs in 2025:

This IPO frenzy is driven by several factors, including a more robust capital environment, better-quality entrepreneurs, and an AI-driven market fostering new efficiencies. The strong performance of previously listed start-ups has also bolstered investor confidence, paving the way for this new wave of public offerings.

Market Outlook and Risks

The Indian stock market in 2025 is poised for a rollercoaster ride, with analysts predicting a mix of opportunities and challenges. Most experts anticipate single to mid-double-digit returns for the Nifty, with only 11% expecting negative returns.

However, the potential return of Donald Trump to the US presidency casts a shadow over these projections. Trump's proposed tariffs could act like a wet blanket on India's market enthusiasm. His threat of imposing tariffs on Indian goods, particularly in sectors like pharmaceuticals, gems and jewelry, and marine products, could dampen export-oriented stocks.

Additionally, the possibility of across-the-board tariffs on all US imports could reduce overall demand for Indian goods in America, India's largest trading partner. This economic headwind, combined with the strengthening dollar that typically accompanies such policies, may cause foreign investors to pull back from Indian markets. Despite these challenges, some see potential benefits in trade diversion opportunities as US companies seek alternatives to Chinese, Mexican, and Canadian imports. Investors should brace for increased volatility and potentially scale down their expectations for 2025, keeping a watchful eye on global geopolitical developments and their impact on India's economic trajectory.