Winning the Market: Jio Financial’s Nifty 50 Debut and What It Means

Jio Financial's entry into the Nifty 50 marks a major shift strengthening the financial sector's dominance and signals India's growing focus on tech-driven financial services.

Jio Financial Services is making waves as it prepares to join the prestigious Nifty 50 index on March 28, 2025. This inclusion signals the growing influence of new-age financial and tech-driven companies in India’s evolving stock market. Analysts anticipate that Jio Financial’s entry could attract passive fund inflows of approximately $308 million, impacting index valuation metrics and sector weightings.

Passive Fund Inflows: A Boost for Jio Financial

Jio Financial’s addition to the Nifty 50 is expected to trigger massive passive investments, as index funds and ETFs tracking the benchmark automatically adjust their portfolios.

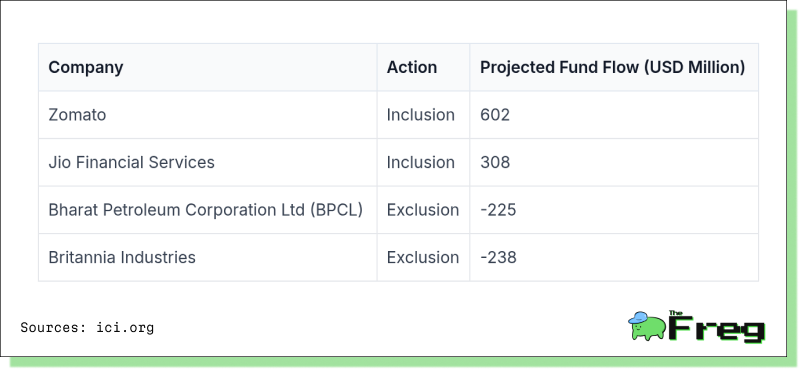

Key projections for fund inflows:

- Jio Financial: Estimated to receive $308 million in passive investments.

- Zomato: Expected to attract an even larger $602 million.

- Britannia Industries & BPCL (being removed from Nifty 50) will see outflows of $238 million and $225 million, respectively.

- Other Nifty index adjustments could lead to combined inflows of up to $910 million for newly included stocks.

The rebalancing coincides with the monthly derivatives expiry on March 27, 2025, a factor that could amplify trading volumes and market volatility.

Sectoral Shake-Up: The New Nifty 50 Landscape

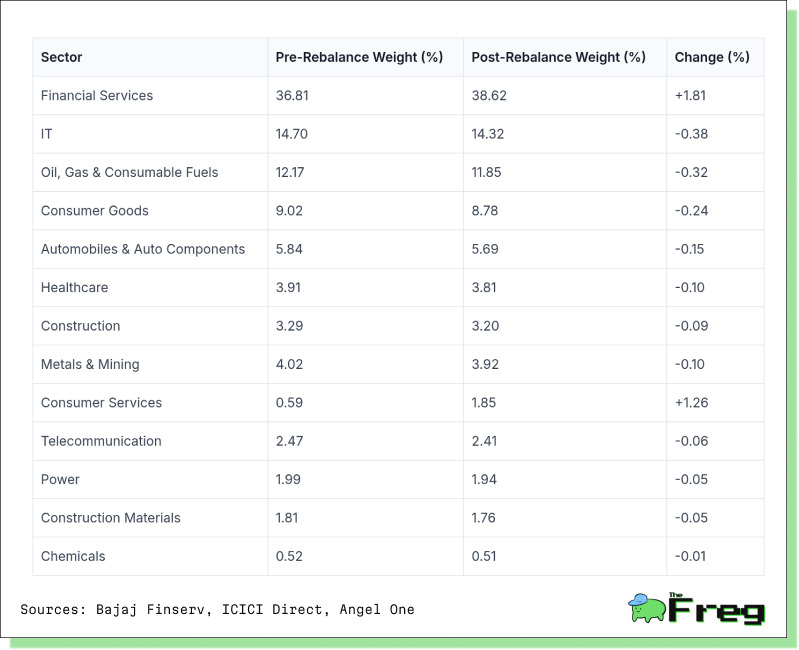

Jio Financial’s entry is set to reshape the sectoral composition of the index, particularly boosting the financial services sector. The financial sector currently dominates the Nifty 50 with a 32.76% weightage, but with Jio Financial’s inclusion, this is expected to rise to 38.62%.

These changes reflect India’s shifting economic priorities, with a stronger focus on finance and technology-driven businesses.

Sectoral allocation in the Nifty 50 index before and after the March 2025 rebalance.

Future outlook for Jio Financial

Jio Financial Services has rapidly expanded, demonstrating strong financial performance since its inception. Its net profit surged 5,034.6% in FY24 to $ 187 million, compared to $ 3.5 million in FY23.

Jio-BlackRock Partnership: A New Era in Indian Asset Management

- 50:50 joint venture with an initial $300 million investment, equally split.

- Expansion into mutual funds, wealth management, and broking.

- Formation of Jio BlackRock Asset Management, with Jio Financial investing ₹82.9 crore for a 50% stake.

- Launch of Jio BlackRock Broking Private Ltd, entering the broking business.

- Appointment of industry veterans like George Heber Joseph (CIO) and Sid Swaminathan (Leadership role).

This collaboration aims to democratize access to sophisticated investment solutions, leveraging technology to deliver digital-first, innovative financial products. Jio Financial’s combination of organic growth and strategic partnerships positions it as a major disruptor in India’s financial sector.